Whales accumulate over 1.25M LINK, reducing exchange supply and setting up a potential supply squeeze.

LINK is holding above $23.44, a key technical level backed by Fibonacci analysis.

Spot volume is rising, signaling renewed investor interest from both retail and institutions.

Short liquidations exceed $180K, adding upward pressure to LINK’s price.

A successful breakout above $28–$32 could lead to targets of $31.57, $39.45, and $44.32.

In the last 48 hours, Chainlink whales have acquired over 1.25 million LINK, according to on-chain data. This trend significantly reduces the token’s liquid supply on centralized exchanges, increasing the probability of a supply squeeze.

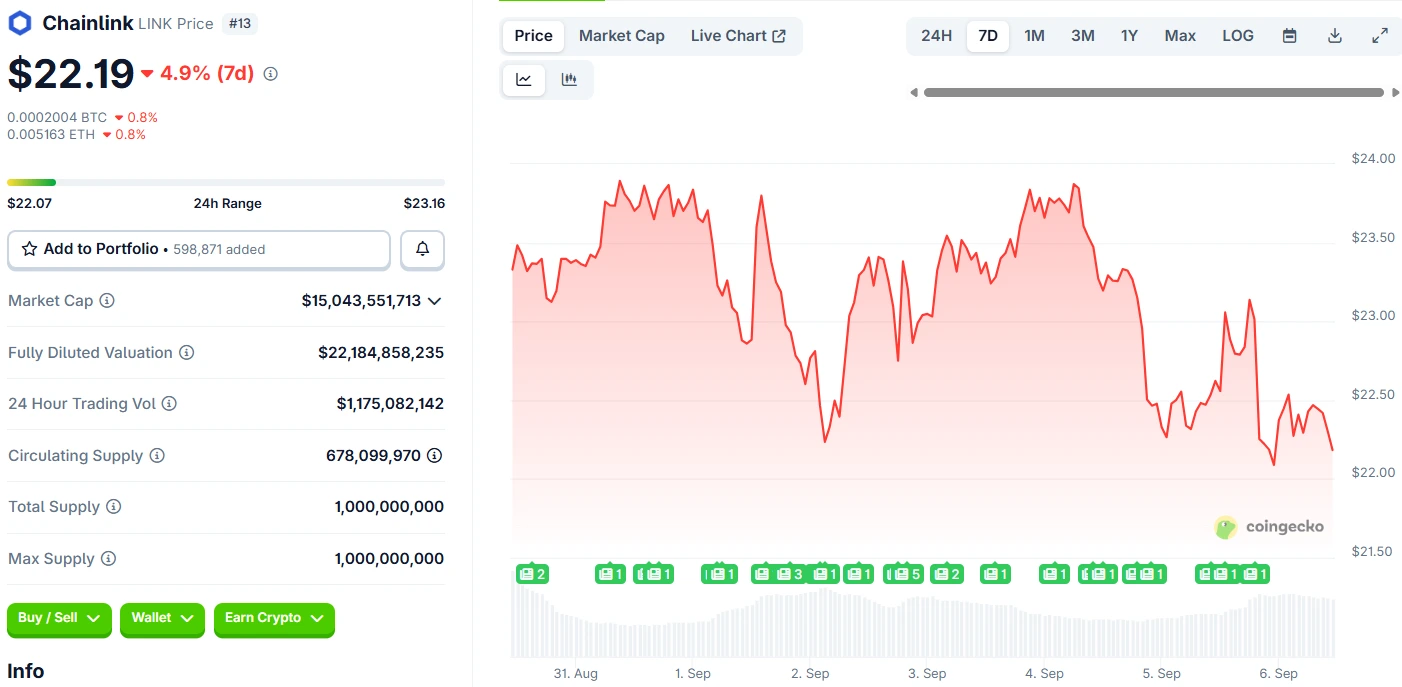

Source: CoinGecko

In crypto markets, reduced availability often leads to price rallies, particularly when combined with strong demand.

Supporting this narrative, Exchange Netflow data shows a $1.84 million outflow, highlighting a drop in sell-side pressure.

When whales transfer tokens to private wallets, it’s usually a sign of long-term conviction, a bullish signal that smart money expects higher prices ahead.

