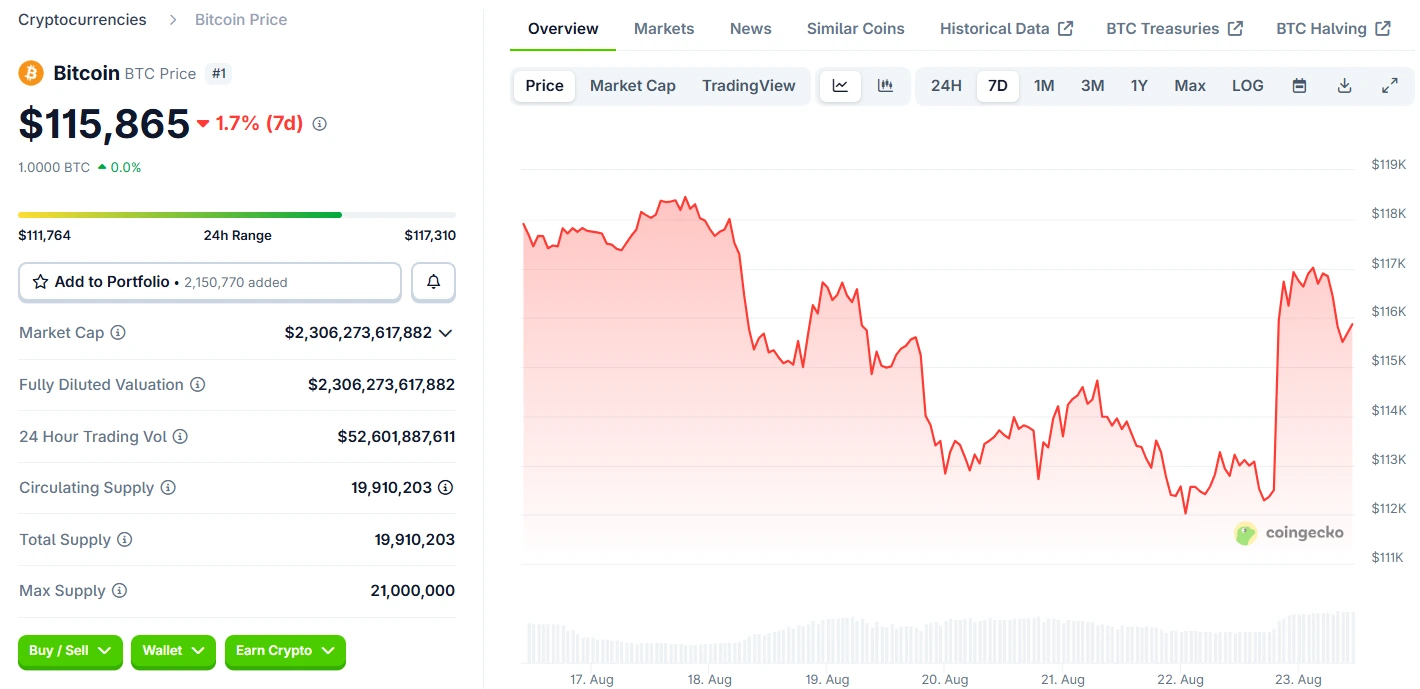

Bitcoin’s price surged to $117,300 following Jerome Powell’s hint at a rate cut.

