Bitcoin miner accumulation is at its highest level since October 2023, mirroring a setup that led to a 48% rally.

BTC price climbed above $116,000 amid strong ETF inflows and institutional buying.

Public companies like MicroStrategy continue to accumulate BTC, reinforcing long-term bullish sentiment.

Rising inflation expectations and declining consumer sentiment may limit upside potential.

Traders are eyeing $140,000+ BTC, but macroeconomic headwinds could delay the breakout.

On Friday, Bitcoin (BTC) surged past $116,000, buoyed by the S&P 500 reaching new all-time highs and growing expectations of a more accommodative monetary policy from the U.S. Federal Reserve.

Behind the scenes, Bitcoin miners have quietly ramped up their holdings, echoing patterns last seen before a 48% price rally in 2023.

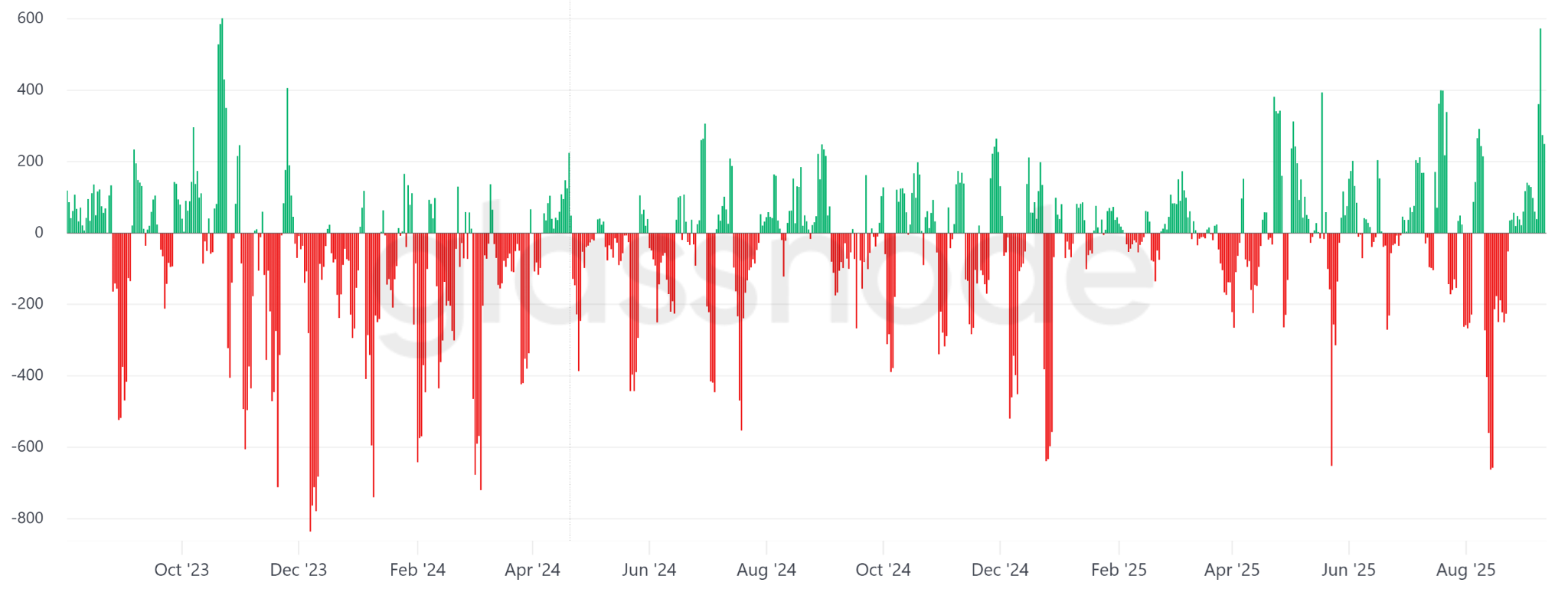

According to Glassnode, the five-day average net transfer volume for miners turned decisively positive, peaking at 573 BTC per day on Tuesday, the highest since October 2023.

BTC Miners’ 5-day Average Net Transfer Volume

Source: Glassnode

Historically, spikes in miner accumulation have preceded significant price movements.

Last year’s late-October surge in miner inflows preceded a major rally that saw Bitcoin’s price jump from $30,000 to over $44,000 by early December, a 48% increase.

This week’s sharp accumulation pattern has many analysts speculating whether $140,000 or even $150,000 BTC could be next.

Despite strong institutional and miner accumulation, the broader economic backdrop remains a wildcard.

The University of Michigan’s consumer sentiment index showed a larger-than-expected dip in September. At the same time, long-term inflation expectations rose to 3.9%, driven by concerns over global tariffs and rising costs.

If inflation persists, it may prompt the Fed to delay interest rate cuts, which could negatively impact speculative assets like Bitcoin.

Traders currently estimate a 75% chance that U.S. interest rates will fall to 3.5% or lower by the end of 2025, a scenario that would likely benefit BTC.

Some analysts warn that even strong Bitcoin miner accumulation may not be enough to propel BTC to new highs if broader economic growth stalls.

