Pump.fun fees surged to $5.73M in 24 hours, ranking 3rd behind only stablecoin issuers.

The rise is fueled by a new dynamic fee model that adjusts with token market caps.

PUMP token price climbed nearly 10%, while trading volume rose 13%.

Bullish momentum may continue, but traders should watch for resistance at $0.005177.

The Solana-based memecoin launchpad Pump.fun is making headlines after surpassing some of the biggest names in crypto in terms of daily revenue.

The latest data shows that Pump.fun fees have soared to $5.73 million in just 24 hours, making it the top-earning crypto protocol, excluding only stablecoin issuers like Tether and Circle.

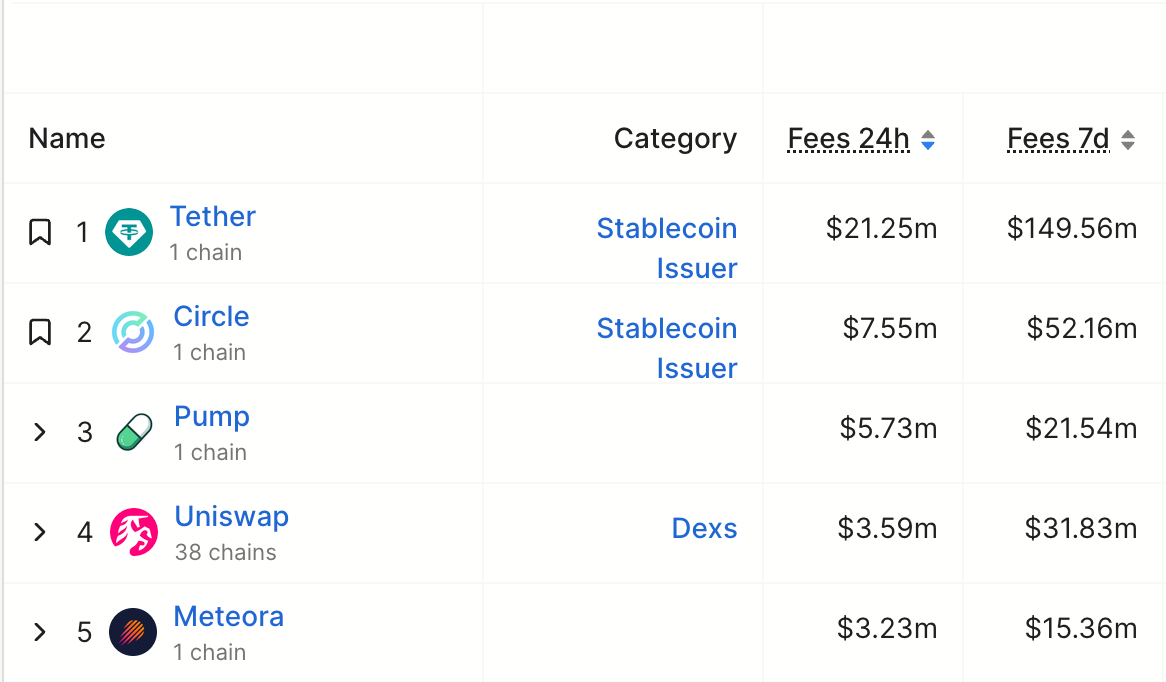

Protocol Rankings By Pump.fun Fees

Source: DefiLlama

The surge in revenue follows the launch of a new creator fee model that dynamically adjusts based on token performance, incentivizing activity and driving demand for the native token, PUMP.

Pump.fun’s recent fee explosion is largely attributed to the introduction of Dynamic Fees V1 under its “Project Ascend” initiative. This new model introduces a tiered fee structure for creators:

Higher initial fees are charged when a new token launches.

As the token’s market capitalization increases, the associated fees gradually decrease.

This system rewards successful token launches while maximizing early protocol revenue. It’s a win-win for creators and the platform alike.

The team noted in a recent update:

“Dynamic Fees V1 is designed to align incentives between token creators and the Pump.fun protocol.”

