Changpeng Zhao has moved to dismiss a $1.8B lawsuit filed by FTX, claiming lack of jurisdiction and no direct involvement.

The lawsuit alleges a fraudulent share buyback funded by misused customer funds in 2021.

Zhao argues that all relevant actions took place outside the U.S., weakening the case under U.S. law.

Binance and former executives have also filed motions to dismiss, calling the lawsuit “legally deficient.”

The outcome of the Changpeng Zhao lawsuit could set precedent for future crypto-related legal battles.

FTX filed the lawsuit in November, alleging that Binance and Zhao received approximately $1.8 billion in crypto assets in a buyback agreement funded through misappropriated customer funds.

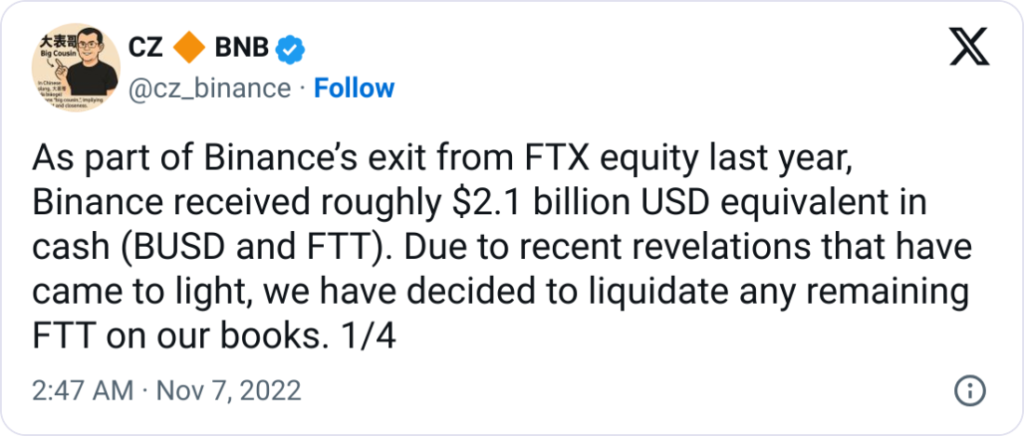

Source: X (@cz_binance)

The FTX legal team, now operating under new management after the exchange’s collapse, asserts that its former CEO, Sam Bankman-Fried, and his inner circle knew they didn’t have the assets to complete the deal legitimately.

Instead, FTX claims, the exchange used customer deposits to finance the transaction, seeking to regain shares previously sold to Binance.

In a recent court filing, Zhao pushed back, asserting that he had no role in the actual transfer of assets and was not the recipient of the alleged funds.

His legal team emphasized that Binance entities involved were located in non-U.S. jurisdictions, including the Cayman Islands, British Virgin Islands, and Ireland.

Zhao himself is based in the United Arab Emirates, which his lawyers argue further distances him from the jurisdiction of U.S. law.

The deal in question involved Binance USD (BUSD) and FTX Token (FTT), two crypto assets created by the respective exchanges.

Another key aspect of the Changpeng Zhao lawsuit involves claims that his public comments on social media triggered a bank run that hastened FTX’s downfall.

In November 2022, following a CoinDesk report that questioned FTX’s balance sheet, Zhao announced that Binance would liquidate its FTT holdings.

Shortly after, Binance appeared poised to acquire FTX, only to back out of the deal after a brief due diligence review. FTX’s legal team alleges that Zhao’s tweets were part of a calculated move to destabilize the rival exchange.

Zhao, however, has denied this, stating in court:

“FTX was a fraudulent enterprise. Even if Mr. Zhao’s social media posts contributed to the timing of the FTX downfall, the company had no right to exist, let alone persist in fraud indefinitely.”

His legal team likened his actions to those of a whistleblower, arguing it would be unjust to blame someone for exposing a failing system.

Binance, which is also named in the lawsuit, filed a motion in May 2025 to dismiss the case entirely, calling the lawsuit “legally deficient” and placing the blame for FTX’s collapse squarely on Sam Bankman-Fried, who is currently serving a 25-year prison sentence for fraud.

