Kraken has paused Monero deposits due to a 51% attack on the network.

Qubic, an AI-focused blockchain and mining pool, claimed responsibility for the attack.

The attack allowed Qubic to reorganize six blocks, raising questions about Monero’s network integrity.

Withdrawals and trading of XMR remain unaffected on Kraken for now.

The event highlights critical decentralization challenges in crypto mining.

A 51% attack occurs when a single mining entity controls more than half of a blockchain’s hashing power, allowing it to reorder transactions, perform double spends, and potentially alter the network consensus.

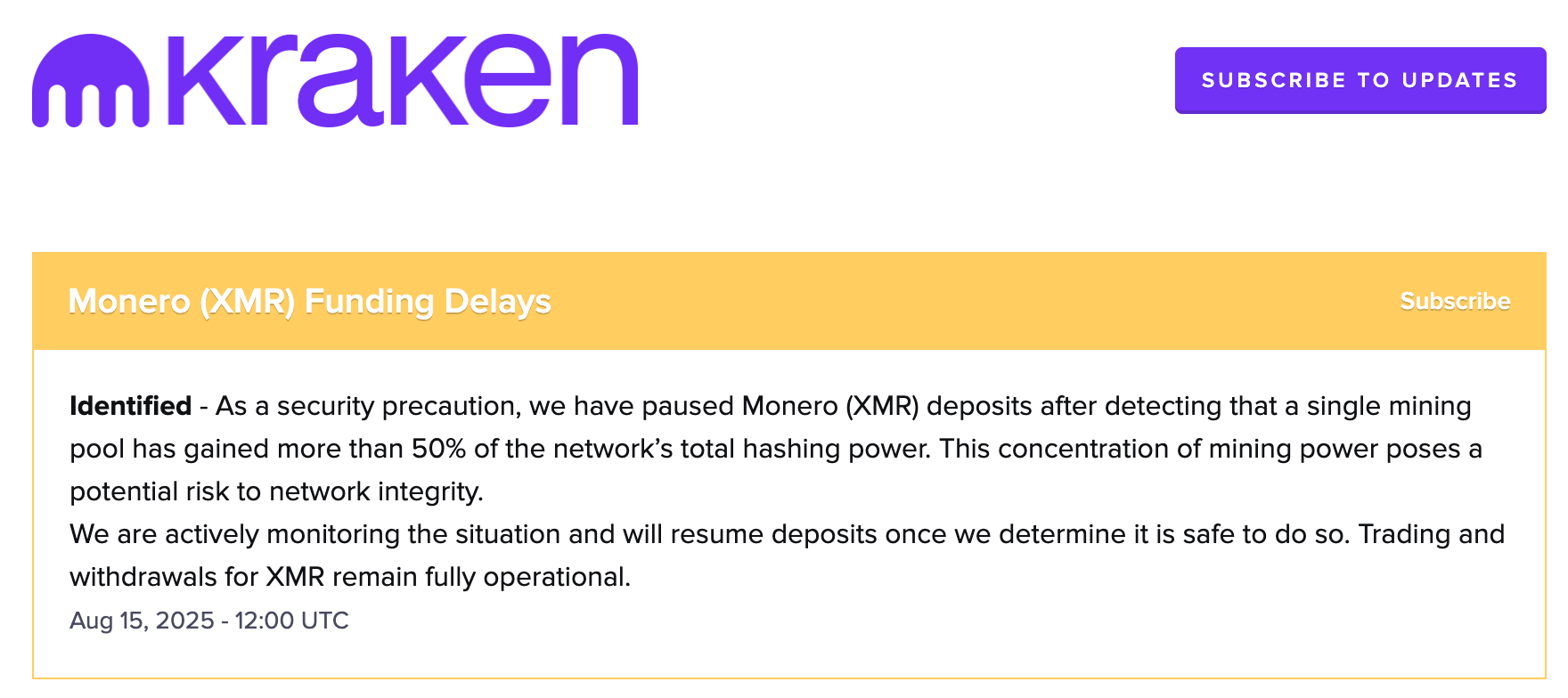

Kraken’s Official Statement On The Monero Situation

Source: Kraken

Yes. Trading and withdrawals of XMR are still operational on Kraken, and the suspension currently applies only to deposits.

The exchange has assured users that Monero deposits will resume once network conditions are deemed stable.

Monero remains the 29th largest cryptocurrency by market capitalization, widely respected for its privacy-focused design and ability to obscure transaction details such as sender, recipient, and amount.

This attack, however, has shaken confidence in its decentralization, a core pillar of its mission.

Qubic, a lesser-known but emerging Layer-1 blockchain project focused on AI, claimed responsibility for the takeover.

