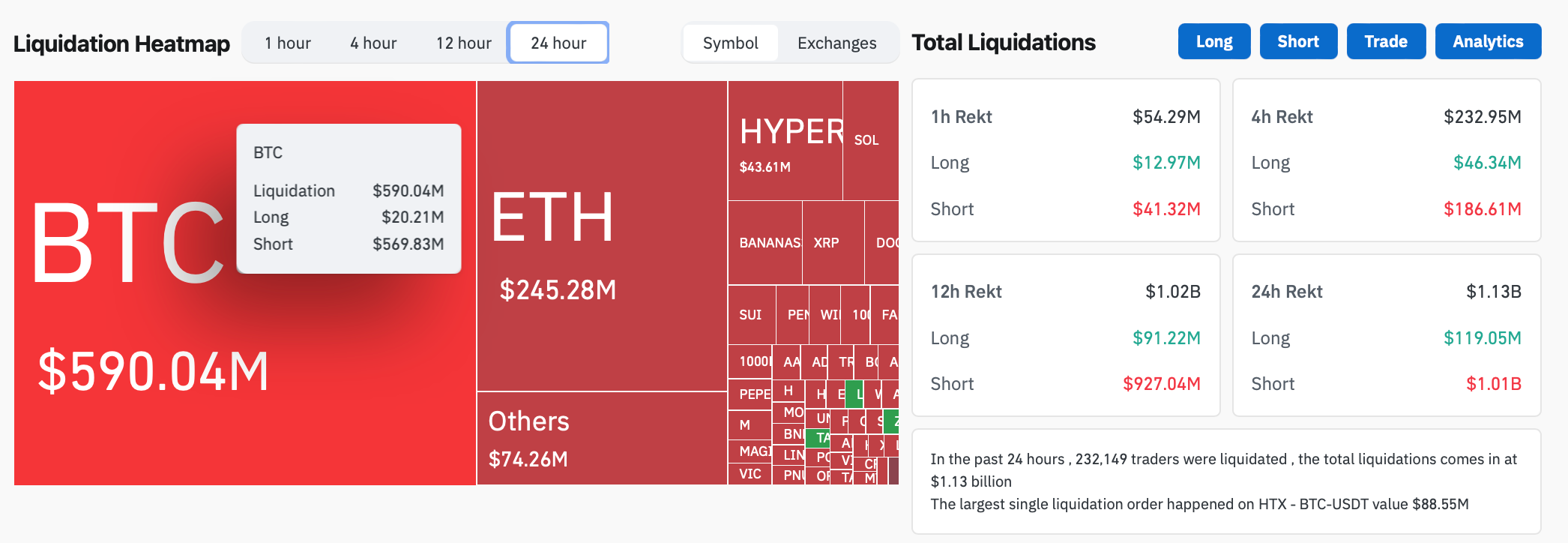

According to CoinGlass, a staggering $1.01 billion in crypto shorts were wiped out across 232,149 traders in just 24 hours.

Source: CoinGlass

This monumental short squeeze not only rattled the bearish camp but also reignited discussions across the market regarding the future of Bitcoin price predictions and whether this is just the beginning of an even more significant rally.

Bitcoin surged from $112,000 on Wednesday to $116,500 on Thursday, marking a two-day streak of new all-time highs. Ether (ETH) wasn’t far behind, climbing to $2,990, triggering widespread altcoin momentum.

The unexpected breakout forced traders and analysts to quickly reevaluate their Bitcoin price prediction models.

Crypto analyst Miles Deutscher described the event succinctly on X, saying:

“Bears in disbelief.”

Prominent trader Daan Crypto Trades chimed in, calling it a:

“MASSIVE short squeeze on BTC & ETH.”

Others, like Velo, highlighted the sheer scale of the liquidation, humorously noting:

“Lots of emails are being sent.”

