Declining Open Interest

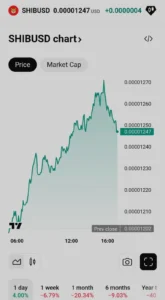

Over the past week, SHIB has fallen by 9.4%, and it has seen a 25.3% drop in the last month. A key factor behind this price drop is the consistent decline in Open Interest (OI).

Source: TradingView

The OI metric reflects unsettled derivative contracts and a decrease suggests that traders are closing positions, weakening market momentum. Coinglass showed SHIB’s OI dropping by nearly 10% in the past 24 hours to $105.94 million, with OI volume also falling by 12.57% to $77.41 million.

SHIB & Whale Activity

Despite the declining Open Interest, SHIB’s price chart hints at a potential short-term rebound. SHIB recently cleared a trend line liquidity, often signaling a reversal, and has entered a demand zone on the chart.

However, data from IntoTheBlock shows that whale transactions have dropped by over 80% from January to the present, indicating reduced confidence among large investors. This suggests that SHIB may struggle to gain momentum without whale support.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.25%

Figure Heloc(FIGR_HELOC)$1.030.25% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Hyperliquid(HYPE)$32.371.50%

Hyperliquid(HYPE)$32.371.50% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.157000-0.34%

Canton(CC)$0.157000-0.34% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% Rain(RAIN)$0.009164-0.01%

Rain(RAIN)$0.009164-0.01% World Liberty Financial(WLFI)$0.1059351.37%

World Liberty Financial(WLFI)$0.1059351.37% MemeCore(M)$1.38-1.54%

MemeCore(M)$1.38-1.54% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Circle USYC(USYC)$1.120.01%

Circle USYC(USYC)$1.120.01% Bittensor(TAO)$191.037.17%

Bittensor(TAO)$191.037.17% Global Dollar(USDG)$1.000.02%

Global Dollar(USDG)$1.000.02% Falcon USD(USDF)$1.000.04%

Falcon USD(USDF)$1.000.04% Aster(ASTER)$0.711.30%

Aster(ASTER)$0.711.30% Sky(SKY)$0.0729635.92%

Sky(SKY)$0.0729635.92% Pi Network(PI)$0.1738211.90%

Pi Network(PI)$0.1738211.90%