To combat anti-vaccine mandate protests, Canadian Prime Minister Justin Trudeau has taken the unusual step of invoking the Emergencies Act. Mr. Trudeau stated that the measures would be time-limited, fair and appropriate, and that the military would not be deployed.

To that end, the nation's banks maintain the authority to freeze personal accounts of anybody associated with the protests without requiring a judicial order.

No more business with the Freedom Convoy

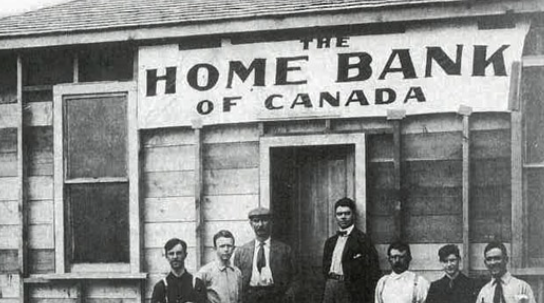

The federal government of Canada declared that it has ordered various banks and other financial institutions to stop doing business with people aiding the Freedom Convoy, a trucker-led protest campaign against vaccination requirements that has expanded into a larger protest against COVID-19 regulations.

The actions are intended to deplete the demonstrators' resources by leveraging rules prohibiting terrorist financing. However, the move may have an unforeseen impact as various Canadian banks abruptly went offline after the announcement. Several banks experienced technical issues with transaction processing, and the Royal Bank of Canada admitted to having technical problems with its online, mobile banking, and phone systems.

Bank run imminent?

Whatever issues the banks were having appeared to be mostly rectified by the next day, but the disruptions sparked widespread suspicion that Canada was undergoing a bank run or that the institutions had been hacked. Moreover, additional bank accounts are expected to be deactivated in the coming weeks as part of the ongoing campaign to deprive demonstrators and their sympathisers of cash and crypto assets.

Still, despite reports that Canada is witnessing a panic rush on banks, there appears to be little actual evidence to support these claims. The spike in searches for bank runs, on the other hand, raises serious concerns that one may nevertheless occur.

It's uncertain at this time if individuals are shutting their bank accounts in droves, but it's worth noting that concern of a bank run can actually trigger a bank run to happen, although deposit insurance may soften the blow were this to happen.

Furthermore, it would not be surprising if many Canadians abruptly remove their funds from large institutions in the wake of such an event. In any case, we shall soon see if Mr. Trudeau accidentally exacerbated his and Canadians' difficulties by cracking down on seemingly nonviolent protestors and what kind of long-term impact this can have on the cryptocurrency atmosphere and market in the country.