– 2025 Edition –

Thank you to our sponsor

We want to give a special thanks to our sponsor, Crypto.com, who are doing amazing work with mass crypto adoption via their easy-to-use mobile app, Visa cards (with amazing rewards) and their crypto exchange for more advanced traders.

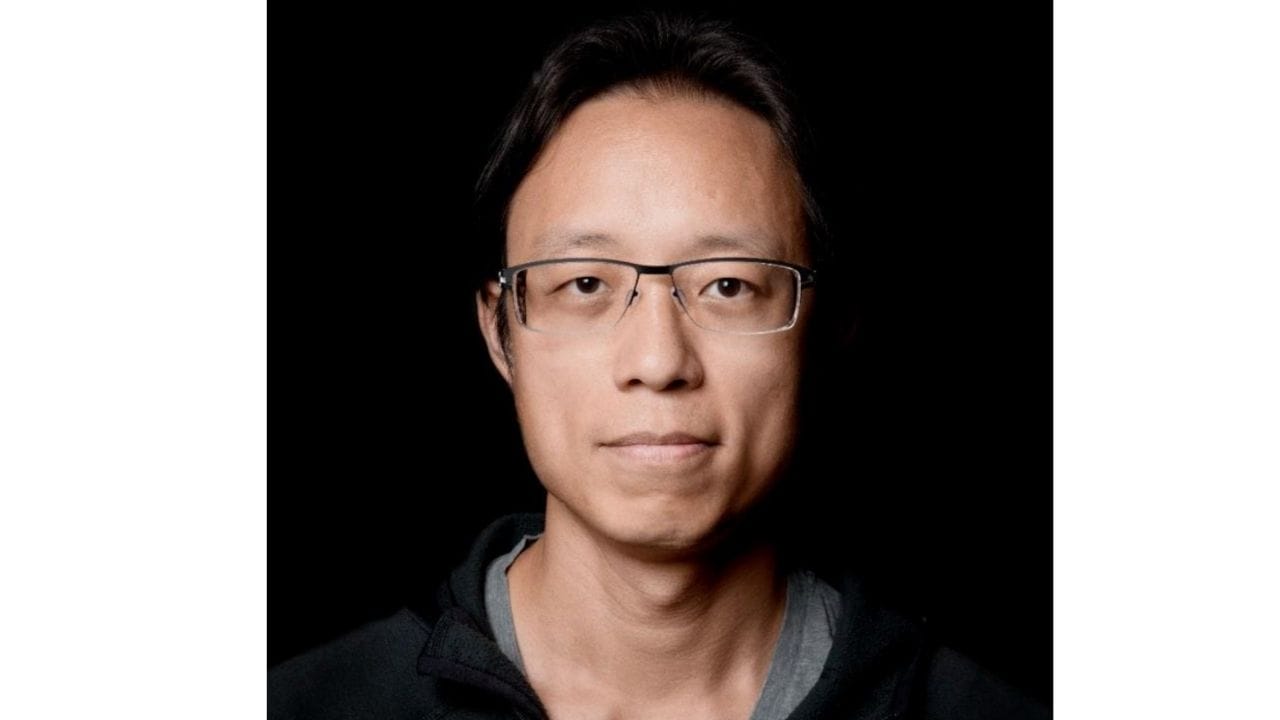

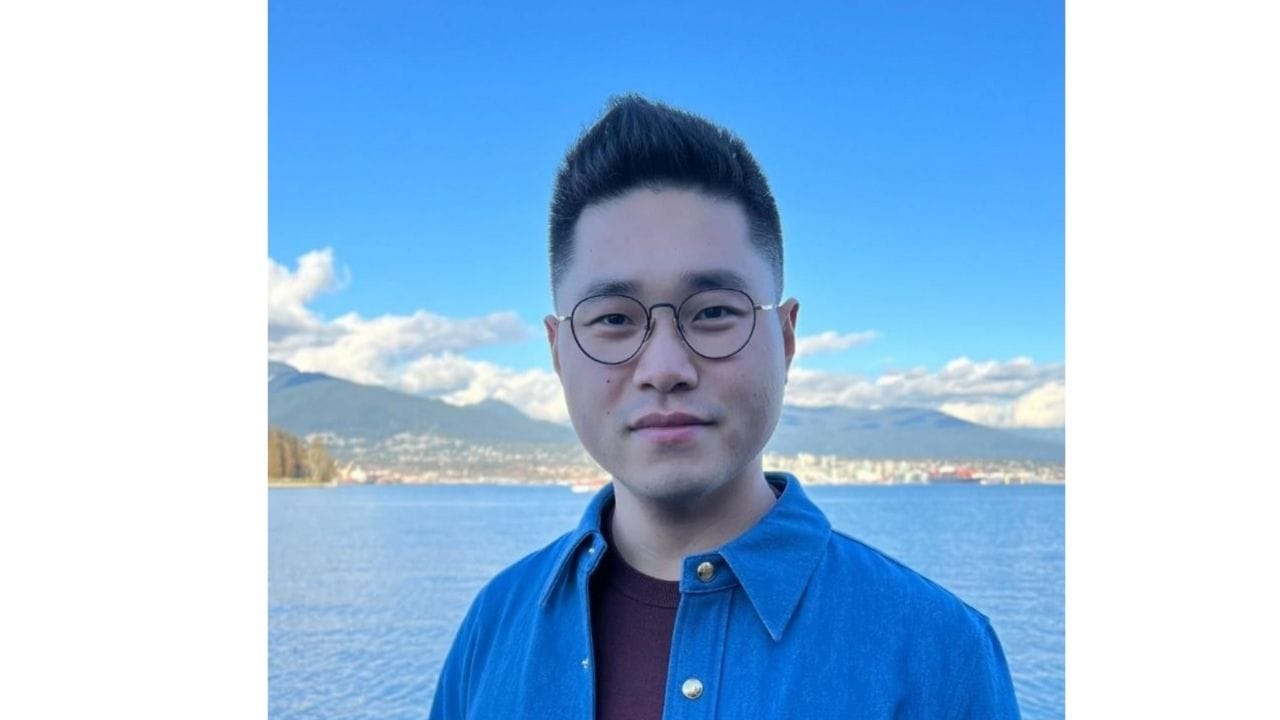

@SergeyNazarov

@VitalikButerin

@realDonaldTrump

@_RichardTeng

@brian_armstrong

Larry Fink | LinkedIn

@paoloardoino

@anatolyakovenko

@saylor

Jenny Johnson - LinkedIn

Arthur Hayes | LinkedIn

@jerallaire

@bgarlinghouse

@justinsuntron

@durov

@RuneKek

@CaitlinLong_

@cz_binance

@sandeepnailwal

@starkness

@gavofyork

@IOHK_Charles

Sreeram Kannan | LinkedIn

Shayne Coplan | LinkedIn