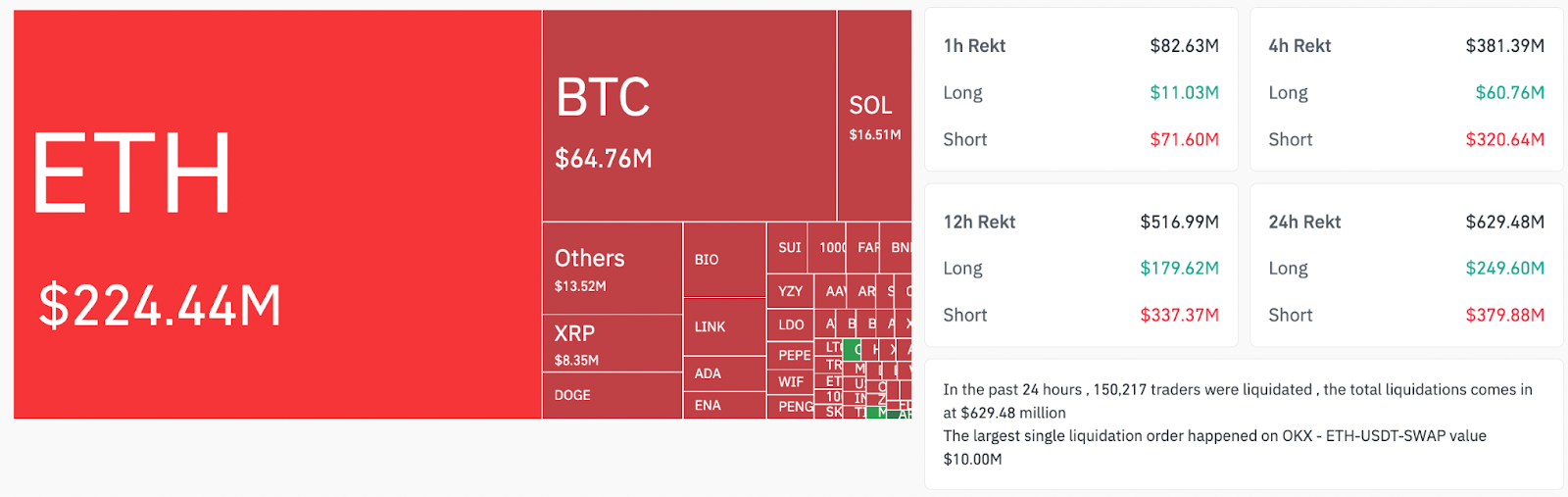

$379.88 million in BTC shorts were liquidated, along with over 150K traders across all crypto markets.

Analysts say the uptrend is confirmed, with targets ranging from $145K to $200K in the coming months.

Market sentiment has flipped bullish, with BTC clearing major resistance zones and eyeing new highs.

In a surprising twist at the Jackson Hole Symposium, Federal Reserve Chair Jerome Powell hinted at a possible interest rate cut in September.

The dovish tone from the Fed reignited risk appetite across markets, with Bitcoin’s price reacting swiftly.

Source: CoinGecko

Bitcoin climbed over 5% on Friday, reaching an intraday high of $117,300, up from a six-week low of $111,600. The rapid spike led to massive short liquidations and renewed optimism among traders.

MN Capital founder Michael van de Poppe, who had earlier predicted a sweep below $112K as a perfect entry, said:

“Uptrend is back.”

According to data from CoinGlass, Bitcoin’s rally triggered $379.88 million in short liquidations. Ethereum also joined the party, contributing $193 million as ETH soared to $4,760, up nearly 15% on the day.

The Total Crypto Liquidation Heatmap

Source: CoinGlass

Across the broader crypto market, total liquidations reached $629.48 million, affecting over 150,000 traders in the span of hours.