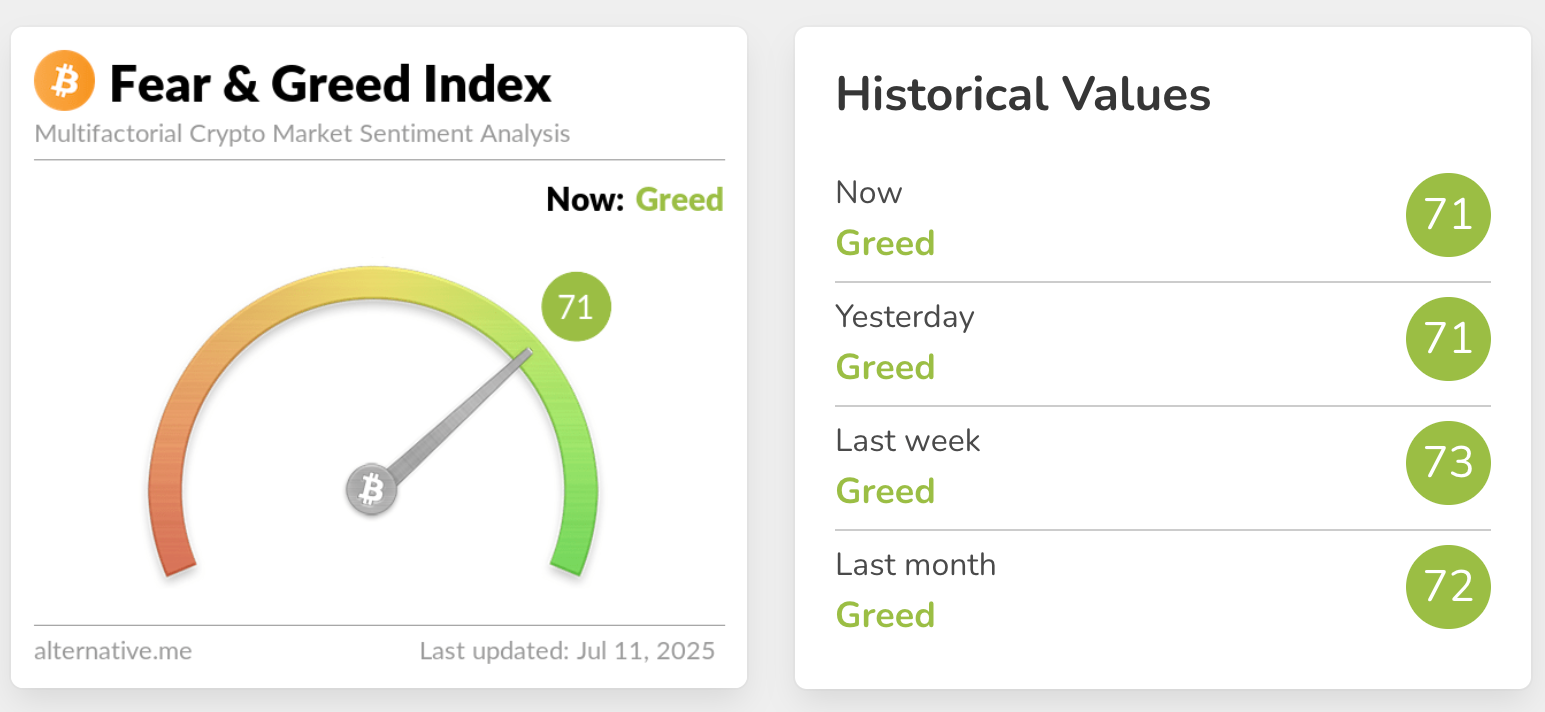

Despite the shockwaves, the Crypto Fear & Greed Index stayed steady at 71/100, maintaining its “Greed” classification. While down slightly from last week’s score of 73, this suggests bullish sentiment remains firm.

Crypto Fear & Greed Index

Source: Alternative.me

Earlier this week, not everyone was convinced Bitcoin would hit new highs. Analysts at Bitfinex observed a “lack of follow-through strength” in BTC’s momentum, suggesting traders were showing signs of hesitation.

On the other hand, Michaël van de Poppe, founder of MN Trading Capital, held a more bullish stance. On June 30, he predicted:

“The inevitable breakout to an ATH on Bitcoin might even happen during the upcoming week.”

That forecast turned out to be spot on.

The short liquidation was triggered by Bitcoin hitting a new all-time high of $116,500, forcing short sellers to cover their positions.

Yes, a large-scale short squeeze often signals bullish momentum. However, it can also result in temporary volatility as the market digests the move.

Yes. With over $2 billion in long positions vulnerable, a drop to $112,000 could result in further liquidations, reinforcing short-term volatility.

Predictions vary. Some analysts see continued upward momentum, while others warn of a potential retracement before the next leg up.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.58%

Figure Heloc(FIGR_HELOC)$1.03-0.58% Wrapped stETH(WSTETH)$3,654.219.43%

Wrapped stETH(WSTETH)$3,654.219.43% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.04%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.04% Hyperliquid(HYPE)$32.8411.16%

Hyperliquid(HYPE)$32.8411.16% WETH(WETH)$2,992.959.09%

WETH(WETH)$2,992.959.09% Wrapped eETH(WEETH)$3,239.079.13%

Wrapped eETH(WEETH)$3,239.079.13% Ethena USDe(USDE)$1.000.03%

Ethena USDe(USDE)$1.000.03% Coinbase Wrapped BTC(CBBTC)$90,746.006.60%

Coinbase Wrapped BTC(CBBTC)$90,746.006.60% World Liberty Financial(WLFI)$0.1610409.88%

World Liberty Financial(WLFI)$0.1610409.88% sUSDS(SUSDS)$1.08-0.81%

sUSDS(SUSDS)$1.08-0.81% Ethena Staked USDe(SUSDE)$1.210.05%

Ethena Staked USDe(SUSDE)$1.210.05% USDT0(USDT0)$1.00-0.01%

USDT0(USDT0)$1.00-0.01% Canton(CC)$0.077829-2.53%

Canton(CC)$0.077829-2.53% Bittensor(TAO)$283.519.36%

Bittensor(TAO)$283.519.36% USD1(USD1)$1.00-0.05%

USD1(USD1)$1.00-0.05%