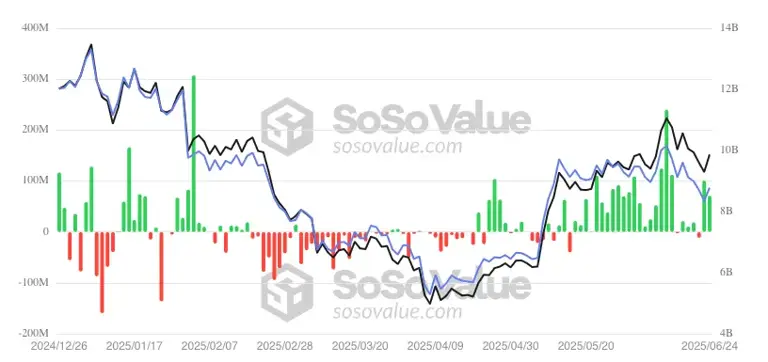

According to SoSoValue, U.S. spot Bitcoin ETFs saw $588.55 million in daily net inflows on June 24, marking the 11th consecutive day of gains.

BTC ETF Inflows

Source: SoSoValue

Over this recent run, Bitcoin ETFs have accumulated over $3.3 billion in net inflows, a strong indicator of institutional faith in digital assets as part of a diversified portfolio.

Ethereum ETFs are also riding this wave of optimism. After a short-lived day of outflows, net inflows into Ethereum ETFs rebounded strongly, totaling $71.24 million in daily net gains.

ETH ETF Inflows

Source: SoSoValue

This marks the second day in a renewed streak of inflows for ETH-backed funds.

BlackRock once again took the lead, this time with its iShares Ethereum Trust (ETHA), which captured $97.98 million in net inflows on the day.

The fund has become the most dominant player among Ethereum ETFs, with $5.41 billion in cumulative inflows and $4.19 billion in net assets under management.

Fidelity’s Ethereum Fund (FETH) was the only outlier, posting $26.74 million in net outflows. Despite the recent dip, FETH maintains $1.61 billion in cumulative inflows and $1.15 billion in assets, ranking second in inflows and fourth in AUM.

The resurgence of Ethereum ETFs, particularly following a market correction, signals a strong institutional appetite for ETH exposure in a regulated, exchange-traded format.

With the SEC’s softening stance on digital asset ETFs and major players like BlackRock and Fidelity spearheading offerings, Ethereum ETFs are becoming a cornerstone of crypto portfolio strategies.

Ethereum ETFs are typically backed by actual ETH held in custody by the fund’s managers. The ETF’s shares represent a portion of this Ethereum, and their price moves in line with ETH market prices.

As of June 2025, BlackRock’s iShares Ethereum Trust (ETHA) is the most popular Ethereum ETF, boasting over $5.41 billion in net inflows and $4.19 billion in assets under management.

Ethereum ETFs are traded on regulated exchanges and often held by reputable custodians. However, like all crypto-related investments, they come with inherent risks due to market volatility.

Yes. Sustained inflows into Ethereum ETFs can increase demand for ETH, potentially influencing the spot market price due to the underlying asset being purchased to back ETF shares.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.18%

Figure Heloc(FIGR_HELOC)$1.040.18% Wrapped stETH(WSTETH)$3,449.76-5.85%

Wrapped stETH(WSTETH)$3,449.76-5.85% Wrapped eETH(WEETH)$3,060.39-5.94%

Wrapped eETH(WEETH)$3,060.39-5.94% USDS(USDS)$1.00-0.15%

USDS(USDS)$1.00-0.15% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.17%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.17% Hyperliquid(HYPE)$32.41-2.86%

Hyperliquid(HYPE)$32.41-2.86% Coinbase Wrapped BTC(CBBTC)$85,576.00-3.94%

Coinbase Wrapped BTC(CBBTC)$85,576.00-3.94% Ethena USDe(USDE)$1.00-0.08%

Ethena USDe(USDE)$1.00-0.08% Canton(CC)$0.1699254.53%

Canton(CC)$0.1699254.53% WETH(WETH)$2,814.64-5.81%

WETH(WETH)$2,814.64-5.81% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04% USDT0(USDT0)$1.00-0.18%

USDT0(USDT0)$1.00-0.18% sUSDS(SUSDS)$1.08-0.07%

sUSDS(SUSDS)$1.08-0.07% World Liberty Financial(WLFI)$0.154094-7.17%

World Liberty Financial(WLFI)$0.154094-7.17% Ethena Staked USDe(SUSDE)$1.21-0.05%

Ethena Staked USDe(SUSDE)$1.21-0.05% Rain(RAIN)$0.009085-7.25%

Rain(RAIN)$0.009085-7.25% MemeCore(M)$1.54-0.76%

MemeCore(M)$1.54-0.76%