The introduction of Bitcoin exchange-traded funds (ETFs) has altered the cryptocurrency’s market dynamics, moving it away from wild boom-and-bust cycles.

Blockware analyst Mitchell Askew said:

“The days of parabolic bull markets and devastating bear markets are over. Bitcoin is heading to $1 million over the next 10 years through steady oscillations.”

BTC Shows Calmer Price Swings Following The Launch Of Bitcoin ETFs In The US

Source: Mitchell Askew

Askew shared that Bitcoin’s price volatility has dramatically decreased since the launch of the U.S.-approved Bitcoin ETFs in January 2024.

He highlighted that Bitcoin (BTC/USD) now behaves like “two entirely different assets” before and after ETF approval.

Askew described Bitcoin’s future price action as a cycle of “pump and consolidate”, rather than the meteoric rallies and crashes seen in the past. His outlook suggests that:

Senior ETF analyst Eric Balchunas of Bloomberg notes that the influx of institutional capital is reducing short-term price volatility. This shift is seen as a double-edged sword:

The rise of Bitcoin ETFs marks the fusion of traditional finance and digital assets.

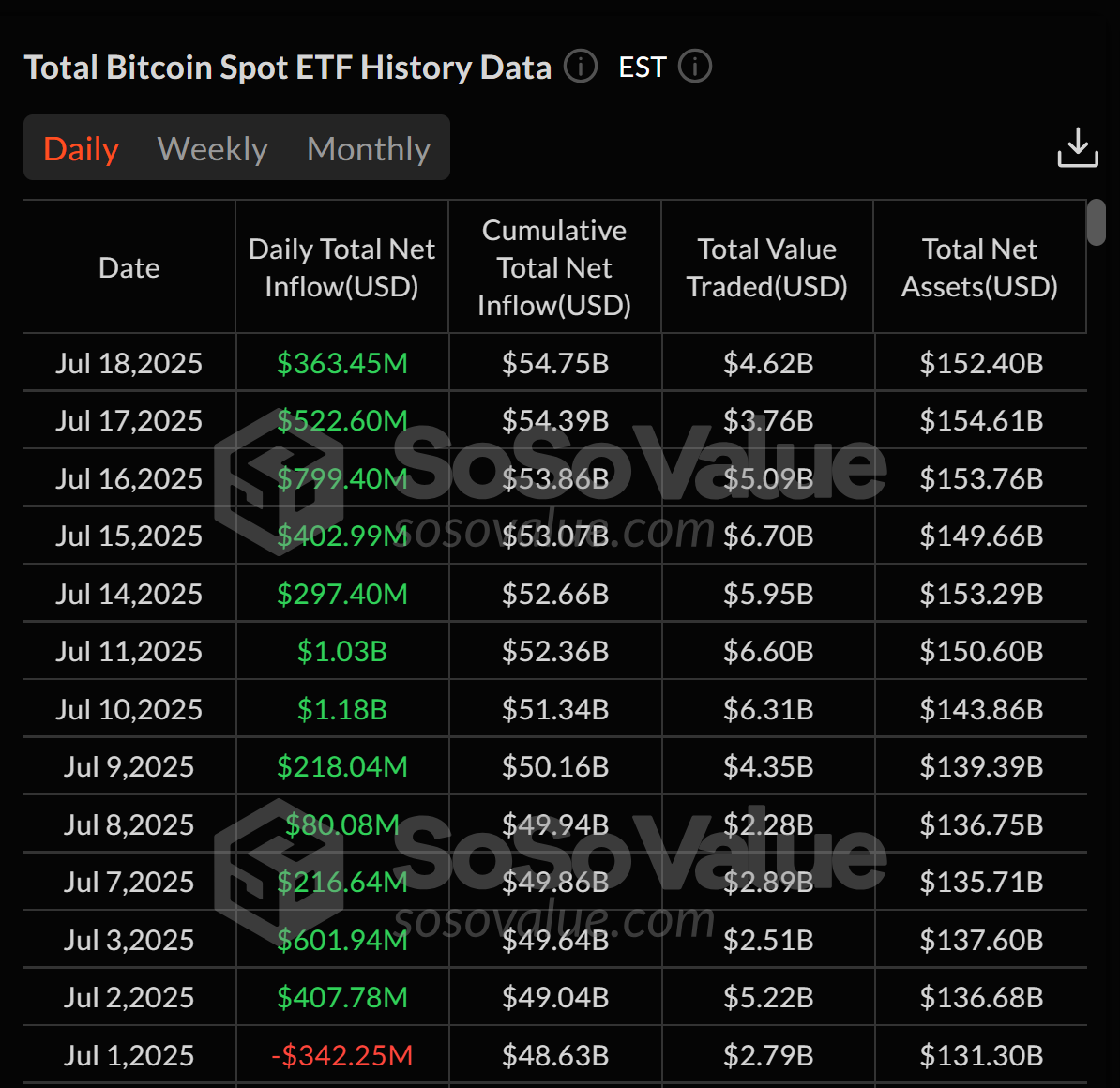

Spot Bitcoin ETFs Recently Went On A 12-Day Streak

Source: SoSoValue

These funds sequester capital into structured investment vehicles, changing the way retail and institutional investors interact with Bitcoin:

One of the lesser-discussed consequences is the lack of capital rotation into altcoins. In past crypto cycles, gains in Bitcoin typically spilled into altcoins. However, with more funds locked in ETFs:

Rather than directly buying and holding Bitcoin, retail investors are increasingly opting for exposure via ETFs. This offers benefits like ease of access and no need for self-custody, but also raises key concerns:

A Bitcoin ETF is an exchange-traded fund that tracks the price of Bitcoin and allows investors to gain exposure to the asset through traditional financial markets without owning it directly.

