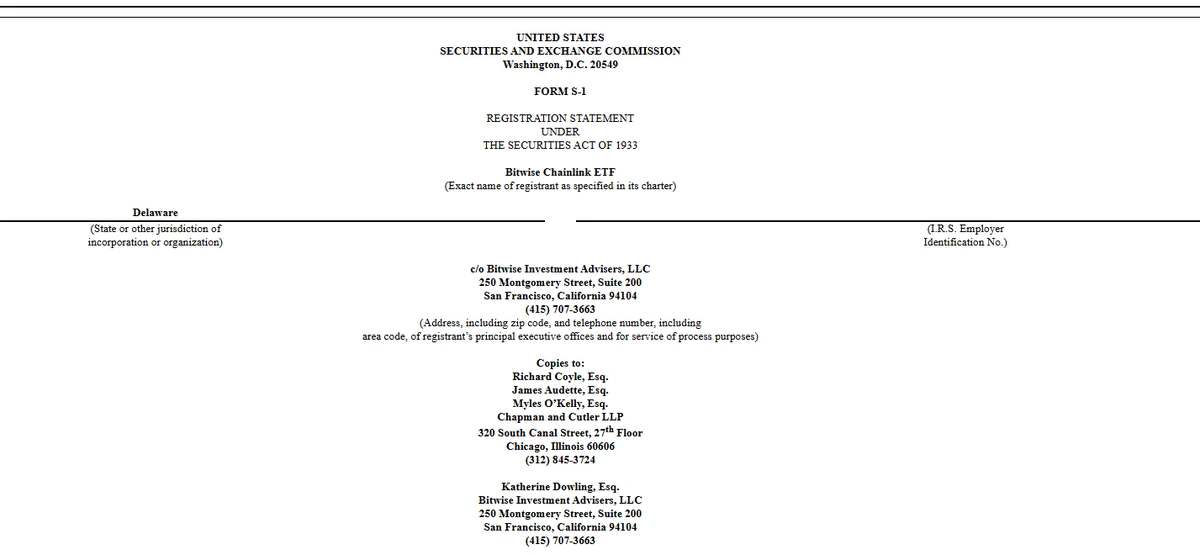

Bitwise has filed for the first U.S. spot Chainlink ETF, which would track LINK’s daily price via a USD benchmark.

Coinbase Custody will hold the underlying Chainlink tokens.

If approved, this ETF would be listed on a regulated U.S. exchange.

Chainlink’s price reacted positively to the news, surging 8% following the announcement.

The ETF represents a major step forward in bringing crypto utility tokens into traditional financial portfolios.

The ETF would be passively managed, aiming to closely follow the price of Chainlink by holding actual LINK tokens. Coinbase Custody Trust Company has been selected to safeguard the underlying assets.

If approved, shares of the Chainlink ETF would be traded on a national U.S. exchange, offering regulated exposure to LINK for both institutional and retail investors.

Source: www.sec.gov

Chainlink has secured strategic partnerships with established players such as:

SBI Group

Mastercard

Franklin Templeton

These collaborations signal Chainlink’s increasing role as a bridge between traditional finance and blockchain-based infrastructure.

Although this would be the first Chainlink ETF in the U.S., European investors already have access to similar products.

For instance, VanEck launched a Chainlink ETN (Exchange-Traded Note) in Europe, giving international investors regulated access to LINK.

The U.S. offering, however, would significantly expand accessibility for American investors seeking regulated exposure to one of crypto’s most valuable utility tokens.

The initial filing, known as an S-1 registration statement, is just the beginning. Bitwise must now follow up with a 19b-4 filing and work through a lengthy SEC review process.

However, depending on feedback and regulatory response, approval could take several months.

Chainlink is a leading decentralized oracle network, known for connecting smart contracts with real-world data. Its services are critical in powering sectors like:

Insurance

Cross-chain interoperability

The announcement had an immediate effect on the market. Chainlink’s price jumped 8%, reaching a high of $24.60 before settling around $24.30 at the time of reporting.

LINK/USD Daily Chart

Source: TradingView

On-chain metrics also showed an uptick in activity among large LINK holders, suggesting renewed interest and growing confidence among investors.

Bitwise’s move reflects a broader trend of institutional interest in crypto assets with clear real-world utility.

Unlike speculative meme coins or illiquid altcoins, Chainlink offers functional value within decentralized ecosystems.

If the Chainlink ETF gains approval, it will:

Provide a regulated investment vehicle for LINK

Make it easier for retail and institutional investors to gain exposure

Boost mainstream adoption of blockchain-based data solutions

The Chainlink ETF is a proposed spot exchange-traded fund that will track the daily price of Chainlink (LINK). It will allow investors to gain exposure to LINK through traditional brokerage accounts without holding the token directly.

The ETF was filed by Bitwise Asset Management, a crypto-focused investment firm known for offering digital asset products in regulated formats.

The ETF is still awaiting SEC approval. The review process typically takes several months and includes a follow-up 19b-4 filing before it can be listed on a U.S. exchange.

It offers regulated exposure to a utility token that plays a vital role in blockchain infrastructure. This opens the door for broader investment, especially from institutions wary of unregulated crypto markets.

No. While this would be the first U.S. spot Chainlink ETF, European investors already have access to similar products such as VanEck’s Chainlink ETN.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.54%

Figure Heloc(FIGR_HELOC)$1.03-0.54% Wrapped stETH(WSTETH)$2,770.32-3.49%

Wrapped stETH(WSTETH)$2,770.32-3.49% USDS(USDS)$1.000.02%

USDS(USDS)$1.000.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05% Hyperliquid(HYPE)$34.325.22%

Hyperliquid(HYPE)$34.325.22% Wrapped eETH(WEETH)$2,460.55-3.61%

Wrapped eETH(WEETH)$2,460.55-3.61% Canton(CC)$0.1781441.22%

Canton(CC)$0.1781441.22% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Coinbase Wrapped BTC(CBBTC)$76,426.00-3.09%

Coinbase Wrapped BTC(CBBTC)$76,426.00-3.09% USD1(USD1)$1.00-0.06%

USD1(USD1)$1.00-0.06% WETH(WETH)$2,260.37-3.73%

WETH(WETH)$2,260.37-3.73% USDT0(USDT0)$1.00-0.12%

USDT0(USDT0)$1.00-0.12% sUSDS(SUSDS)$1.08-0.20%

sUSDS(SUSDS)$1.08-0.20% Ethena Staked USDe(SUSDE)$1.220.03%

Ethena Staked USDe(SUSDE)$1.220.03% World Liberty Financial(WLFI)$0.1307691.79%

World Liberty Financial(WLFI)$0.1307691.79% Rain(RAIN)$0.0094253.63%

Rain(RAIN)$0.0094253.63% MemeCore(M)$1.480.25%

MemeCore(M)$1.480.25%