At 2:47 am UTC on July 14th, Bitcoin hit a fresh milestone, tapping $120,000 on Coinbase. This marks a 13% gain for the month and positions BTC to close its third consecutive green monthly candle, reflecting continued market strength.

BTC/USD – July 14th, 2025

Source: TradingView

One of the primary catalysts behind this new Bitcoin all-time high price is the rapid growth of BlackRock’s spot Bitcoin ETF (IBIT), which now boasts over 700,000 BTC in assets under management. The ETF has tripled its AUM in just 200 trading days, reaching a staggering $83 billion, a feat that took GLD, the gold ETF, over 15 years.

IBIT is officially now the 21st largest ETF overall, surpassing MicroStrategy’s Bitcoin holdings by nearly 100,000 BTC.

Despite this new Bitcoin all-time high, the Long-Term Holder Net Unrealized Profit/Loss (NUPL) metric remains at 0.69, well below the 0.75 threshold typically associated with overheated markets. This indicates that long-term investors are not yet aggressively taking profits, leaving room for more upside.

In the previous bull cycle, NUPL stayed above 0.75 for 228 days. This cycle? Just around 30 days, suggesting more growth could be on the horizon.

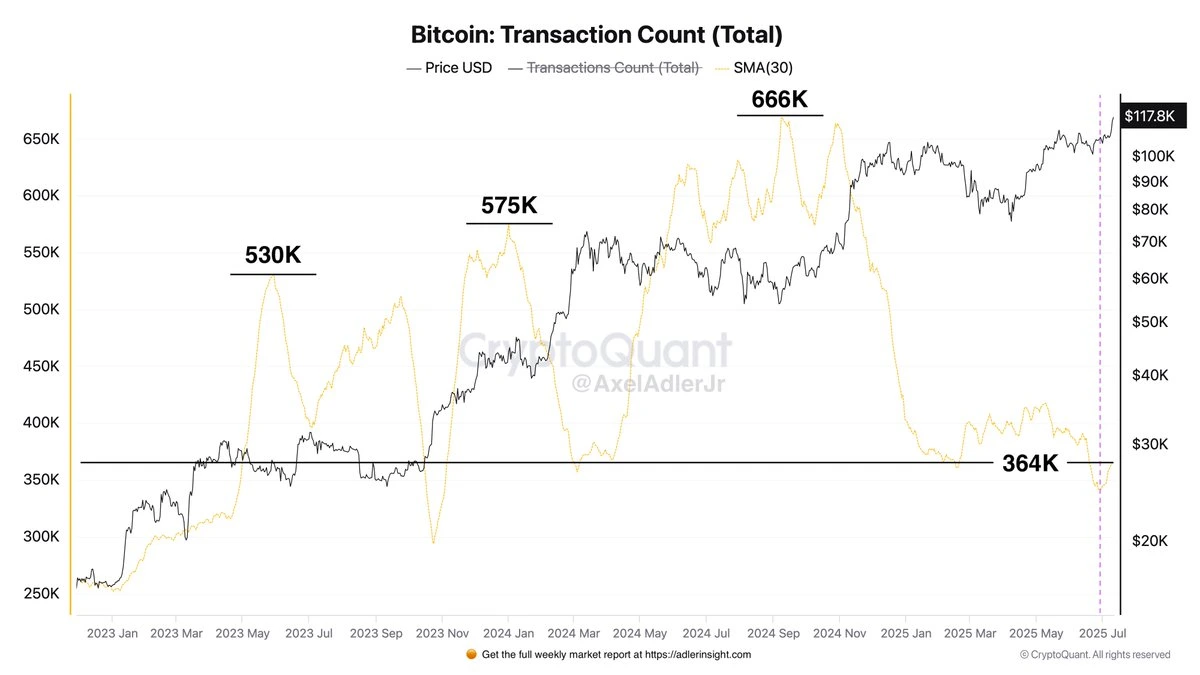

Bitcoin’s daily transactions have increased from 340,000 to 364,000 in recent days. However, these numbers still sit below the 530,000–666,000 range seen during prior market tops, a sign that the market is growing steadily without signs of euphoria or panic selling.

Source: CryptoQuant

Data from CryptoQuant shows that accumulator wallets, those that consistently acquire BTC without significant selling, now hold over 250,000 BTC, the highest level of the year.

The current Bitcoin All-Time High is $120,000, reached on Coinbase on July 14th, 2025.

On-chain data suggests Bitcoin is not in a bubble yet, as long-term holders are not aggressively taking profits and market euphoria remains subdued.

NUPL (Net Unrealized Profit/Loss) measures the profit margin of long-term holders. Levels above 0.75 typically signal market overheating. Currently, NUPL is at 0.69, indicating potential for further upside.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.041.94%

Figure Heloc(FIGR_HELOC)$1.041.94% USDS(USDS)$1.000.12%

USDS(USDS)$1.000.12% Hyperliquid(HYPE)$29.38-0.85%

Hyperliquid(HYPE)$29.38-0.85% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Canton(CC)$0.161942-3.04%

Canton(CC)$0.161942-3.04% USD1(USD1)$1.00-0.02%

USD1(USD1)$1.00-0.02% Rain(RAIN)$0.009776-3.76%

Rain(RAIN)$0.009776-3.76% World Liberty Financial(WLFI)$0.1052942.71%

World Liberty Financial(WLFI)$0.1052942.71% MemeCore(M)$1.43-1.12%

MemeCore(M)$1.43-1.12% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.04%

Falcon USD(USDF)$1.000.04% Aster(ASTER)$0.711.71%

Aster(ASTER)$0.711.71% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.03%

Global Dollar(USDG)$1.00-0.03% HTX DAO(HTX)$0.0000020.70%

HTX DAO(HTX)$0.0000020.70% Ripple USD(RLUSD)$1.000.03%

Ripple USD(RLUSD)$1.000.03%