Circle has partnered with Mastercard and Finastra to embed USDC settlement into global payment systems.

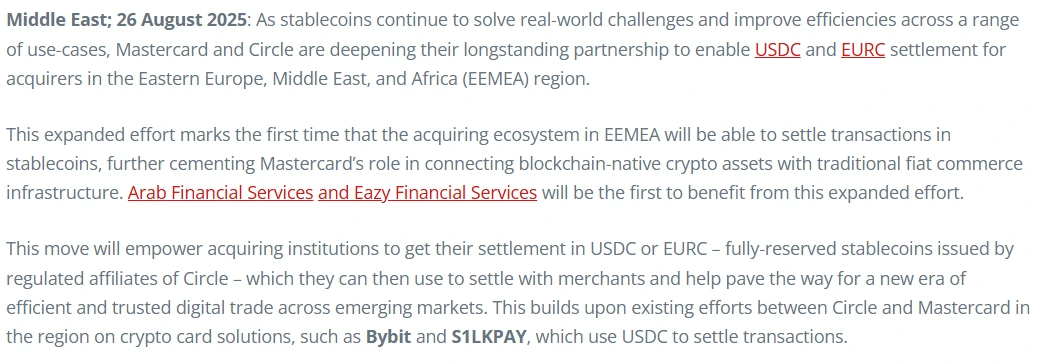

Mastercard will enable USDC and EURC settlement in Eastern Europe, the Middle East, and Africa, with initial adoption by Arab Financial Services and Eazy Financial Services.

Finastra’s Global PAYplus platform will now support USDC for international payments across 50 countries.

Circle’s global expansion is supported by the newly passed GENIUS Act and includes major moves in Asia, South Korea, and Japan.

The growing use of USDC is helping reshape how global payments are made, offering speed, transparency, and lower costs.

On Wednesday, Mastercard announced it would enable acquirers and merchants in Eastern Europe, the Middle East, and Africa (EEMEA) to settle transactions in USDC and Euro Coin (EURC).

Source: Impact News

The move represents a significant step forward in both USDC settlements and wider stablecoin adoption, especially in developing markets where cross-border payments often face high fees and long settlement times.

In parallel, London-based Finastra, a leading provider of financial software solutions, also announced on Wednesday its integration of USDC settlement into its Global PAYplus platform.

This system reportedly processes over $5 trillion in cross-border payments daily, making the integration a major development in the financial tech sector.

Finastra’s update will allow banks in 50 countries to use USDC for international payments, even when the transactions are initiated in traditional fiat currencies.

Circle’s recent global push comes on the heels of legislative support in the United States.

The GENIUS Act, signed into law in July, provides the first federal regulatory framework for stablecoins in the U.S., giving Circle the confidence and legal clarity needed to scale operations worldwide.

