Ethena Labs has surpassed $500 million in total revenue.

USDe supply reached an all-time high of $11.7 billion.

Synthetic stablecoins like Sky Dollar and Falcon USD are gaining strong market traction.

The stablecoin market grew 4% in August, aided by the U.S. GENIUS Act.

China may be preparing to launch yuan-backed stablecoins, signaling rising global competition.

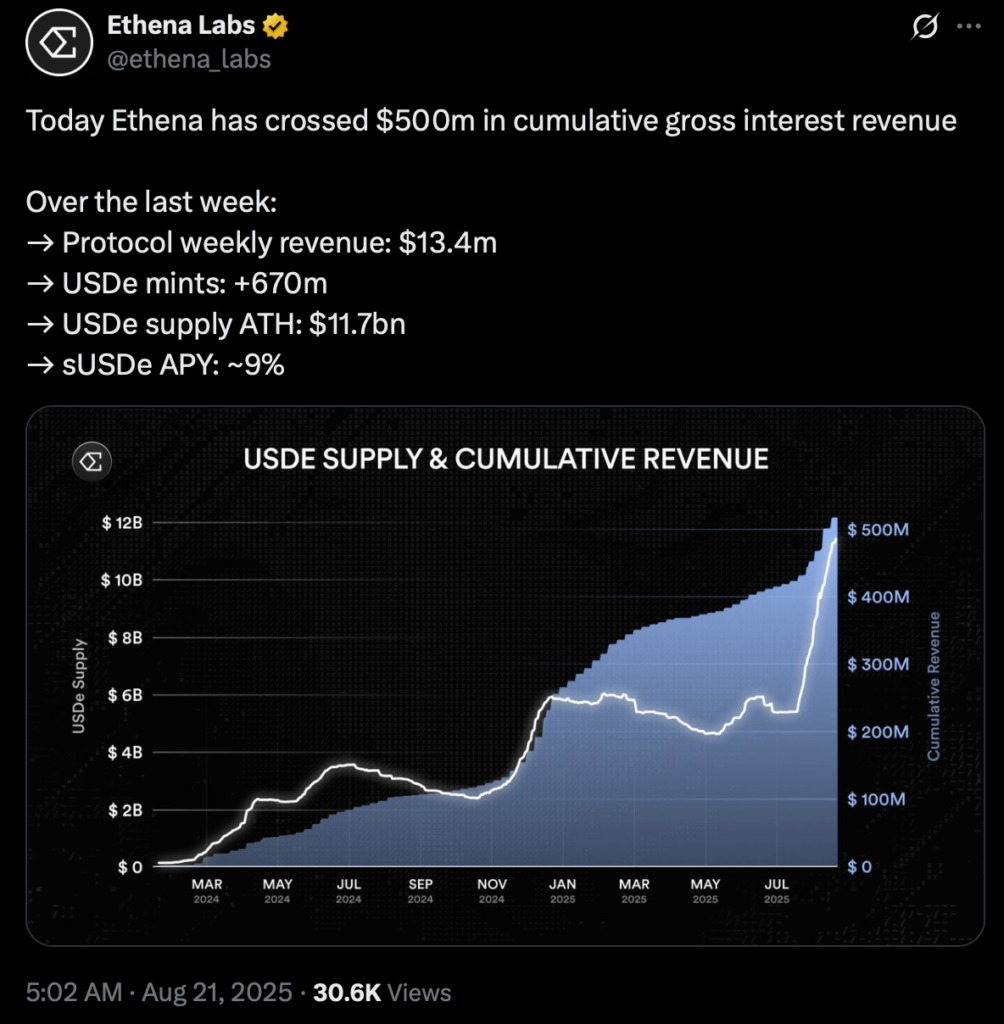

Ethena Labs has officially reported over $500 million in cumulative revenue generated through its Ethena protocol, as adoption of synthetic stablecoins accelerates.

Over the past week alone, the Ethena protocol generated $13.4 million in revenue, while the circulating supply of Ethena USDe hit a record high of $11.7 billion.

Source: X (@ethena_labs)

A spokesperson from Ethena Labs said:

“Ethena’s revenue has been driven by strong inflows into USDe and favorable market conditions that have amplified returns from its delta-neutral hedging reserve model.”

These gains are emblematic of a broader trend: investors and institutions are increasingly viewing synthetic stablecoins as viable alternatives to traditional fiat-backed stablecoins.

Synthetic stablecoins are digital assets designed to maintain price stability without being directly backed by fiat currencies or physical collateral.

Instead, they use algorithmic strategies, hedging models, or derivatives to simulate price stability.

Lower transaction costs due to minimal reliance on physical backing.

Cross-border efficiency with fewer regulatory hurdles.

Algorithmic flexibility, allowing scalability under varying market conditions.

Depegging risks during market volatility.

Lower investor confidence compared to fiat-collateralized stablecoins.

Complex reserve models that may lack transparency.

