PENGU, the native token tied to the widely recognized NFT project ‘Pudgy Penguins’, is back in the spotlight.

Over the past 24 hours, PENGU has rallied 6%, bolstered by rising investor interest and increased trading activity. The growing traction comes at a critical juncture as on-chain indicators flash bullish signals for short-term traders.

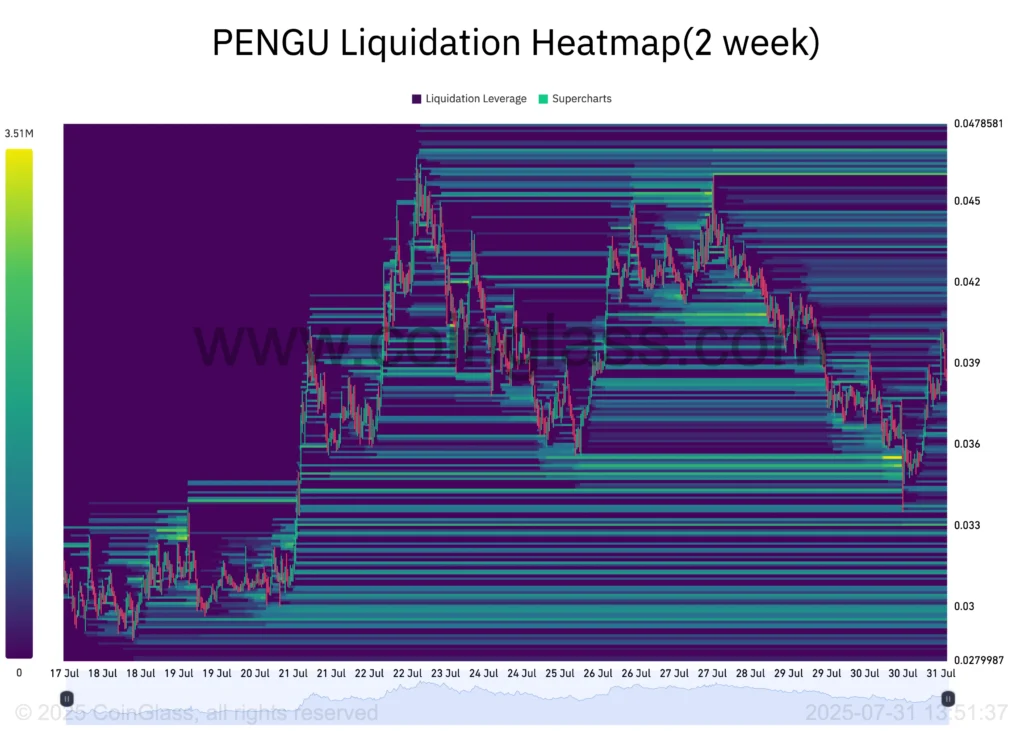

In particular, attention has turned to PENGU’s liquidation heatmap, which shows a concentration of liquidity forming just above current prices.

PENGU’s Heatmap

Source: CoinGlass

According to market analysts, this setup could act as a magnet for price action, potentially pushing the memecoin to new short-term highs.

One of the most telling signals comes from the PENGU liquidation heatmap, a tool used by traders to identify zones where large numbers of leveraged positions could be liquidated. In this case, a notable liquidity cluster has formed near the $0.045 price level.

This cluster near $0.045 could act as a gravitational pull on PENGU’s price. Traders aiming to ignite momentum often push price action toward these zones to force liquidations, thereby accelerating bullish pressure.