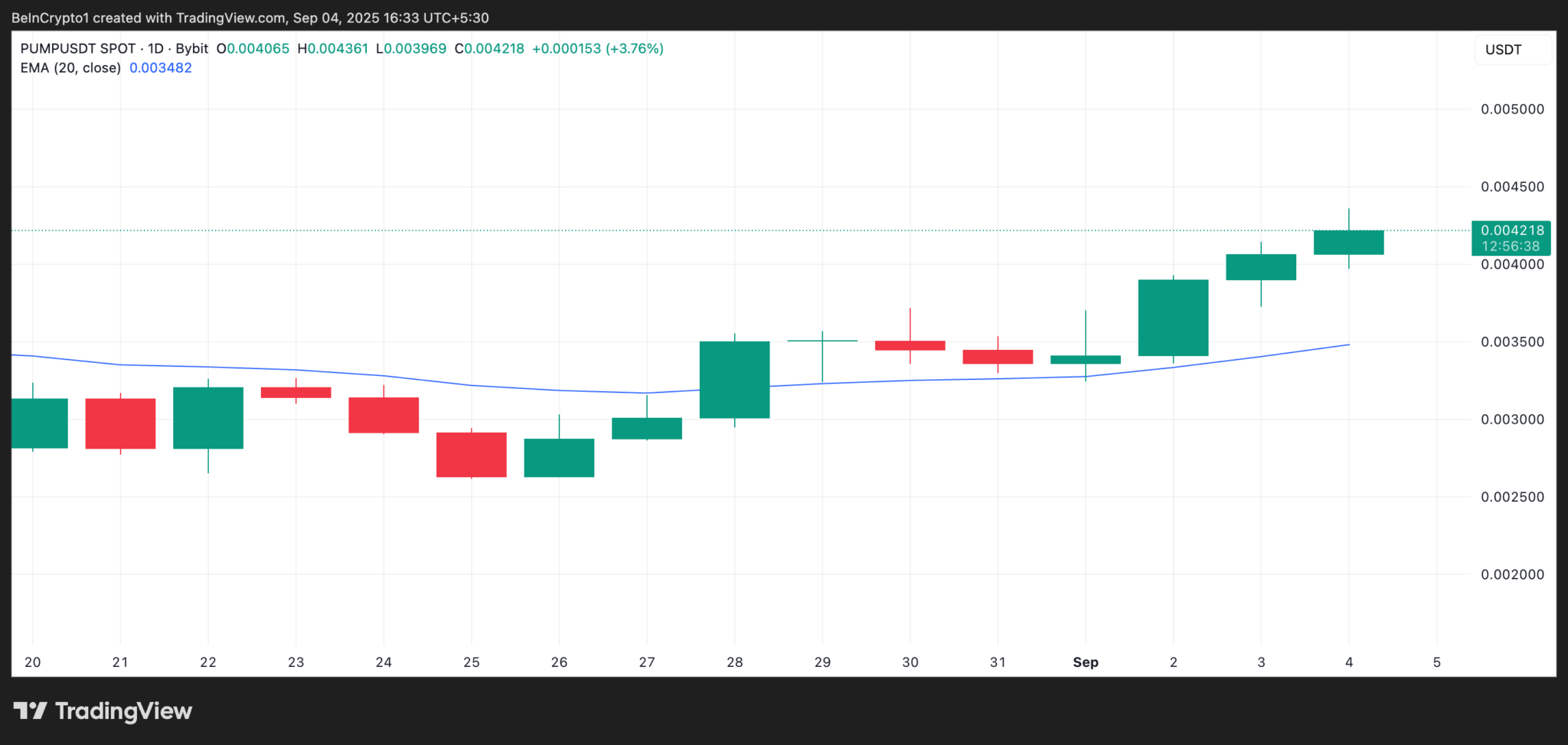

As a direct response to the spike in Pump.fun fees, the price of PUMP rose 9.8%, reaching $0.004204 at the time of writing.

The trading volume also saw a 13% increase, totaling over $348 million, which further confirms strong buy-side momentum.

PUMP/USDT

Source: TradingView

Support zone: $0.004027

Resistance target: $0.005177

If PUMP continues to ride the current wave, breaking above resistance could be imminent. However, traders should be cautious of profit-taking, which could pull the price back toward support levels.

According to DefiLlama, Pump.fun is now the top crypto protocol by daily fees, excluding only fiat-backed stablecoins.

This is a remarkable feat for a relatively new platform and highlights just how effective the new Pump.fun fee structure has been in driving engagement.

Pump.fun has outpaced long-standing DeFi giants like Uniswap, Lido, and Aave, demonstrating just how powerful an innovative fee model can be.

Pump.fun fees refer to the charges applied during the creation and trading of memecoins on the Pump.fun platform. These fees are now dynamic and scale with a token’s market capitalization.

The Dynamic Fees V1 model introduces a tiered structure where:

Higher fees apply to newly launched tokens.

As tokens increase in market cap, the platform reduces associated fees.

This aligns creator incentives with platform success.

The PUMP token is gaining traction due to increased demand tied to the new fee model. As protocol usage increases, so does demand for the native token, pushing up its price.

While the recent success is impressive, sustainability will depend on continued user growth, platform upgrades, and community engagement. However, the fee model creates a strong foundation for recurring revenue.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.00-2.04%

Figure Heloc(FIGR_HELOC)$1.00-2.04% Wrapped stETH(WSTETH)$2,957.43-8.12%

Wrapped stETH(WSTETH)$2,957.43-8.12% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.05% Wrapped eETH(WEETH)$2,622.47-8.65%

Wrapped eETH(WEETH)$2,622.47-8.65% Hyperliquid(HYPE)$30.851.39%

Hyperliquid(HYPE)$30.851.39% Canton(CC)$0.177233-4.72%

Canton(CC)$0.177233-4.72% Ethena USDe(USDE)$0.99-0.47%

Ethena USDe(USDE)$0.99-0.47% Coinbase Wrapped BTC(CBBTC)$78,575.00-5.01%

Coinbase Wrapped BTC(CBBTC)$78,575.00-5.01% WETH(WETH)$2,413.46-8.57%

WETH(WETH)$2,413.46-8.57% USD1(USD1)$1.00-0.11%

USD1(USD1)$1.00-0.11% USDT0(USDT0)$1.000.02%

USDT0(USDT0)$1.000.02% sUSDS(SUSDS)$1.08-0.76%

sUSDS(SUSDS)$1.08-0.76% Ethena Staked USDe(SUSDE)$1.21-0.11%

Ethena Staked USDe(SUSDE)$1.21-0.11% World Liberty Financial(WLFI)$0.123094-15.80%

World Liberty Financial(WLFI)$0.123094-15.80% Rain(RAIN)$0.0095985.31%

Rain(RAIN)$0.0095985.31%