Slowing GDP, weaker job numbers, or persistent inflation could make risk assets less attractive in the short term.

In addition to miners, corporate buyers and institutional funds continue to accumulate Bitcoin aggressively.

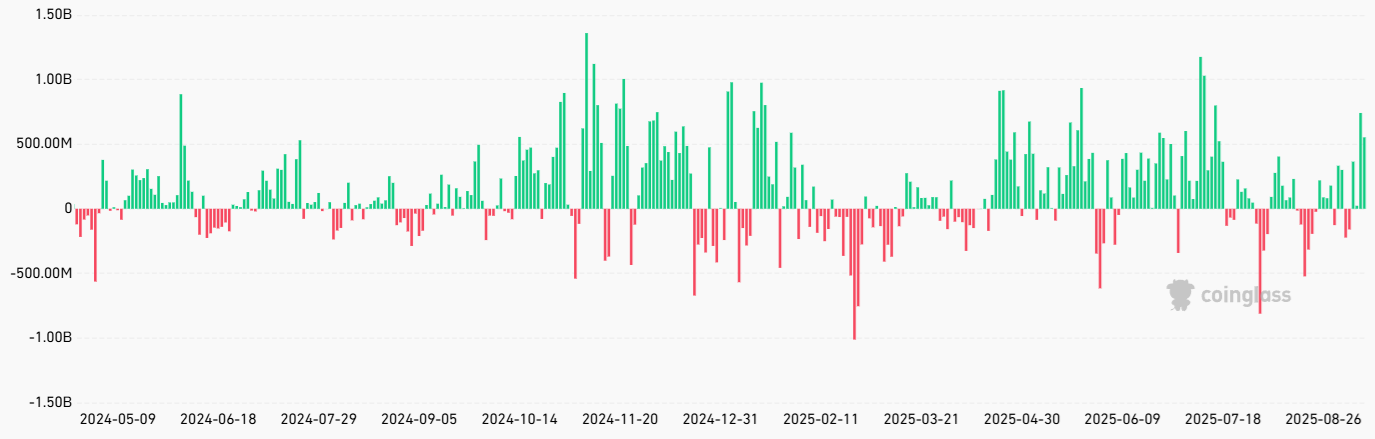

In fact, U.S.-listed spot Bitcoin ETFs recorded $1.3 billion in net inflows between Wednesday and Thursday alone.

Spot Bitcoin ETFs Daily Net Inflows

Source: CoinGlass

This pushed total assets under management (AUM) to $148 billion.

iShares Bitcoin Trust (IBIT) leads with $87.5 billion AUM

Fidelity Wise Origin Bitcoin Fund (FBTC) follows with $23 billion

Grayscale Bitcoin Trust (GBTC) holds $20.6 billion

Data from BitcoinTreasuries.net shows that the top 100 publicly traded companies now hold over 1 million BTC, a historic milestone.

Among them, MicroStrategy (MSTR) continues to lead the charge, disclosing an additional $220 million BTC purchase this week.

Even without S&P 500 inclusion, MicroStrategy now boasts a $95 billion market cap, placing it ahead of notable firms like Dell, Moody’s, and General Dynamics.

Bitcoin miner accumulation refers to the trend where miners hold onto the BTC they mine, rather than selling it. It’s often seen as a bullish indicator, suggesting miners expect higher prices in the future.

Miners are typically sensitive to market conditions. When they accumulate instead of selling, it shows confidence in future price appreciation and can reduce BTC selling pressure on exchanges.

Increased miner accumulation can tighten supply and contribute to upward price momentum, especially when combined with ETF inflows and institutional interest.

While historical patterns suggest a bullish setup, investors should weigh macroeconomic risks, potential rate changes, and their own risk tolerance before entering the market.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.12%

Figure Heloc(FIGR_HELOC)$1.030.12% Wrapped stETH(WSTETH)$3,693.743.05%

Wrapped stETH(WSTETH)$3,693.743.05% Wrapped eETH(WEETH)$3,276.963.10%

Wrapped eETH(WEETH)$3,276.963.10% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01% Hyperliquid(HYPE)$30.0520.42%

Hyperliquid(HYPE)$30.0520.42% Coinbase Wrapped BTC(CBBTC)$89,194.001.31%

Coinbase Wrapped BTC(CBBTC)$89,194.001.31% WETH(WETH)$3,014.923.08%

WETH(WETH)$3,014.923.08% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.1544311.08%

Canton(CC)$0.1544311.08% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% World Liberty Financial(WLFI)$0.1648402.56%

World Liberty Financial(WLFI)$0.1648402.56% USDT0(USDT0)$1.000.07%

USDT0(USDT0)$1.000.07% sUSDS(SUSDS)$1.08-0.40%

sUSDS(SUSDS)$1.08-0.40% Ethena Staked USDe(SUSDE)$1.22-0.05%

Ethena Staked USDe(SUSDE)$1.22-0.05% Rain(RAIN)$0.010088-3.26%

Rain(RAIN)$0.010088-3.26% MemeCore(M)$1.56-3.24%

MemeCore(M)$1.56-3.24%