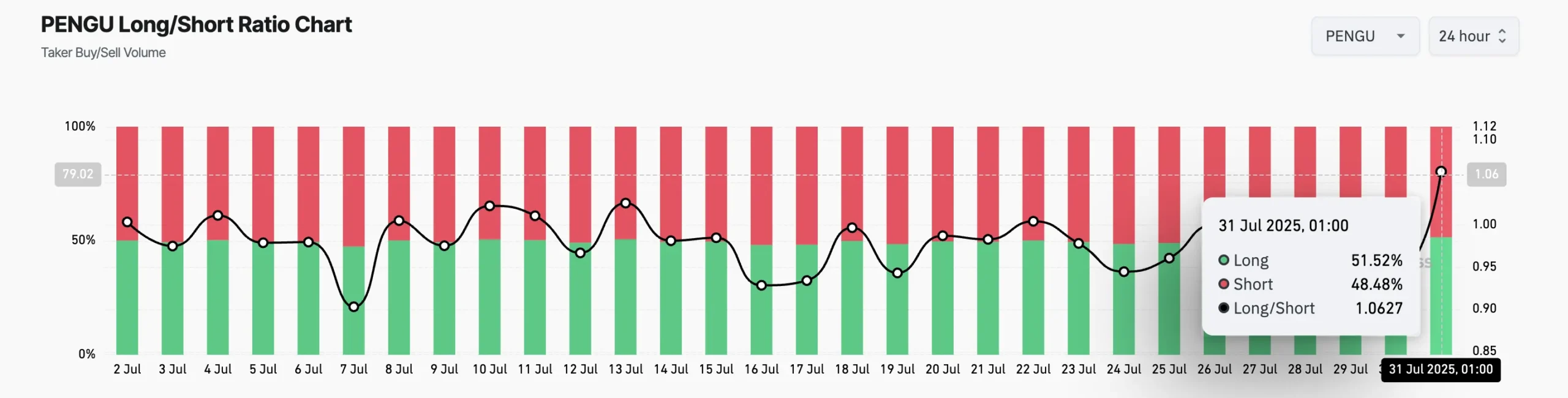

Further bolstering the bullish case is PENGU’s long/short ratio, which has jumped to a monthly high of 1.06. This metric, tracked across crypto futures markets, shows how many traders are betting on price increases (longs) versus declines (shorts).

A ratio above 1.0 means long positions outnumber short ones, a sign that market participants are increasingly optimistic.

Source: CoinGlass

This trend aligns with recent developments in the NFT and memecoin sectors, both of which have seen renewed interest in 2025 amid shifting investor sentiment and risk appetite.

At the time of writing, PENGU trades at $0.0379, hovering just above the critical support level of $0.0369.

If the bullish momentum holds, traders anticipate a move toward $0.044–$0.045, right where the largest liquidity clusters are located. A successful push into this range could trigger additional short liquidations, creating a potential rally.

However, if selling pressure returns, a break below the $0.0369 support could send PENGU back toward the $0.0291 area, a zone that previously acted as a major support in early July.

The combination of rising trading volumes, clustered liquidity targets, and a favorable long/short ratio creates an environment ripe for a short-term breakout.

For swing traders and crypto enthusiasts watching the memecoin space, this could be a notable opportunity, but also a setup that requires close monitoring due to potential volatility.

PENGU is the native token associated with Pudgy Penguins, a leading NFT project known for its vibrant community and brand expansions into physical toys and social platforms.

A liquidation heatmap visualizes where large clusters of leveraged positions (longs or shorts) are likely to be liquidated. These zones often become price targets in volatile markets.

A large liquidity cluster has formed around $0.045, suggesting that traders may attempt to push the price upward toward this level to trigger liquidations and drive momentum.

It means that more traders are betting on price increases (longs) than declines (shorts), reflecting bullish sentiment in the market.

While technical indicators are showing bullish signals, the crypto market remains volatile. Investors should do their own research and consider risk management strategies before investing.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.02-0.99%

Figure Heloc(FIGR_HELOC)$1.02-0.99% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Hyperliquid(HYPE)$31.71-0.58%

Hyperliquid(HYPE)$31.71-0.58% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Canton(CC)$0.1559390.97%

Canton(CC)$0.1559390.97% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.009111-0.28%

Rain(RAIN)$0.009111-0.28% World Liberty Financial(WLFI)$0.103244-1.45%

World Liberty Financial(WLFI)$0.103244-1.45% MemeCore(M)$1.431.58%

MemeCore(M)$1.431.58% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Circle USYC(USYC)$1.120.01%

Circle USYC(USYC)$1.120.01% Pi Network(PI)$0.19163411.55%

Pi Network(PI)$0.19163411.55% Bittensor(TAO)$184.65-1.08%

Bittensor(TAO)$184.65-1.08% Sky(SKY)$0.0767497.27%

Sky(SKY)$0.0767497.27% Aster(ASTER)$0.722.30%

Aster(ASTER)$0.722.30% Falcon USD(USDF)$1.000.02%

Falcon USD(USDF)$1.000.02% Global Dollar(USDG)$1.000.00%

Global Dollar(USDG)$1.000.00%