Andy Ayrey | LinkedIn

Tigran Gambaryan | LinkedIn

Hunter Horsley | LinkedIn

Matthew Hougan | LinkedIn

Balaji Srinivasan, PhD | LinkedIn

Eric Balchunas | LinkedIn

ames Seyffart, CFA, CAIA | LinkedIn

Illia Polosukhin | LinkedIn

Johnny Ng | LinkedIn

ulia Leung | LinkedIn

Mahesh Ramakrishnan | LinkedIn

Ray Chan | LinkedIn

@robin_linus

@zachxbt

Yat Siu | LinkedIn

Steve Yun | LinkedIn

Luuk Strijers | LinkedIn

@calilyliu

@PatrickMcHenry

Howard W. Lutnick | LinkedIn

Fred Thiel | LinkedIn

Greg Osuri | LinkedIn

Adam Back | LinkedIn

Jesse Powell | LinkedIn

@StaniKulechov

@AndreCronjeTech

@AndreCronjeTech

@twobitidiot

@OneMorePeter

@KieranWarwick

@spair

@sammcingvale

Profile / X

Olaf Carlson-Wee | LinkedIn

Bobby Ong | LinkedIn

@BarrySilbert

@CathieDWood

Chamath Palihapitiya | LinkedIn

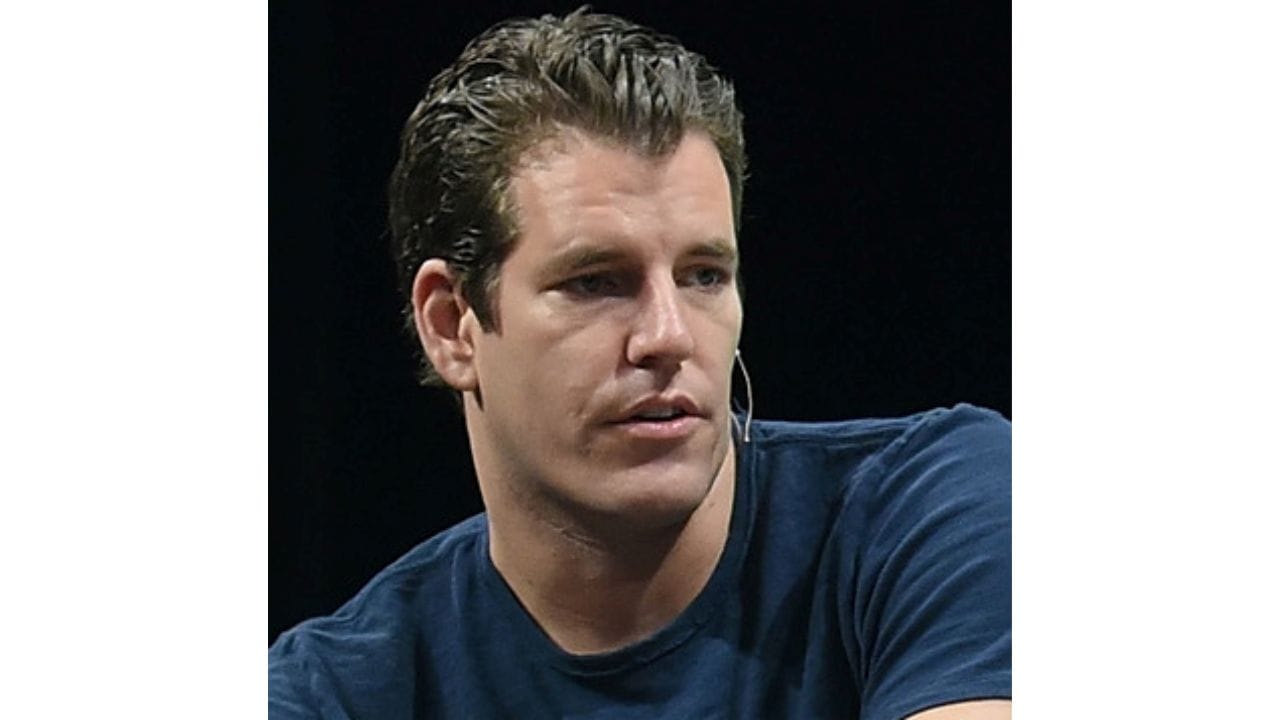

@tyler

@cameron

@Melt_Dem

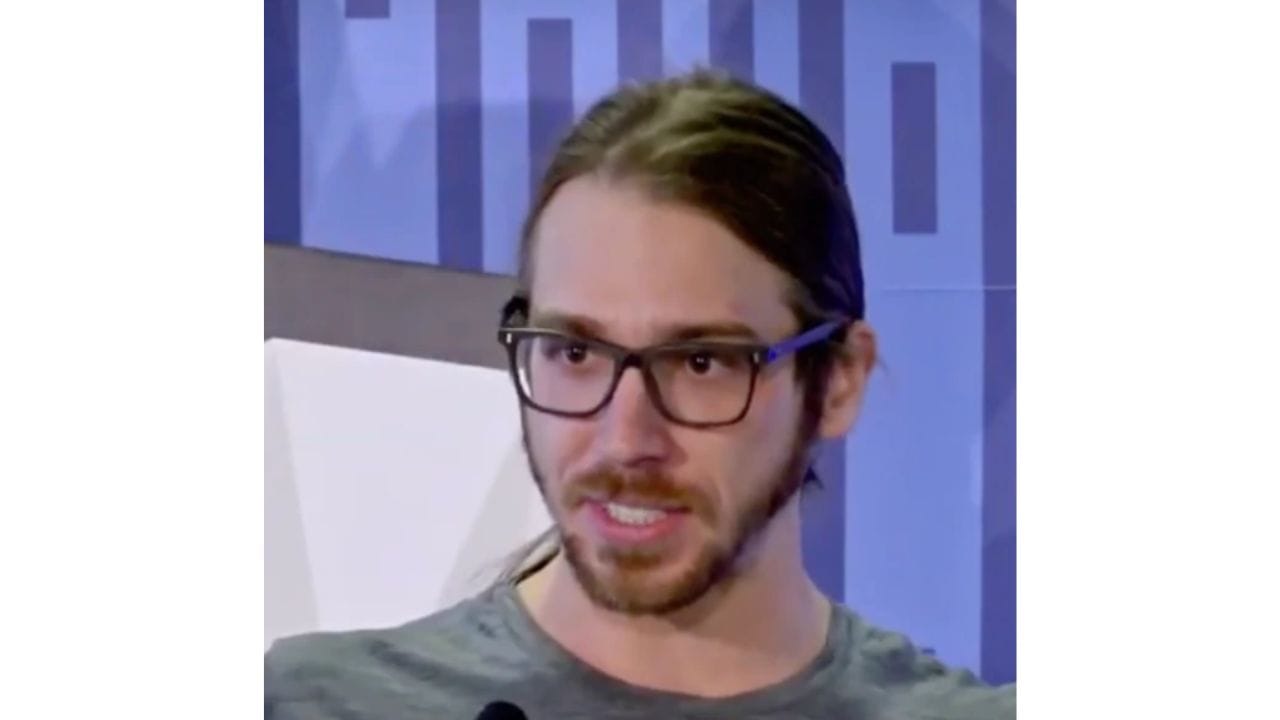

@rleshner

@dannyryan

@Dan_Schulman

Wu Jihan | LinkedIn

Gavin Andresen | LinkedIn

Profile / X

Chris Dixon | LinkedIn

@NavalQuotes

Stanley Freeman Druckenmiller | LinkedIn

@BrianBrooksUS

@ErikVoorhees

Dante A. Disparte | LinkedIn

Caroline D. Pham | LinkedIn

@el33th4xor

@DomSchiener

@katie_haun

@AriDavidPaul

@laurashin

@lopp

@TimDraper

@APompliano

Profile / X

Vinny Lingham | LinkedIn

Evan Cheng | LinkedIn

Sergio Demian Lerner | LinkedIn

Profile / X

@AmberBaldet

Profile / X

@pwuille

Profile / X

@BrendanBlumer

@mikebelshe

@MatthewRoszak

Figure Heloc(FIGR_HELOC)$1.051.64%

Figure Heloc(FIGR_HELOC)$1.051.64% USDS(USDS)$1.00-0.08%

USDS(USDS)$1.00-0.08% Hyperliquid(HYPE)$29.52-0.26%

Hyperliquid(HYPE)$29.52-0.26% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Canton(CC)$0.162488-2.70%

Canton(CC)$0.162488-2.70% USD1(USD1)$1.00-0.03%

USD1(USD1)$1.00-0.03% Rain(RAIN)$0.009819-3.67%

Rain(RAIN)$0.009819-3.67% World Liberty Financial(WLFI)$0.1054352.34%

World Liberty Financial(WLFI)$0.1054352.34% MemeCore(M)$1.43-0.75%

MemeCore(M)$1.43-0.75% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.723.05%

Aster(ASTER)$0.723.05% Falcon USD(USDF)$1.000.05%

Falcon USD(USDF)$1.000.05% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000020.57%

HTX DAO(HTX)$0.0000020.57%