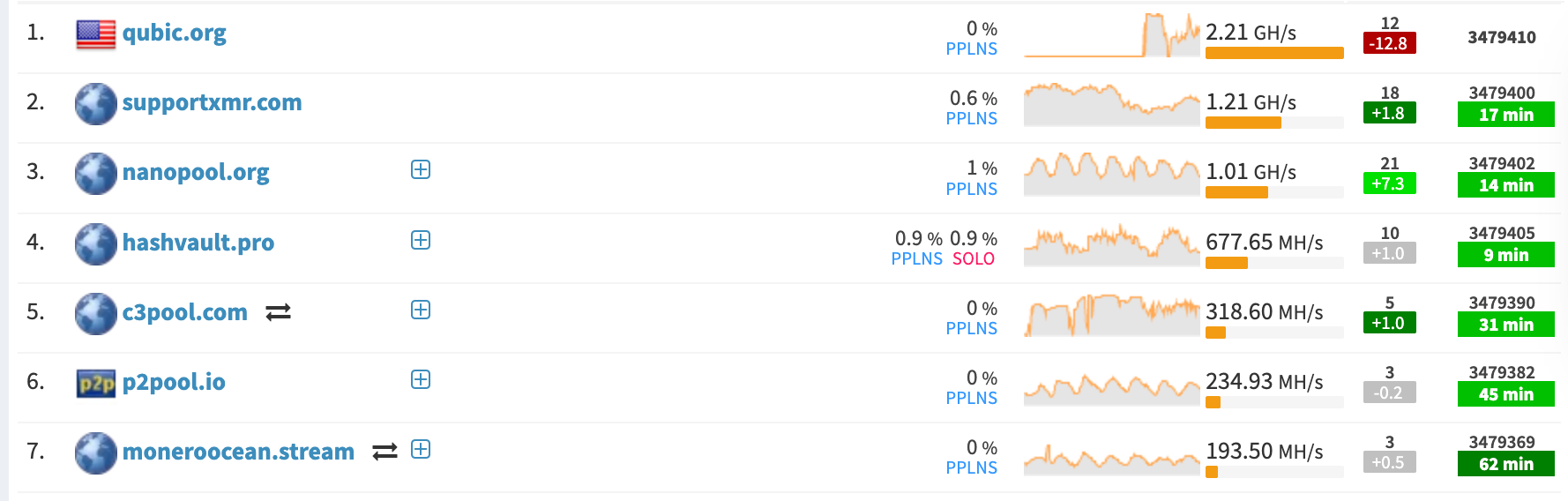

Qubic Is Now The Highest Ranked Monero Mining Pool

Source: MiningPoolStats

The team behind Qubic stated that after a protracted month-long technical standoff, it successfully gained majority control over Monero’s hashrate and managed to reorganize six blocks on the chain.

This claim was met with strong resistance and denial from the Monero community, which argued that no irreversible harm had been done to the network and downplayed the incident’s severity.

Interestingly, Qubic’s mining efforts were initially thwarted.

On August 4th, Qubic’s hashrate dropped dramatically after suffering a Distributed Denial of Service (DDoS) attack, a cyberattack that overwhelms a network with artificial traffic, rendering it inoperable. During this time, Qubic slipped to the seventh-largest miner on the Monero network.

Despite this, Qubic’s mining pool managed to recover its hashrate from 0.8 GH/s back to 2.6 GH/s, ultimately reclaiming dominance and control over the Monero blockchain.

The incident underscores the risks associated with mining centralization, especially in privacy coins, where transparency and trust are more fragile.

Qubic has framed this takeover as a historic achievement, claiming:

“This event marks a pivotal moment in the crypto industry, the takeover of a $6 billion privacy protocol by a $300 million AI protocol.”

While critics have labeled the act as opportunistic and dangerous, it’s clear that the line between innovation and disruption in the DeFi sector remains thin.

A 51% attack occurs when a single entity gains control of more than 50% of a blockchain’s mining power. This allows them to potentially alter transactions, delay confirmations, or reverse completed transactions.

Yes, Kraken has stated that the pause is a precautionary measure. All Monero funds on the exchange are secure, and users can still withdraw and trade XMR.

Kraken has not given a specific date but assures users that deposits will resume once the network is deemed secure.

While the 51% attack raises concerns, Monero continues to be a leading privacy cryptocurrency. However, users should stay informed and monitor the situation closely.

This event highlights the vulnerability of even well-established blockchains to centralization. It may push more communities to adopt decentralization-focused measures in their mining strategies.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.40%

Figure Heloc(FIGR_HELOC)$1.040.40% Wrapped stETH(WSTETH)$3,692.092.64%

Wrapped stETH(WSTETH)$3,692.092.64% Wrapped eETH(WEETH)$3,275.732.71%

Wrapped eETH(WEETH)$3,275.732.71% USDS(USDS)$1.000.03%

USDS(USDS)$1.000.03% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.04%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.04% Hyperliquid(HYPE)$32.6627.81%

Hyperliquid(HYPE)$32.6627.81% Coinbase Wrapped BTC(CBBTC)$89,340.000.99%

Coinbase Wrapped BTC(CBBTC)$89,340.000.99% WETH(WETH)$3,014.322.75%

WETH(WETH)$3,014.322.75% Ethena USDe(USDE)$1.00-0.07%

Ethena USDe(USDE)$1.00-0.07% Canton(CC)$0.154618-0.96%

Canton(CC)$0.154618-0.96% USD1(USD1)$1.000.03%

USD1(USD1)$1.000.03% World Liberty Financial(WLFI)$0.1638493.83%

World Liberty Financial(WLFI)$0.1638493.83% USDT0(USDT0)$1.00-0.06%

USDT0(USDT0)$1.00-0.06% sUSDS(SUSDS)$1.08-0.67%

sUSDS(SUSDS)$1.08-0.67% Ethena Staked USDe(SUSDE)$1.22-0.04%

Ethena Staked USDe(SUSDE)$1.22-0.04% Rain(RAIN)$0.009926-0.55%

Rain(RAIN)$0.009926-0.55% MemeCore(M)$1.56-2.27%

MemeCore(M)$1.56-2.27%