Monetary Easing

The Fed is now widely expected to reduce interest rates by at least 0.25%, possibly even 0.5%. This would lower the effective federal funds rate from its current range of 5.25% to 5.5% to around 5.0% to 5.25%.

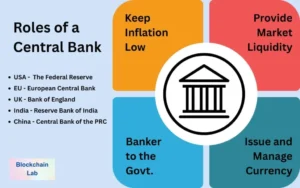

Source: Blockchain Lab

The likelihood of this cut is backed by the Fed’s March guidance, where it indicated a shift toward monetary easing beginning in April, including possible quantitative easing to inject more liquidity into the economy.

Looking Ahead

A rate cut would reduce borrowing costs and discourage excessive saving, potentially fueling economic activity. This could spark a strong rally in financial markets, with Bitcoin (BTC) expected to push past $100,000 and altcoins possibly rebounding by 30% to 50%.

The Federal Reserve’s policy decisions are largely influenced by inflation data. In general, when inflation is high, the Fed raises interest rates to slow spending. When inflation is low, it lowers rates to encourage borrowing and investment.

By managing interest rates, the Fed helps stabilize the economy and keep inflation within its ideal range of 0% to 2%.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.02-1.98%

Figure Heloc(FIGR_HELOC)$1.02-1.98% Wrapped stETH(WSTETH)$3,301.58-1.48%

Wrapped stETH(WSTETH)$3,301.58-1.48% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01% Wrapped eETH(WEETH)$2,924.67-1.61%

Wrapped eETH(WEETH)$2,924.67-1.61% Hyperliquid(HYPE)$31.558.39%

Hyperliquid(HYPE)$31.558.39% Canton(CC)$0.1853993.59%

Canton(CC)$0.1853993.59% Coinbase Wrapped BTC(CBBTC)$83,911.001.88%

Coinbase Wrapped BTC(CBBTC)$83,911.001.88% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% WETH(WETH)$2,691.15-1.56%

WETH(WETH)$2,691.15-1.56% USD1(USD1)$1.000.02%

USD1(USD1)$1.000.02% USDT0(USDT0)$1.000.06%

USDT0(USDT0)$1.000.06% sUSDS(SUSDS)$1.08-1.29%

sUSDS(SUSDS)$1.08-1.29% World Liberty Financial(WLFI)$0.1518670.19%

World Liberty Financial(WLFI)$0.1518670.19% Ethena Staked USDe(SUSDE)$1.220.00%

Ethena Staked USDe(SUSDE)$1.220.00% Rain(RAIN)$0.0093881.00%

Rain(RAIN)$0.0093881.00% MemeCore(M)$1.42-5.72%

MemeCore(M)$1.42-5.72%