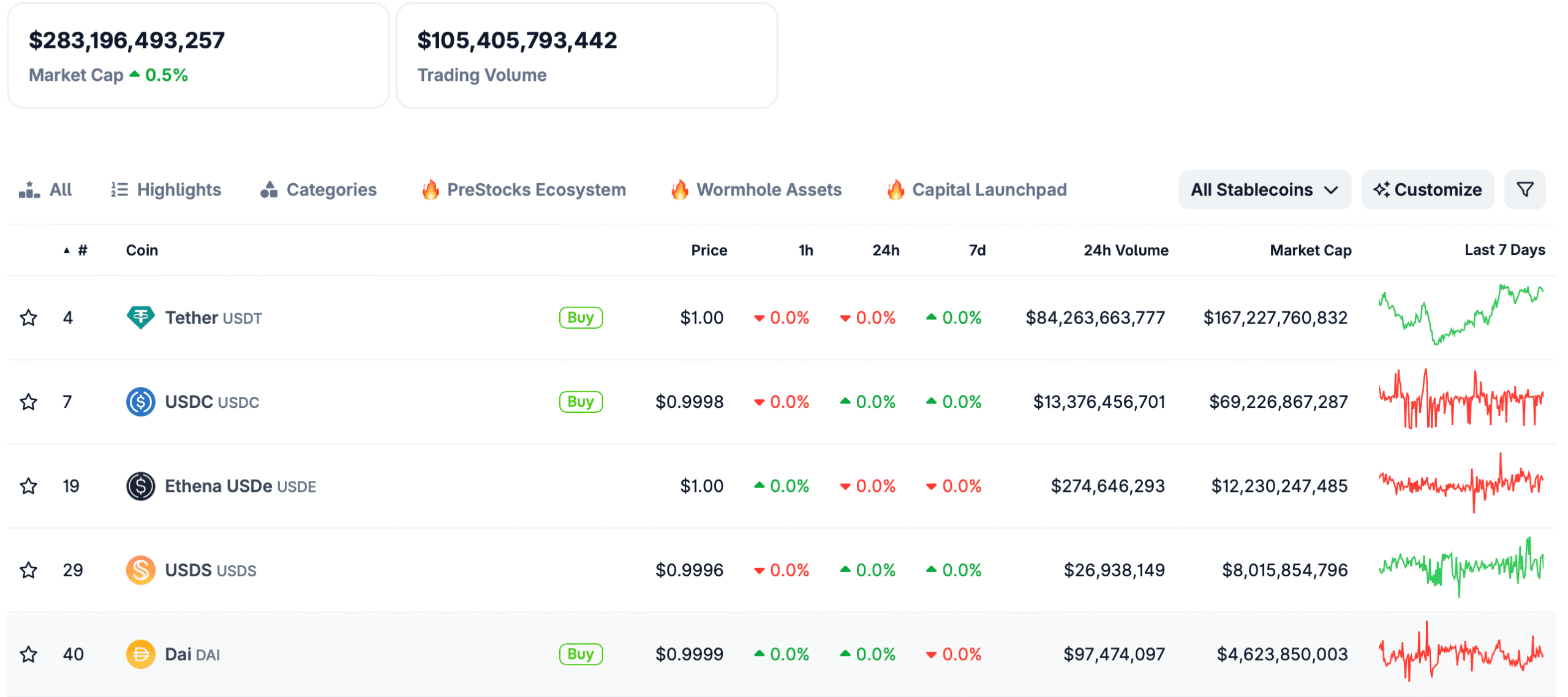

Source: CoinGecko

In July, Circle also inked a deal with OKX, one of the world’s top crypto exchanges. The partnership introduced zero-fee USDC conversions to USD, boosting global liquidity and encouraging adoption among traders in Asia, the Middle East, and Europe.

In August, Circle’s executive team met with leaders of South Korea’s four largest banks, namely KB Kookmin, Shinhan, Hana, and Woori.

These discussions centered on potential on-chain integrations and the launch of a won-backed stablecoin, further signaling Circle’s commitment to localized solutions for stable digital payments.

Circle has also joined a joint venture with SBI Group, Ripple, and Startale Labs to foster USDC adoption in Japan.

The partnership will focus on developing a tokenized asset trading platform that enables the exchange of real-world assets using blockchain technology.

USDC settlement enables near-instantaneous cross-border payments, eliminating the delays often associated with legacy banking rails.

By bypassing intermediaries, USDC helps reduce transaction fees for international merchants and financial institutions.

The ability to integrate stablecoins into existing payment systems provides access to modern financial infrastructure in underserved and emerging markets.

USDC settlement refers to the process of completing payment transactions using USD Coin, a stablecoin pegged 1:1 to the U.S. dollar. It allows for faster, cheaper, and borderless transactions compared to traditional fiat systems.

USDC offers real-time settlement, significantly lower fees, and fewer intermediaries, making it ideal for cross-border transactions and global remittances.

Mastercard is aiming to modernize its payment infrastructure and address inefficiencies in cross-border payments by incorporating blockchain-based assets like USDC and EURC.

Banks in 50 countries will have access to the USDC-powered payment infrastructure through Finastra’s Global PAYplus platform.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.40%

Figure Heloc(FIGR_HELOC)$1.04-0.40% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Hyperliquid(HYPE)$31.020.91%

Hyperliquid(HYPE)$31.020.91% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% Canton(CC)$0.162403-2.10%

Canton(CC)$0.162403-2.10% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.0098100.51%

Rain(RAIN)$0.0098100.51% World Liberty Financial(WLFI)$0.103663-0.12%

World Liberty Financial(WLFI)$0.103663-0.12% MemeCore(M)$1.452.61%

MemeCore(M)$1.452.61% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.00-0.01%

Falcon USD(USDF)$1.00-0.01% Aster(ASTER)$0.711.71%

Aster(ASTER)$0.711.71% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.02%

Global Dollar(USDG)$1.00-0.02% HTX DAO(HTX)$0.0000021.66%

HTX DAO(HTX)$0.0000021.66%