At the time of writing, Chainlink is trading around $23.44, a level that aligns with a key Fibonacci extension zone.

This price point has become a battleground for bulls attempting to establish a base for the next upward leg.

Technical analysts note a rounded bottom breakout formation on LINK’s chart, a bullish pattern that typically follows a period of accumulation. If LINK maintains momentum above $23, it could target the $28–$32 resistance zone.

A decisive breakout above this range may open the door to $31.57, $39.45, and potentially $44.32, according to Fibonacci projections.

However, if LINK fails to hold above $23, short-term downside risk includes a possible retracement to $18.82.

Data from volume bubble maps shows a marked increase in spot market activity, reflecting growing interest from both retail and institutional investors. Historically, such volume surges tend to precede structural breakouts, especially when accompanied by limited supply.

While rising volume indicates growing confidence among buyers, it may also introduce short-term volatility, so traders should stay alert.

Recent trading data reveals over $180,000 in short positions have been liquidated in just a few hours, compared to only $14,000 in longs. This imbalance shows that bearish traders are being forced out of the market, pushing LINK’s price even higher.

In terms of Bitcoin’s dominance in the market, as compared to altcoins like Ethereum (ETH) and stablecoins.

Source: CoinGecko

Short squeezes often act as catalysts in rally phases, creating a feedback loop where more shorts get liquidated as prices rise—further amplifying upward pressure.

The $28–$32 zone has historically acted as a strong resistance area, often triggering sell-offs or trapping late buyers.

But current conditions, whale accumulation, reduced exchange supply, and ongoing short liquidations, suggest LINK may finally have the strength to break through convincingly.

If it does, the Chainlink price prediction for $31 and beyond becomes far more realistic in the near term.

Chainlink remains a cornerstone of DeFi infrastructure, powering decentralized oracles that feed real-world data into smart contracts.

Despite market volatility, the project has consistently maintained its utility and relevance, making it a strong candidate for long-term investment.

The recent surge in whale activity suggests that institutional players are reaffirming their belief in Chainlink’s long-term value proposition.

As of the latest data, Chainlink is trading around $23.44, hovering near key technical support levels.

Based on current momentum and technical indicators, LINK could target $31–$44 in the near to mid-term, assuming bullish conditions persist. Long-term projections depend heavily on broader market trends and adoption.

Whale accumulation reduces liquid supply on exchanges, increasing the likelihood of a supply squeeze. This can significantly drive up prices when demand remains strong.

While no investment is without risk, the current data suggests bullish momentum supported by whale buying, short liquidations, and strong fundamentals. Traders should monitor support at $23 and resistance at $28–$32.

Failure to maintain support above $23, negative macroeconomic news, or a broader crypto market correction could send LINK back to the $18–$20 range.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.10%

Figure Heloc(FIGR_HELOC)$1.031.10% Wrapped stETH(WSTETH)$3,577.390.08%

Wrapped stETH(WSTETH)$3,577.390.08% Wrapped eETH(WEETH)$3,172.440.06%

Wrapped eETH(WEETH)$3,172.440.06% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.04%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.04% Coinbase Wrapped BTC(CBBTC)$87,742.00-0.89%

Coinbase Wrapped BTC(CBBTC)$87,742.00-0.89% WETH(WETH)$2,920.15-0.13%

WETH(WETH)$2,920.15-0.13% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Hyperliquid(HYPE)$27.5621.27%

Hyperliquid(HYPE)$27.5621.27% Canton(CC)$0.1525920.57%

Canton(CC)$0.1525920.57% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% USDT0(USDT0)$1.000.14%

USDT0(USDT0)$1.000.14% World Liberty Financial(WLFI)$0.156815-0.51%

World Liberty Financial(WLFI)$0.156815-0.51% sUSDS(SUSDS)$1.090.14%

sUSDS(SUSDS)$1.090.14% Ethena Staked USDe(SUSDE)$1.220.07%

Ethena Staked USDe(SUSDE)$1.220.07% Rain(RAIN)$0.0100435.10%

Rain(RAIN)$0.0100435.10% MemeCore(M)$1.54-4.86%

MemeCore(M)$1.54-4.86%