In an effort dubbed “Crypto Week” by Republican lawmakers, House leaders are working to push forward a trio of bills aimed at shaping the future of digital assets in the U.S. These include:

House Speaker Mike Johnson emphasized the urgency of passing these bills before the August congressional recess, stating:

“It’s a priority of the White House, the Senate and the House to do all of these crypto bills.”

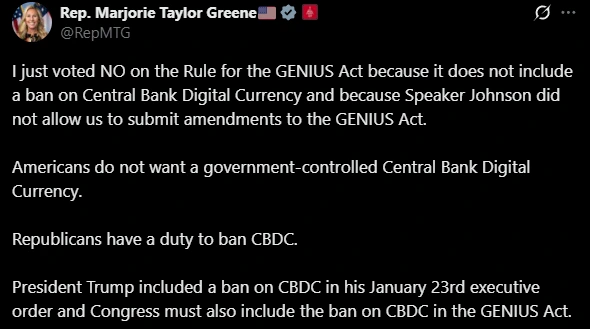

However, the legislative effort faced a setback Tuesday when 13 Republican lawmakers voted against the rule needed to proceed. Their main concern: the GENIUS Act does not currently include language banning a CBDC.

Source: X (@RepMTG)

Lawmakers such as Andy Biggs, Marjorie Taylor Greene, and Anna Paulina Luna made it clear they support crypto innovation, but not without explicit safeguards against a government-issued digital dollar.

Rep. Biggs voiced specific concerns that the GENIUS Act could inadvertently lay groundwork for a layered CBDC system and fail to guarantee user self-custody.

Biggs added:

“House Leadership must allow an open amendment process so Members can freely debate and improve the bill.”

This sentiment echoes broader skepticism among conservative lawmakers, many of whom fear that a CBDC could infringe on privacy, financial autonomy, and personal freedoms.

One of the key disagreements among House Republicans is whether the three bills should be bundled into a single legislative package.

While some GOP lawmakers argue this would strengthen the bills’ collective impact, Speaker Johnson reportedly insists that separating the votes is a more viable strategy for passing them through the Senate.

Despite internal tension, Johnson said discussions are ongoing with the White House and Senate leadership. The goal remains passing all three bills, though the path forward continues to evolve in real time.

In Johnson’s words:

“Some of these guys insist that it needs to be all in one package. We’re trying to work with our Senate partners on this.”

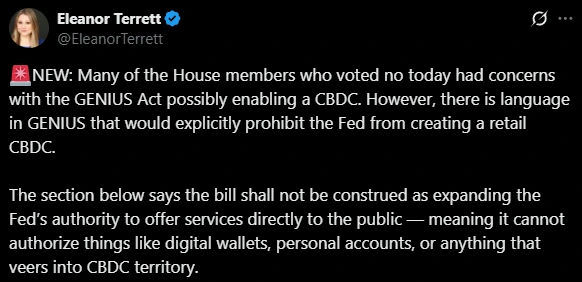

Despite the current debate, some experts argue the GENIUS Act already addresses concerns about CBDC overreach. Eleanor Terrett, host of the Crypto in America podcast, pointed out that the bill explicitly limits the Federal Reserve’s authority to engage with retail customers.

Source: X (@EleanorTerrett)

Terrett explained:

“The bill shall not be construed as expanding the Fed’s authority to offer services directly to the public. That rules out digital wallets, personal accounts, and other CBDC-related infrastructure.”

The House is scheduled to reconvene Wednesday morning for additional debate and legislative business. Many believe the crypto bills still stand a strong chance of passing, just not in a single session.

The GENIUS Act ultimately passed the Senate in June with bipartisan support, although it initially failed a cloture vote in May. Democratic opposition at that time stemmed largely from Trump’s growing association with pro-crypto lobbying efforts.

Still, some believe bipartisan agreement on stablecoin and crypto market frameworks remains within reach, especially as consumer demand for crypto regulation and clarity continues to grow.

The GENIUS Act is a proposed U.S. law that focuses on regulating stablecoins. It aims to provide a legal framework for their issuance while ensuring the Federal Reserve cannot offer services directly to retail users.

Many Republicans fear that a CBDC would allow the government to surveil, control, or limit personal financial transactions. They argue this goes against privacy rights and the principle of financial sovereignty.

It depends. If Republicans can resolve their internal disagreements and keep the bills separate, there’s a strong chance of bipartisan support, especially since the GENIUS Act already passed the Senate once.

This bill seeks to ban the creation and implementation of a central bank digital currency in the U.S., citing risks to privacy, freedom, and financial independence.

If passed, these bills could mark a major step toward clear and comprehensive crypto regulation, providing legal certainty for businesses, investors, and consumers.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.020.00%

Figure Heloc(FIGR_HELOC)$1.020.00% USDS(USDS)$1.00-0.03%

USDS(USDS)$1.00-0.03% Hyperliquid(HYPE)$29.92-2.90%

Hyperliquid(HYPE)$29.92-2.90% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.160243-1.51%

Canton(CC)$0.160243-1.51% USD1(USD1)$1.000.02%

USD1(USD1)$1.000.02% Rain(RAIN)$0.009615-1.30%

Rain(RAIN)$0.009615-1.30% World Liberty Financial(WLFI)$0.1005290.42%

World Liberty Financial(WLFI)$0.1005290.42% MemeCore(M)$1.438.75%

MemeCore(M)$1.438.75% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$189.454.27%

Bittensor(TAO)$189.454.27% Aster(ASTER)$0.720.10%

Aster(ASTER)$0.720.10% Falcon USD(USDF)$1.00-0.02%

Falcon USD(USDF)$1.00-0.02% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.000.02%

Global Dollar(USDG)$1.000.02%