Nano Labs has committed $500 million in convertible notes toward building a $1 billion BNB treasury.

The company aims to eventually hold 5% to 10% of BNB’s total circulating supply.

Notes mature in 360 days and can be converted into Nano Labs Class A shares at $20/share.

CZ publicly supported the initiative but did not participate in the investment round.

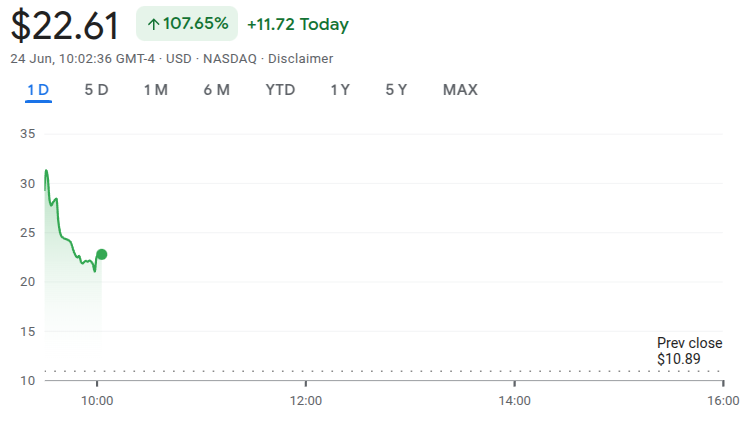

Nano Labs’ stock jumped 106% following the announcement, closing at $22.50.

Growing institutional interest in BNB includes hedge fund activity and a potential VanEck spot BNB ETF.

In an official announcement on Tuesday, Nano Labs revealed plans to acquire up to $1 billion in BNB, combining convertible promissory notes with private placement funding.

This hybrid financing structure will allow the firm to scale up its BNB reserves gradually while mitigating upfront liquidity constraints.

Maturity Period: 360 days from issuance

Interest: None (zero-coupon)

Conversion Rights: Investors can convert the notes fully or partially into Class A ordinary shares of Nano Labs

Initial Conversion Price: $20 per share, subject to future adjustments

Security Status: Unsecured, with no assurance of full closing

Nano Labs also emphasized that there’s no guarantee the deal will close entirely, reflecting the volatile and high-risk nature of large-scale crypto investments.

Changpeng Zhao (CZ), Binance co-founder and former CEO, acknowledged Nano Labs’ announcement on X, praising the move. He noted the immediate positive market reaction to the news.

Source: X (@cz_binance)

Interestingly, Changpeng Zhao clarified that neither he nor any affiliated entities participated in the funding round but reaffirmed their strong support for the company’s vision.

This isn’t the first time BNB has attracted institutional attention:

Earlier in the month, crypto hedge fund managers were reportedly raising $100 million for dedicated BNB investments.

Asset manager VanEck has filed with U.S. regulators for permission to list a spot BNB ETF, a potential game-changer for regulated access to Binance Coin.

These developments point to an evolving landscape where BNB is becoming a mainstream asset in corporate treasuries and institutional portfolios.

Following the news, Nano Labs’ stock surged by over 106%, jumping from $10.90 to $22.50 in a single trading day. This dramatic rise underscores the growing institutional appetite for BNB and investor confidence in Nano Labs’ blockchain infrastructure strategy.

Nanolabs Stock Price

Source: Google Finance

Nano Labs’ commitment to acquiring up to 10% of BNB’s circulating supply shows long-term confidence in the token’s utility, security, and future value.

This move could influence BNB’s supply-demand dynamics, potentially boosting its price stability and valuation metrics, especially if followed by similar initiatives from other institutional players.

Nano Labs sees BNB as a long-term strategic asset. The company aims to diversify its blockchain treasury and capitalize on BNB’s ecosystem utility and potential appreciation.

A convertible note is a form of short-term debt that converts into equity. In this case, investors have the option to convert their notes into Nano Labs’ Class A ordinary shares at $20 per share.

Large-scale acquisitions can influence market perception and pricing. However, the long-term impact will depend on how and when the tokens are acquired and held.

No. Nano Labs clearly states that the transaction is not guaranteed to close fully, and the notes are unsecured. Investors should consider the associated risks.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.00-2.04%

Figure Heloc(FIGR_HELOC)$1.00-2.04% Wrapped stETH(WSTETH)$2,896.83-6.70%

Wrapped stETH(WSTETH)$2,896.83-6.70% USDS(USDS)$1.00-0.04%

USDS(USDS)$1.00-0.04% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.14%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.14% Wrapped eETH(WEETH)$2,570.65-6.69%

Wrapped eETH(WEETH)$2,570.65-6.69% Hyperliquid(HYPE)$29.210.07%

Hyperliquid(HYPE)$29.210.07% Canton(CC)$0.174225-6.52%

Canton(CC)$0.174225-6.52% Ethena USDe(USDE)$1.00-0.19%

Ethena USDe(USDE)$1.00-0.19% Coinbase Wrapped BTC(CBBTC)$78,073.00-4.01%

Coinbase Wrapped BTC(CBBTC)$78,073.00-4.01% WETH(WETH)$2,365.76-6.65%

WETH(WETH)$2,365.76-6.65% USD1(USD1)$1.00-0.01%

USD1(USD1)$1.00-0.01% USDT0(USDT0)$1.000.10%

USDT0(USDT0)$1.000.10% sUSDS(SUSDS)$1.09-0.59%

sUSDS(SUSDS)$1.09-0.59% Ethena Staked USDe(SUSDE)$1.21-0.19%

Ethena Staked USDe(SUSDE)$1.21-0.19% World Liberty Financial(WLFI)$0.121717-13.94%

World Liberty Financial(WLFI)$0.121717-13.94% Rain(RAIN)$0.0094877.64%

Rain(RAIN)$0.0094877.64% Falcon USD(USDF)$0.990.09%

Falcon USD(USDF)$0.990.09%