Since the launch of U.S. Bitcoin ETFs in January 2024, volatility has significantly decreased. The asset has transitioned into more stable price movements, favoring long-term growth over short-term spikes.

Yes, but expectations should be adjusted. With institutional involvement and reduced volatility, Bitcoin is now positioned more like a long-term store of value rather than a speculative asset.

Yes. Large asset managers like BlackRock holding significant portions of Bitcoin through ETFs could centralize control and influence over the asset.

Possibly. With less capital rotation and more funds locked in ETFs, altcoins may see diminished liquidity and lower price appreciation in future cycles.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.032.72%

Figure Heloc(FIGR_HELOC)$1.032.72% Wrapped stETH(WSTETH)$3,663.97-7.00%

Wrapped stETH(WSTETH)$3,663.97-7.00% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Wrapped eETH(WEETH)$3,250.24-6.95%

Wrapped eETH(WEETH)$3,250.24-6.95% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.04%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.04% WETH(WETH)$2,992.17-6.96%

WETH(WETH)$2,992.17-6.96% Coinbase Wrapped BTC(CBBTC)$89,596.00-3.85%

Coinbase Wrapped BTC(CBBTC)$89,596.00-3.85% Ethena USDe(USDE)$1.00-0.19%

Ethena USDe(USDE)$1.00-0.19% Hyperliquid(HYPE)$21.14-11.65%

Hyperliquid(HYPE)$21.14-11.65% Canton(CC)$0.12556514.28%

Canton(CC)$0.12556514.28% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% sUSDS(SUSDS)$1.090.26%

sUSDS(SUSDS)$1.090.26% World Liberty Financial(WLFI)$0.164264-1.20%

World Liberty Financial(WLFI)$0.164264-1.20% Ethena Staked USDe(SUSDE)$1.220.01%

Ethena Staked USDe(SUSDE)$1.220.01% USD1(USD1)$1.00-0.05%

USD1(USD1)$1.00-0.05% Rain(RAIN)$0.008627-5.26%

Rain(RAIN)$0.008627-5.26% MemeCore(M)$1.654.84%

MemeCore(M)$1.654.84%