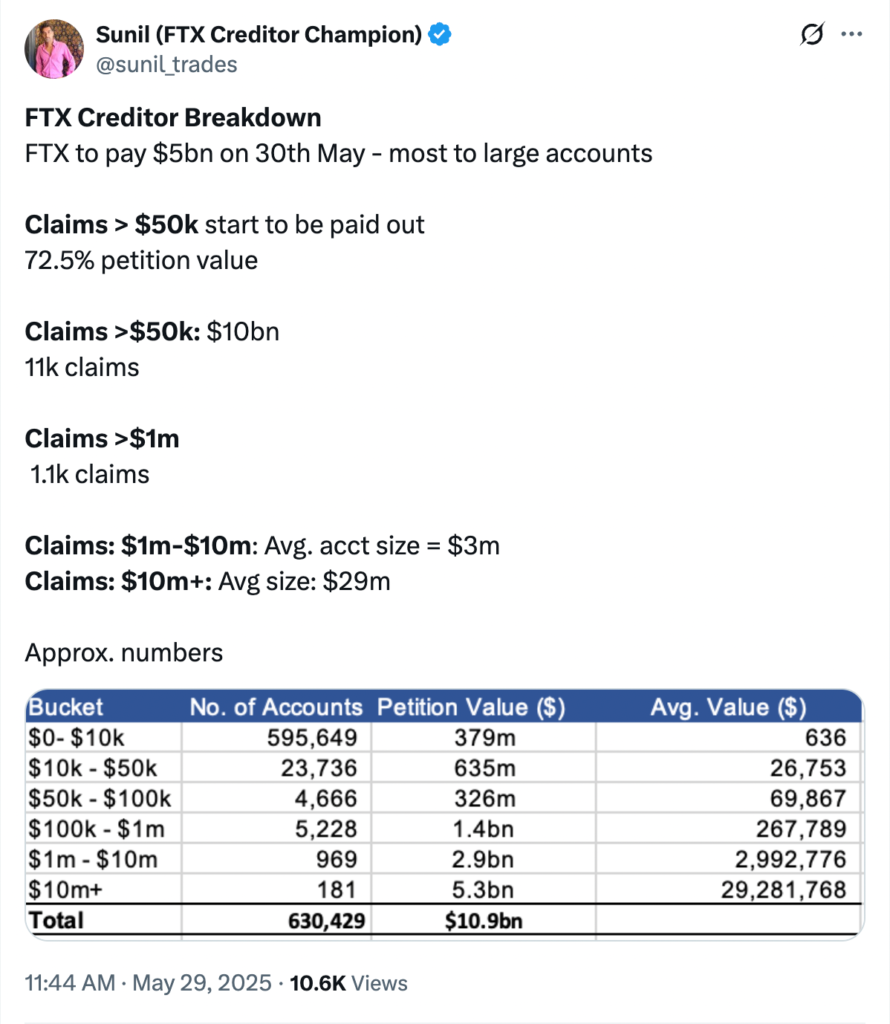

Two other former Binance executives, Samuel Wenjun Lim and Dinghua Xiao, have also moved to dismiss related claims made by FTX. The FTX repayments may have swayed public opinion, but not by much as many thought it was too little, too late.

Source: X (@sunil_trades)

Zhao served a four-month prison sentence in 2024 after pleading guilty to money laundering violations related to Binance operations. Meanwhile, Bankman-Fried’s appeal of his conviction is expected to be heard in November 2025.

The Changpeng Zhao lawsuit represents one of the highest-profile legal entanglements remaining from the crypto industry’s turbulent past two years, as regulators and bankruptcy courts continue to sort through the debris left by collapsed firms.

FTX claims Zhao and Binance received $1.8 billion in crypto as part of a share buyback that was funded with misappropriated customer assets in 2021.

Zhao argues he had no direct involvement in the transfers and that the deal occurred entirely outside U.S. jurisdiction. He also denies contributing to FTX’s collapse via social media posts.

Binance originally invested in FTX, later exited its position in 2021 by selling its shares back. FTX alleges the repurchase was funded illegally. Zhao claims FTX’s mismanagement and fraud led to its collapse.

Zhao resides in the United Arab Emirates. He completed a four-month prison sentence in 2024 for unrelated money laundering charges.

A U.S. bankruptcy court in Delaware will decide whether to dismiss the case or proceed to trial. Zhao and other Binance figures are actively seeking dismissal.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.00%

Figure Heloc(FIGR_HELOC)$1.030.00% Wrapped stETH(WSTETH)$3,446.98-4.61%

Wrapped stETH(WSTETH)$3,446.98-4.61% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Wrapped eETH(WEETH)$3,056.33-4.63%

Wrapped eETH(WEETH)$3,056.33-4.63% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.04%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.04% Coinbase Wrapped BTC(CBBTC)$86,535.00-2.90%

Coinbase Wrapped BTC(CBBTC)$86,535.00-2.90% Ethena USDe(USDE)$1.000.03%

Ethena USDe(USDE)$1.000.03% WETH(WETH)$2,815.05-4.53%

WETH(WETH)$2,815.05-4.53% Canton(CC)$0.142609-8.05%

Canton(CC)$0.142609-8.05% Hyperliquid(HYPE)$22.17-4.49%

Hyperliquid(HYPE)$22.17-4.49% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04% USDT0(USDT0)$1.00-0.01%

USDT0(USDT0)$1.00-0.01% World Liberty Financial(WLFI)$0.165822-7.00%

World Liberty Financial(WLFI)$0.165822-7.00% sUSDS(SUSDS)$1.090.59%

sUSDS(SUSDS)$1.090.59% Ethena Staked USDe(SUSDE)$1.220.05%

Ethena Staked USDe(SUSDE)$1.220.05% Rain(RAIN)$0.009536-4.40%

Rain(RAIN)$0.009536-4.40% MemeCore(M)$1.63-0.04%

MemeCore(M)$1.63-0.04%