A prominent Bitcoin whale has opened a $235 million short position with 10x leverage, betting on further downside.

The same investor recently earned $200 million in profit from last week’s market crash.

Whale wallet activity shows hundreds of millions in BTC transfers, including to Coinbase.

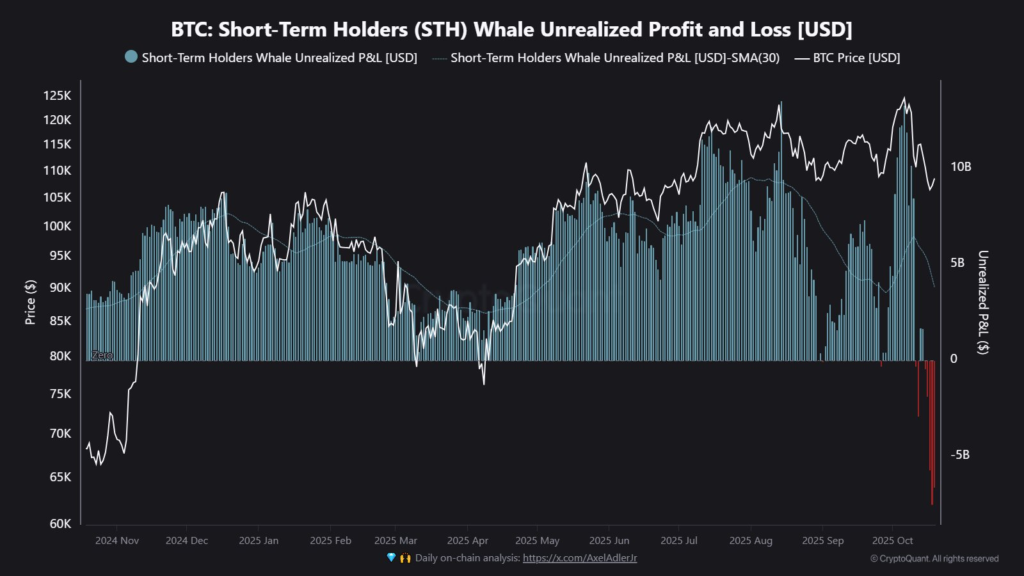

New Bitcoin whales now hold $6.95 billion in unrealized losses following the latest price decline.

Analysts from Glassnode and CryptoQuant view the correction as a healthy reset for the crypto market.

The Bitcoin whale, a term used to describe investors holding substantial amounts of BTC, has opened a $235 million short position using 10x leverage.

According to Hypurrscan, the short was placed when Bitcoin traded around $111,190, with liquidation set to occur if BTC surpasses $112,368. As of now, the whale faces a small unrealized loss of approximately $2.6 million.

Wallet ‘0xb317,’ Short Position

Source: Hypurrscan.io

The trade represents a clear bet that Bitcoin’s price will decline further amid mounting economic concerns, including ongoing U.S. fiscal uncertainty and trade tariffs.

This move follows the whale’s previous success, where the same investor netted roughly $200 million in profit from the recent crypto market downturn using a similar short strategy.

By leveraging borrowed funds, the trader multiplied their returns when Bitcoin’s price plunged last week.

Leverage allows traders to borrow capital to amplify potential gains, but it also increases the risk of liquidation and loss.

For example, a 10x leveraged position means a 10% market move against the trader could wipe out the entire position, making such trades both high-reward and high-risk.

Arkham revealed that the whale behind last week’s massive short has once again moved funds to trading platforms. According to them:

“The whale who made $200M shorting the Bitcoin crash to $100K has now moved $30M to Hyperliquid and is shorting AGAIN.”

Over the past week, the investor also transferred $540 million worth of Bitcoin to new wallets, including $220 million sent to Coinbase exchange wallets, likely to increase liquidity for active trading.

Interestingly, this Bitcoin whale has been strategically rotating assets for months.

Around September, the investor reportedly shifted $5 billion in BTC into Ethereum (ETH), temporarily surpassing the holdings of major corporate treasuries in total ETH value.

Such diversification indicates a broader strategy that extends beyond simple short-term speculation, possibly reflecting the whale’s view on Ethereum’s long-term potential versus Bitcoin.

While this long-time investor capitalizes on volatility, new Bitcoin whales are facing the opposite outcome.

According to CryptoQuant, these newer large holders are sitting on over $6.95 billion in unrealized losses after Bitcoin fell below $113,000.

Source: CryptoQuant

This cohort now represents around 45% of the total Whale Realized Cap, indicating that many large holders are currently underwater following the latest correction.

Despite short-term pain, several analysts view the recent drop as a “healthy correction.” Glassnode highlighted that the sharp move lower flushed out excess leverage, reducing speculative risk and paving the way for a more stable price foundation.

The firm also noted a rise in short-term holder supply and an increase in speculative capital, suggesting a potential reset of market sentiment before the next bullish phase.

A Bitcoin whale refers to an investor or entity that holds large amounts of Bitcoin, often influencing market movements through their trades.

Shorting Bitcoin involves borrowing BTC to sell at the current price, aiming to repurchase it later at a lower price—profiting from the difference. If the price rises instead, the trader incurs losses.

Whales may be shorting to hedge against market risk or capitalize on short-term corrections amid broader economic uncertainty.

Not necessarily. While short-term volatility may continue, analysts suggest that such corrections often strengthen long-term market structure by removing over-leveraged positions.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.000.03%

Figure Heloc(FIGR_HELOC)$1.000.03% Wrapped stETH(WSTETH)$3,891.984.57%

Wrapped stETH(WSTETH)$3,891.984.57% USDS(USDS)$1.000.02%

USDS(USDS)$1.000.02% Hyperliquid(HYPE)$35.082.23%

Hyperliquid(HYPE)$35.082.23% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.06%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.06% WETH(WETH)$3,188.334.41%

WETH(WETH)$3,188.334.41% Wrapped eETH(WEETH)$3,451.054.43%

Wrapped eETH(WEETH)$3,451.054.43% Ethena USDe(USDE)$1.00-0.03%

Ethena USDe(USDE)$1.00-0.03% Coinbase Wrapped BTC(CBBTC)$93,352.000.68%

Coinbase Wrapped BTC(CBBTC)$93,352.000.68% World Liberty Financial(WLFI)$0.160180-0.59%

World Liberty Financial(WLFI)$0.160180-0.59% sUSDS(SUSDS)$1.080.98%

sUSDS(SUSDS)$1.080.98% USDT0(USDT0)$1.00-0.01%

USDT0(USDT0)$1.00-0.01% Ethena Staked USDe(SUSDE)$1.210.00%

Ethena Staked USDe(SUSDE)$1.210.00% Bittensor(TAO)$306.946.65%

Bittensor(TAO)$306.946.65% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Canton(CC)$0.074807-4.20%

Canton(CC)$0.074807-4.20%