Hyperliquid reimbursed $1.99 million in USDC after a 37-minute API outage.

The issue stemmed from a traffic surge, not a security exploit.

Affected users were compensated based on the size of their losses.

Users owed more than $10,000 must complete KYC verification by August 18th.

The quick response has drawn praise from the crypto community.

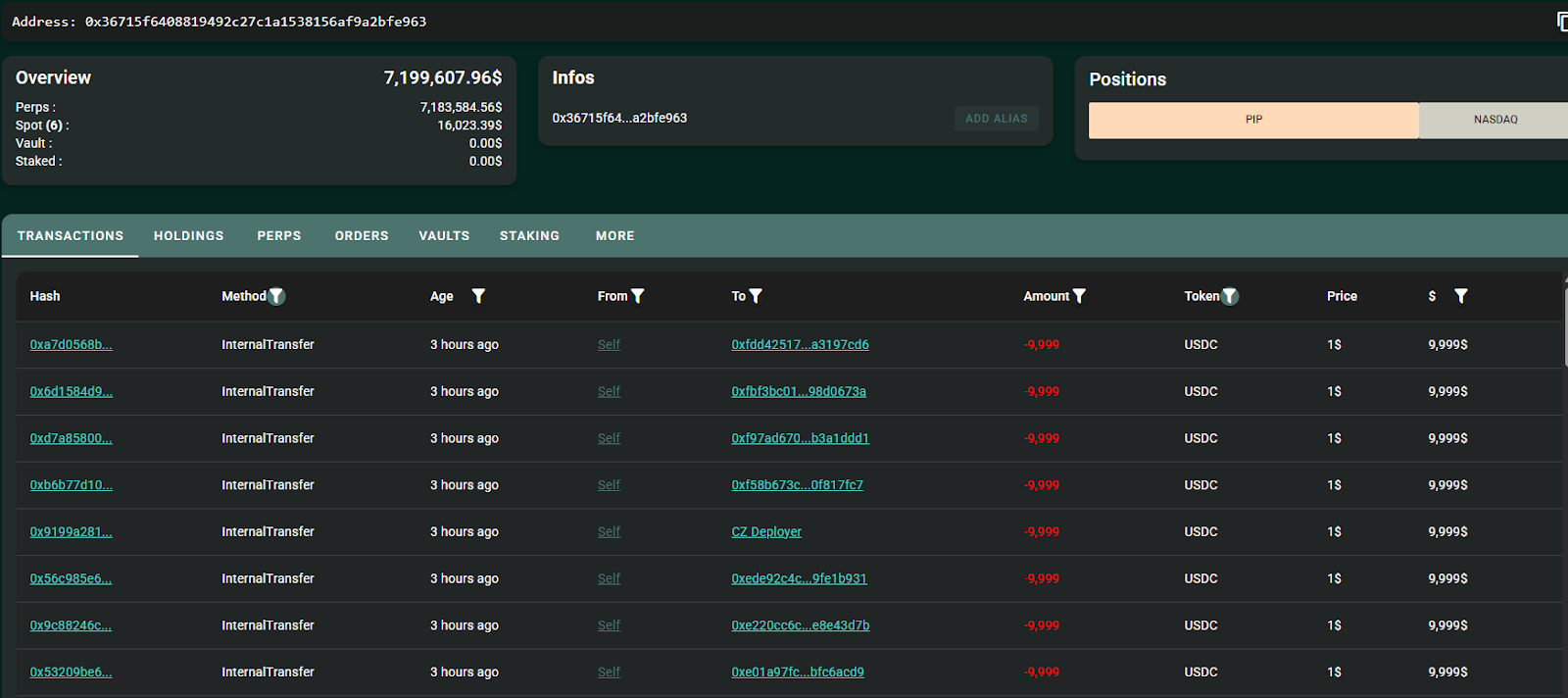

On August 4th, Hyperliquid began issuing refunds to affected users, totaling $1.99 million in USDC, according to on-chain data from Hypurrscan.

Source: Hypurrscan

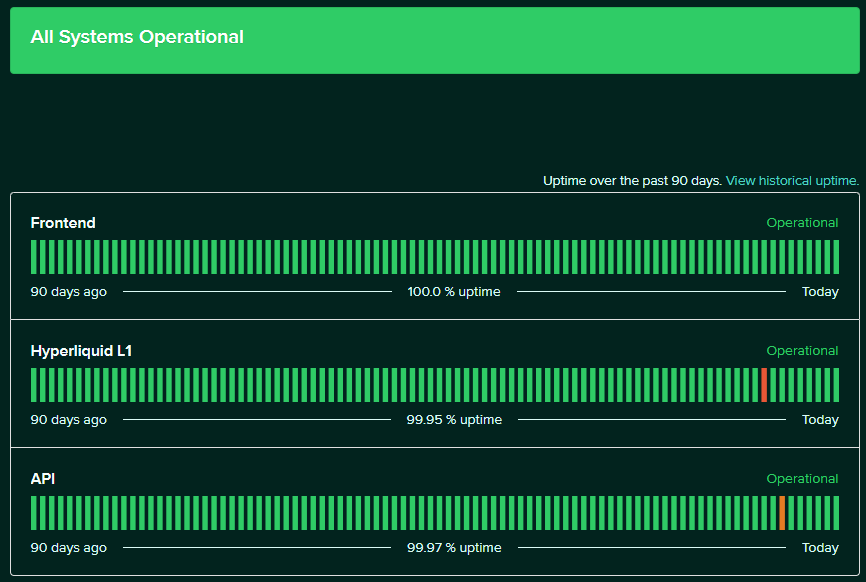

On July 29th, from 14:10 to 14:47 UTC, the Hyperliquid API suffered a disruption due to a massive traffic spike.