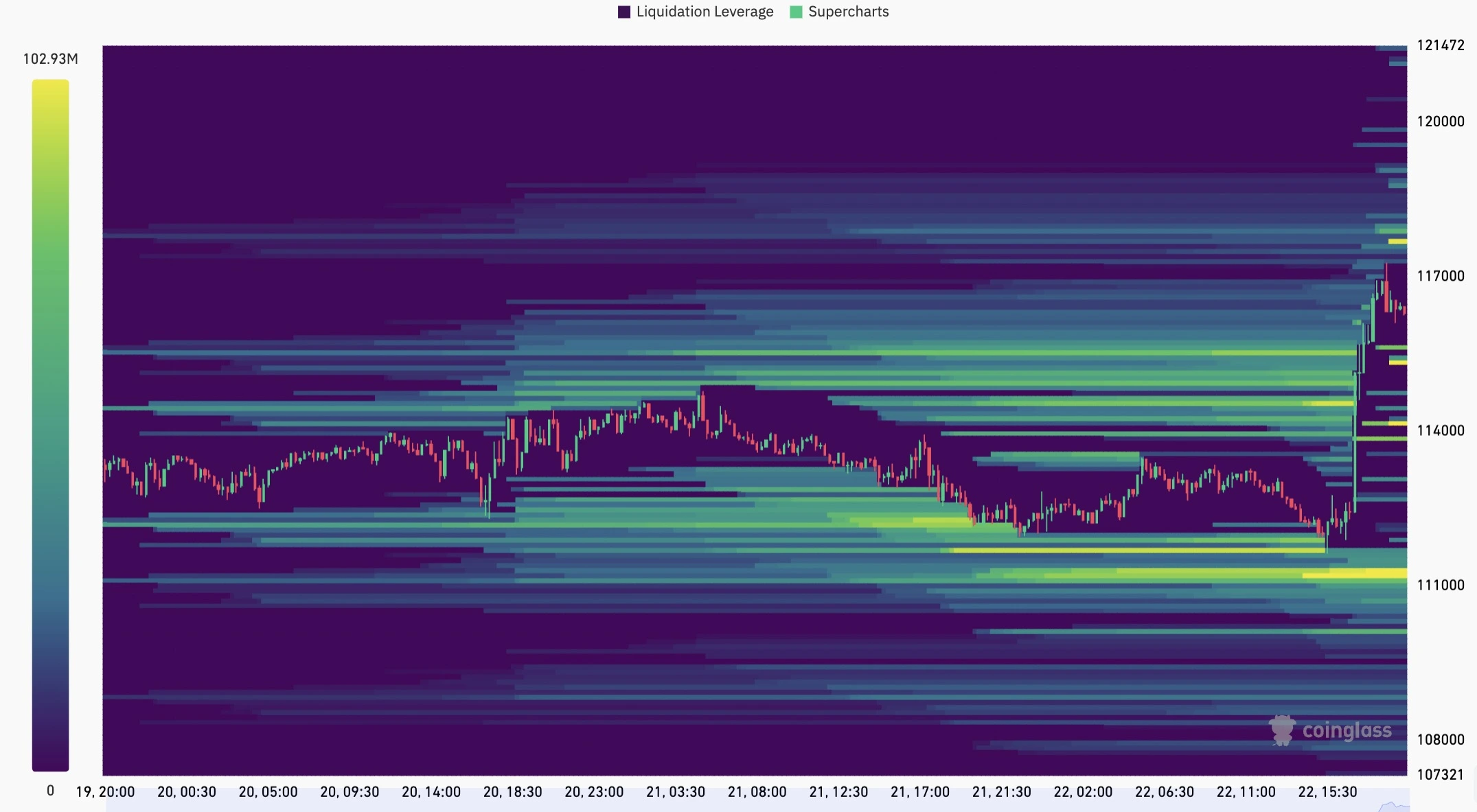

Heatmap data revealed significant ask liquidity between $117,000 and $118,000, totaling over $259.5 million.

The surge cleared out most resistance in that zone, positioning BTC for a possible run toward new all-time highs.

Bitcoin’s Liquidation Heatmap

Source: CoinGlass

The rally followed a pattern predicted by van de Poppe, who anticipated a sweep of August lows before a breakout. As BTC bounced aggressively from $111,600, he confirmed the return of bullish momentum.

“A small sweep took place and an immediate massive move upward on Bitcoin. Uptrend is back.”

Crypto analyst BitQuant remains confident in his $145,000 cycle top prediction for Bitcoin in 2025. Meanwhile, André Dragosch, head of European research at Bitwise, sees even greater potential.

Meanwhile, Dragosch also said that President Trump’s endorsement of crypto in 401(k) retirement plans could serve as a catalyst to push Bitcoin to $200,000 by year-end.

While short-term corrections are expected after such a parabolic move, the broader sentiment remains bullish.

Technicals, fundamentals, and macroeconomic cues are aligning to support the case for new all-time highs.

Support: $114,500 – $112,000

Immediate resistance: $118,000

Breakout target: $130,000 and beyond

Fed’s interest rate decision in September

Growing institutional interest and ETF flows

Regulatory clarity around crypto retirement plans

Many analysts believe so. If institutional adoption accelerates and macro conditions remain favorable, BTC could test or exceed the $200K mark.

Yes. After a sharp move like this, minor pullbacks are common. However, long-term momentum remains bullish.

Rate cuts typically weaken the dollar and boost demand for risk assets like Bitcoin, making the Fed’s decisions crucial to BTC’s price trajectory.

While the uptrend looks strong, it’s essential to do your own research. Consider waiting for a pullback or setting limit orders near key support zones.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.40%

Figure Heloc(FIGR_HELOC)$1.040.40% Wrapped stETH(WSTETH)$3,678.792.21%

Wrapped stETH(WSTETH)$3,678.792.21% Wrapped eETH(WEETH)$3,265.272.29%

Wrapped eETH(WEETH)$3,265.272.29% USDS(USDS)$1.000.02%

USDS(USDS)$1.000.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01% Hyperliquid(HYPE)$32.8427.04%

Hyperliquid(HYPE)$32.8427.04% Coinbase Wrapped BTC(CBBTC)$89,138.000.59%

Coinbase Wrapped BTC(CBBTC)$89,138.000.59% WETH(WETH)$3,003.612.23%

WETH(WETH)$3,003.612.23% Ethena USDe(USDE)$1.00-0.06%

Ethena USDe(USDE)$1.00-0.06% Canton(CC)$0.1540560.39%

Canton(CC)$0.1540560.39% USD1(USD1)$1.000.02%

USD1(USD1)$1.000.02% USDT0(USDT0)$1.00-0.10%

USDT0(USDT0)$1.00-0.10% World Liberty Financial(WLFI)$0.1622432.86%

World Liberty Financial(WLFI)$0.1622432.86% sUSDS(SUSDS)$1.080.09%

sUSDS(SUSDS)$1.080.09% Ethena Staked USDe(SUSDE)$1.22-0.07%

Ethena Staked USDe(SUSDE)$1.22-0.07% Rain(RAIN)$0.009933-0.74%

Rain(RAIN)$0.009933-0.74% MemeCore(M)$1.56-1.02%

MemeCore(M)$1.56-1.02%