SOL is currently trading around $203, its highest level since February, after experiencing a sharp rise powered by over $12 billion in daily trading volume.

Solana has now become one of the most actively traded crypto assets in the last 24 hours, underscoring bullish sentiment and growing demand.

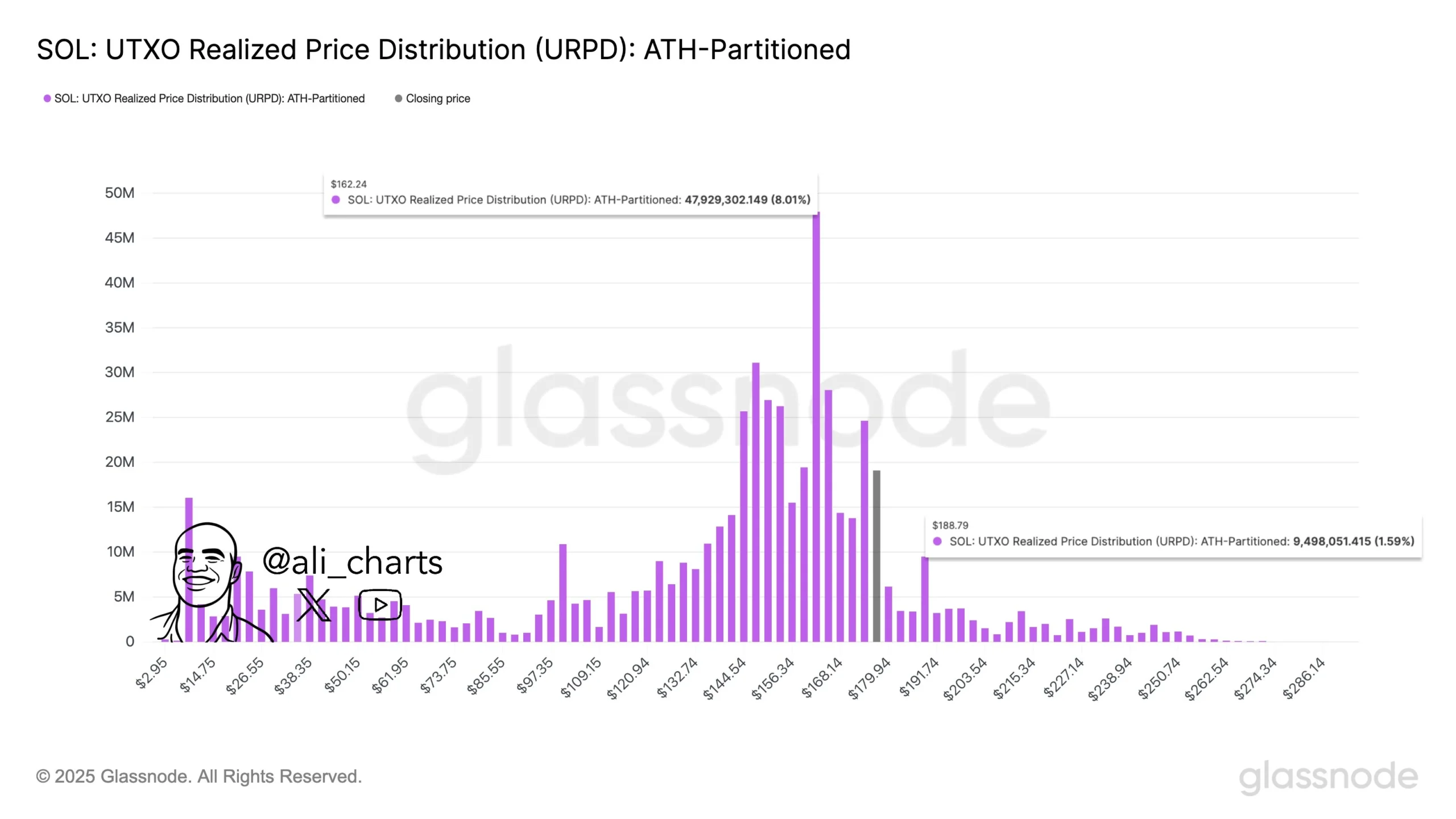

SOL’s Realized Price Distribution

Source: Glassnode

This move not only signals a psychological milestone but also confirms strong technical momentum behind the token.

Market participants view this surge as more than just a temporary pump, it’s seen as a reflection of increasing adoption, deeper liquidity, and broader belief in the Solana ecosystem.

One of the key drivers behind Solana’s breakout is the growing anticipation around the upcoming Block Assembly Marketplace, a new project built on the Solana network.

The platform promises faster and more equitable transactions, further strengthening Solana’s appeal as a high-performance blockchain.

Major players such as DeFi Development Corp have reportedly been making significant purchases of SOL, signaling long-term trust in the asset.

At the same time, capital inflows into Solana-backed funds have jumped by over $40 million this week, bringing total assets under management (AUM) close to $1.8 billion.