According to Hyperliquid’s status page, the outage delayed order execution for thousands of users, although transactions were still reaching the mempool and eventually processed on-chain.

The decision to refund came without any legal requirement or enforceable contract, underscoring the exchange’s commitment to its user base.

Hyperliquid categorized the reimbursement process into three tiers, depending on the user’s trading impact and losses during the outage. Here’s how it worked:

Refunds up to $9,999 USDC: Sent automatically to user wallets.

Refunds above $10,000: Users must complete KYC verification via a Discord ticket system by August 18 to receive full compensation.

Partial Payouts: Those requiring KYC have already received $9,999 pending full verification.

Traders and community members praised the platform’s integrity. One user, aaalex, posted on X:

“Over $1.5m has already been sent out to users (can confirm). Incredible considering they have no legal obligation, no contract or SLA to do this.”

Despite the recent hiccup, Hyperliquid continues to climb the global rankings for derivatives trading. According to CoinGecko:

$10.6 billion in 24-hour open interest

Ranked 7th globally, up from 12th just a few months ago

This growth places Hyperliquid ahead of several centralized exchanges, showing increasing user confidence in decentralized alternatives, especially in light of the Hyperliquid reimbursement response.

Initial concerns of a potential exploit or cyberattack were quickly dispelled. In a Telegram announcement, Hyperliquid clarified:

“Orders were delayed due to API servers experiencing a significant spike in traffic, not a hack.”

This spike followed a surge in platform activity, where Hyperliquid surpassed $14.7 billion in open interest on July 23rd, a record high for the platform.

Hyperliquid Uptime

Source: Hyperliquid.statuspage.io

It’s worth noting this isn’t Hyperliquid’s first high-profile issue. In March 2025, the platform suffered a $6.26 million exploit linked to the Jelly my Jelly (JELLY) memecoin due to a flaw in liquidation parameters.

Despite this, the platform’s recovery efforts and transparency seem to be building resilience rather than eroding trust.

The crypto trading community has often criticized decentralized platforms for lacking the accountability and responsiveness found in traditional finance or even centralized exchanges.

However, Hyperliquid’s $2 million reimbursement may be a turning point, demonstrating that decentralized platforms can act swiftly and ethically even without legal frameworks forcing their hand.

Hyperliquid is a decentralized derivatives trading platform offering high-speed, low-latency trading without a central authority.

Traders were unable to execute orders during a 37-minute API outage. Hyperliquid chose to compensate affected users, despite having no legal or contractual obligation to do so.

A total of $1.99 million in USDC was distributed to affected traders, according to on-chain data.

While no platform is risk-free, Hyperliquid’s response to both technical and security incidents suggests a high level of accountability and transparency, rare in the DeFi space.

Only users owed more than $10,000 are required to complete KYC verification. All others were reimbursed automatically.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.74%

Figure Heloc(FIGR_HELOC)$1.03-0.74% Wrapped stETH(WSTETH)$3,589.00-3.23%

Wrapped stETH(WSTETH)$3,589.00-3.23% Wrapped eETH(WEETH)$3,182.25-3.20%

Wrapped eETH(WEETH)$3,182.25-3.20% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01% Hyperliquid(HYPE)$34.251.25%

Hyperliquid(HYPE)$34.251.25% Coinbase Wrapped BTC(CBBTC)$87,878.00-2.42%

Coinbase Wrapped BTC(CBBTC)$87,878.00-2.42% Ethena USDe(USDE)$1.000.04%

Ethena USDe(USDE)$1.000.04% WETH(WETH)$2,929.15-3.15%

WETH(WETH)$2,929.15-3.15% Canton(CC)$0.1710604.51%

Canton(CC)$0.1710604.51% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% World Liberty Financial(WLFI)$0.160738-2.79%

World Liberty Financial(WLFI)$0.160738-2.79% USDT0(USDT0)$1.00-0.04%

USDT0(USDT0)$1.00-0.04% sUSDS(SUSDS)$1.090.23%

sUSDS(SUSDS)$1.090.23% Ethena Staked USDe(SUSDE)$1.220.03%

Ethena Staked USDe(SUSDE)$1.220.03% Rain(RAIN)$0.009639-2.47%

Rain(RAIN)$0.009639-2.47% MemeCore(M)$1.54-0.31%

MemeCore(M)$1.54-0.31%