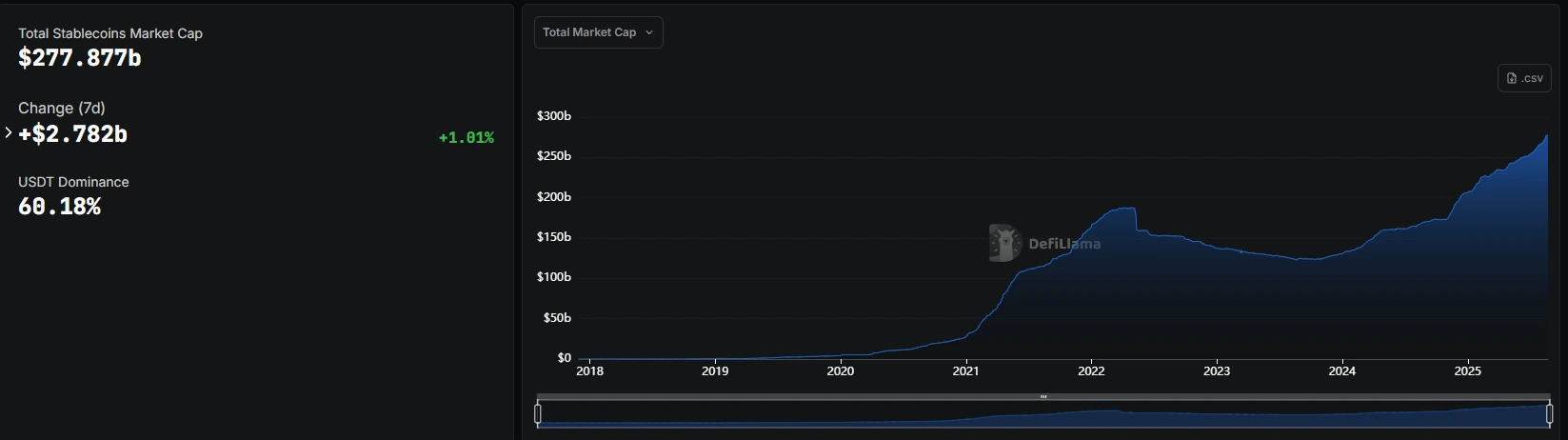

According to DefiLlama, USDe currently holds the third-largest market cap among all stablecoins, and it is the leading synthetic stablecoin by a wide margin.

The overall stablecoin market is also showing signs of growth. The total stablecoin market cap rose by 4% in August, reaching $277.8 billion, up from $266.6 billion at the end of July.

Source: DefiLlama

In just the last month, USDe’s market capitalization has surged by 86.6%, reflecting a steep increase in both demand and adoption.

Sky Dollar, a synthetic stablecoin powering the Sky ecosystem and an upgraded version of DAI, has seen a 14% increase in market cap recently.

It builds on decentralized finance principles while using a synthetic mechanism for stability.

Falcon USD, developed by Falcon Finance, has demonstrated impressive growth with an 89.4% increase in market cap over the last month.

It utilizes a hybrid synthetic model and is gaining popularity among institutional DeFi users.

This growth has been supported by regulatory clarity in the U.S., especially after President Donald Trump signed the GENIUS Act into law on July 18th. The law aims to provide a legal framework for digital assets and stablecoins.

President Trump Signing The GENIUS Act Into Law

Source: Associated Press

At the Wyoming Blockchain Symposium 2025, U.S. Federal Reserve Governor Christopher Waller commented that the act could enable stablecoins to “reach their full potential” and enhance the global influence of the U.S. dollar.

In response to U.S. developments, reports suggest China is considering issuing yuan-backed stablecoins, marking a potential shift in digital currency policy.

If confirmed, this could further intensify competition in the synthetic and fiat-backed stablecoin space.

A synthetic stablecoin is a cryptocurrency designed to maintain price stability through algorithmic models, derivatives, or hedging strategies rather than being backed by traditional assets like USD or gold.

USDe is a synthetic stablecoin, meaning it doesn’t rely on fiat reserves. In contrast, USDT (Tether) and USDC are fiat-collateralized, with reserves held in traditional banks.

While they offer benefits such as lower costs and scalability, synthetic stablecoins carry risks, especially during market volatility. If the underlying model fails, the coin can lose its peg.

Their growth is fueled by higher returns, algorithmic flexibility, and reduced dependence on traditional financial systems. As DeFi expands, demand for alternative stablecoin models continues to rise.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

JUSD(JUSD)$1.000.02%

JUSD(JUSD)$1.000.02% Figure Heloc(FIGR_HELOC)$1.030.12%

Figure Heloc(FIGR_HELOC)$1.030.12% Wrapped stETH(WSTETH)$3,601.74-0.61%

Wrapped stETH(WSTETH)$3,601.74-0.61% Wrapped eETH(WEETH)$3,195.24-0.40%

Wrapped eETH(WEETH)$3,195.24-0.40% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.10%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.10% Coinbase Wrapped BTC(CBBTC)$88,857.00-0.91%

Coinbase Wrapped BTC(CBBTC)$88,857.00-0.91% WETH(WETH)$2,940.07-0.64%

WETH(WETH)$2,940.07-0.64% Ethena USDe(USDE)$1.00-0.05%

Ethena USDe(USDE)$1.00-0.05% Canton(CC)$0.1504803.92%

Canton(CC)$0.1504803.92% Hyperliquid(HYPE)$21.24-0.47%

Hyperliquid(HYPE)$21.24-0.47% World Liberty Financial(WLFI)$0.1733503.26%

World Liberty Financial(WLFI)$0.1733503.26% USDT0(USDT0)$1.000.06%

USDT0(USDT0)$1.000.06% sUSDS(SUSDS)$1.09-0.09%

sUSDS(SUSDS)$1.09-0.09% Ethena Staked USDe(SUSDE)$1.22-0.03%

Ethena Staked USDe(SUSDE)$1.22-0.03% Rain(RAIN)$0.01007912.47%

Rain(RAIN)$0.01007912.47% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04% MemeCore(M)$1.651.39%

MemeCore(M)$1.651.39%