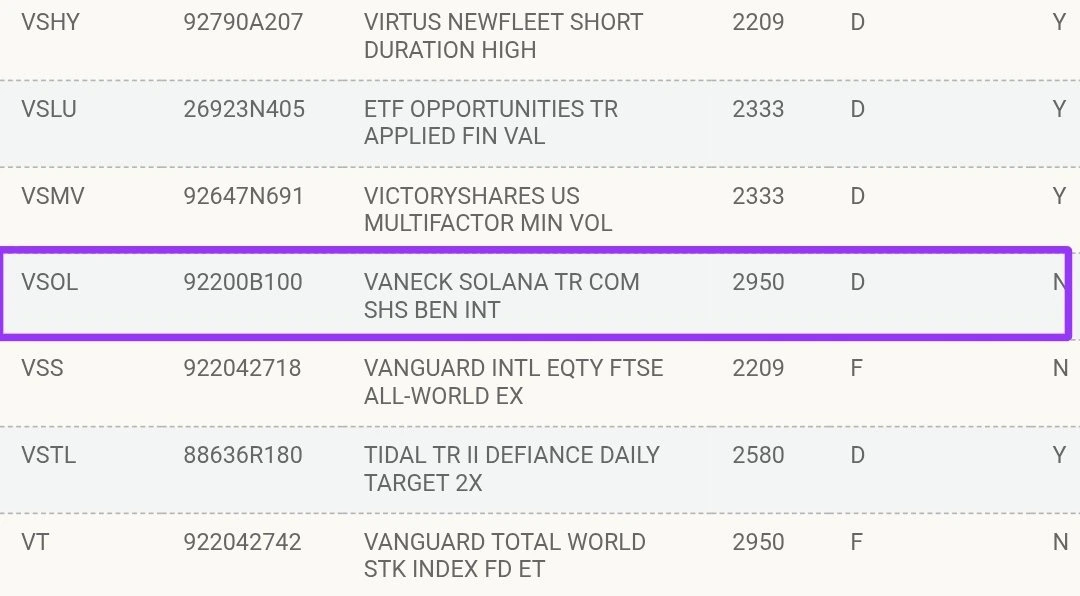

Adding to the excitement is the potential launch of a Solana Spot ETF.

According to crypto investor Crypto Hedgehog, VanEck’s Solana Spot ETF (ticker: VSOL) has appeared on the DTCC (Depository Trust & Clearing Corporation) platform, a critical step often preceding formal regulatory approval.

VanEck’s SOL ETF Filing

Source: VanEck

Although the listing does not guarantee approval, this development has stoked bullish speculation, especially among U.S.-based investors. Many analysts view this as a breakout signal for traders and a long-term catalyst for price appreciation.

If SOL holds above the $200 level, the next key resistance lies around $220. This zone could pose a challenge, particularly given that technical indicators are flashing signs of the token being in overbought territory.

However, a minor pullback is not out of the question. Analysts warn that prices could briefly dip toward $185, a key support level where significant buying interest has previously emerged.

On-chain data from Glassnode shows more than 8 million SOL were accumulated near the $190 zone, strengthening the argument for a potential bounce if a correction occurs.

Crypto analyst Ali emphasizes that $189 is a critical support level. If SOL stays above it, the path toward further gains remains wide open. With limited resistance beyond this point, the token could continue climbing, especially if ETF approval rumors turn into reality.

Solana’s breakout above $200 suggests strong bullish momentum, especially with increasing institutional interest and ETF buzz. If support at $190 holds, the next major target is $220.

Key drivers include hype around the Block Assembly Marketplace, large-scale institutional purchases, ETF speculation, and increased capital inflows into Solana investment products.

No, the VanEck Solana Spot ETF has not yet been approved. However, its listing on the DTCC platform is seen as a preliminary step toward regulatory acceptance.

While the momentum is strong, potential investors should be cautious of short-term corrections. It’s best to assess your risk tolerance and stay updated on ETF news and technical signals before making investment decisions.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.17%

Figure Heloc(FIGR_HELOC)$1.040.17% Wrapped stETH(WSTETH)$2,770.32-3.49%

Wrapped stETH(WSTETH)$2,770.32-3.49% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05% Hyperliquid(HYPE)$33.63-8.92%

Hyperliquid(HYPE)$33.63-8.92% Wrapped eETH(WEETH)$2,460.55-3.61%

Wrapped eETH(WEETH)$2,460.55-3.61% Canton(CC)$0.178415-7.44%

Canton(CC)$0.178415-7.44% Ethena USDe(USDE)$1.00-0.08%

Ethena USDe(USDE)$1.00-0.08% Coinbase Wrapped BTC(CBBTC)$76,426.00-3.09%

Coinbase Wrapped BTC(CBBTC)$76,426.00-3.09% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% WETH(WETH)$2,260.37-3.73%

WETH(WETH)$2,260.37-3.73% USDT0(USDT0)$1.00-0.12%

USDT0(USDT0)$1.00-0.12% sUSDS(SUSDS)$1.090.18%

sUSDS(SUSDS)$1.090.18% Ethena Staked USDe(SUSDE)$1.220.03%

Ethena Staked USDe(SUSDE)$1.220.03% World Liberty Financial(WLFI)$0.1365014.57%

World Liberty Financial(WLFI)$0.1365014.57% Rain(RAIN)$0.009135-1.39%

Rain(RAIN)$0.009135-1.39% MemeCore(M)$1.48-0.67%

MemeCore(M)$1.48-0.67%