Bitcoin’s price jumped following a 0.25% interest rate cut by the U.S. Federal Reserve.

Historical trends suggest rate cuts precede Bitcoin bull markets.

Technical analysis points to strong momentum, with $120,000 in sight.

Global events, including bank freezes and crypto adoption in developing countries, highlight Bitcoin’s relevance.

Short-term volatility remains possible, but long-term Bitcoin price prediction models remain bullish.

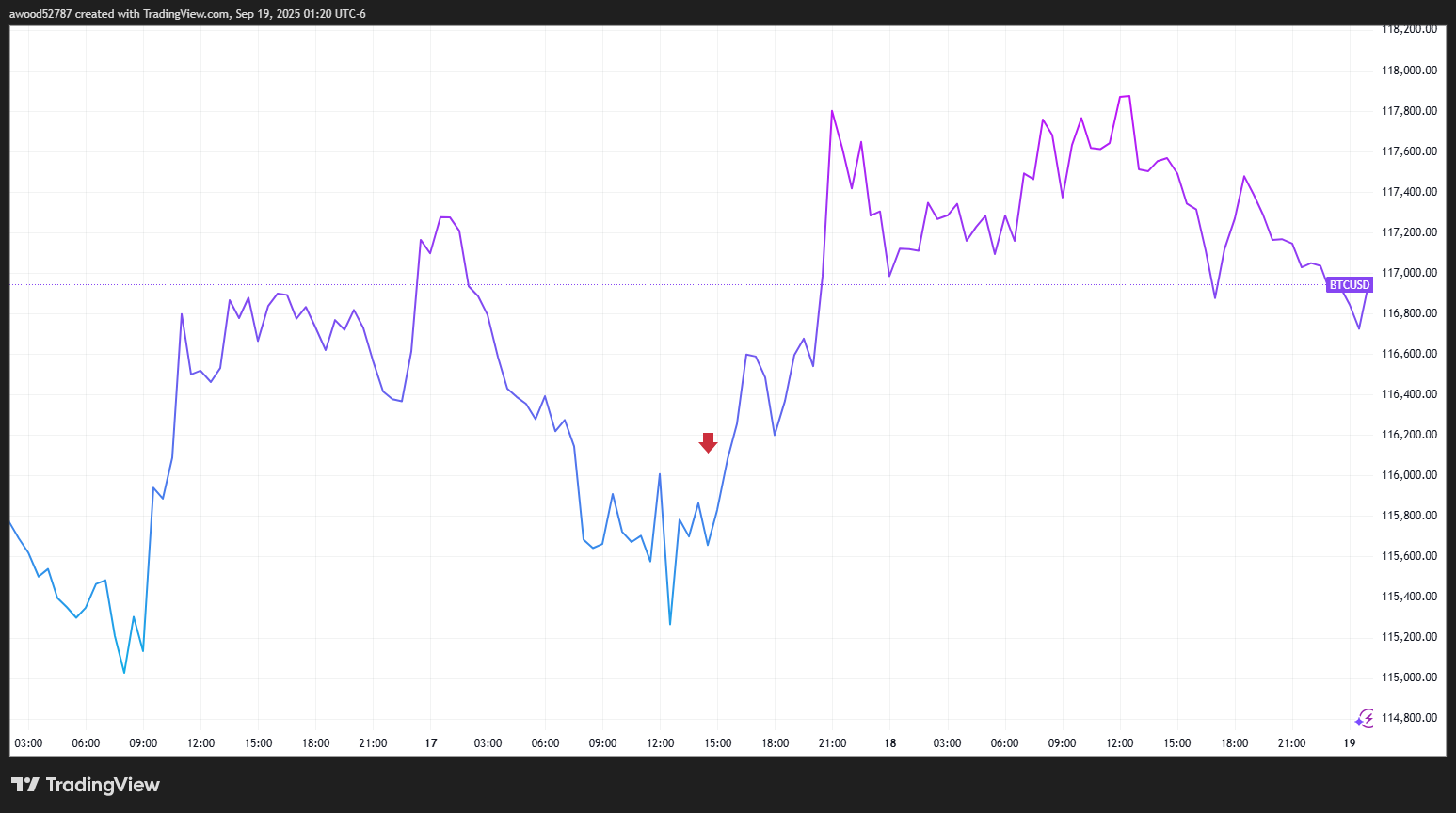

Bitcoin’s price climbed sharply after the U.S. Federal Reserve announced a 25 basis point rate cut, reducing the federal funds rate from 4.3% to 4.1%.

This marked the first rate cut since December 2024 and signaled a potential return to easier monetary policy, a condition historically favorable for crypto markets.

The Fed Rate Cut Caused A Small Surge In Bitcoin’s Price

Source: TradingView

As liquidity flows back into the system, risk-on assets like Bitcoin tend to benefit. The price of BTC rose immediately after the announcement, with trading volumes spiking on major exchanges.

The market reaction mirrors what occurred in 2020, when rate cuts in response to the COVID-19 crisis helped ignite a massive Bitcoin rally that peaked in early 2021.

Analysts are drawing similar parallels now, with Coin Bureau’s Nic Puckrin saying:

“Rate cuts increase liquidity and risk appetite. That’s a bullish signal for Bitcoin in the mid to long term.”

However, Puckrin also warned of short-term volatility, suggesting the move could be a classic “buy the rumor, sell the news” event.

Bitcoin’s recent pump pushed it past key resistance levels, with traders eyeing $120,000 as the next psychological target. Technical analysts are pointing to strong support around $112,000–$115,000, making current levels a critical zone to watch.

The Relative Strength Index (RSI) remains below overbought territory, indicating more room to run if bullish momentum continues.

The rate cut is just one part of a broader economic narrative benefiting Bitcoin:

U.S. job growth is stalling, increasing the likelihood of future cuts.

Geopolitical uncertainty is driving interest in decentralized assets.

Fiat currencies are under pressure globally, prompting capital flows into digital stores of value.

Together, these factors are fueling a renewed interest in Bitcoin price prediction models, many of which are now targeting six-figure valuations by early 2026.

In Thailand, over 3 million bank accounts were frozen in a nationwide scam crackdown. Though intended to target illicit activity, the move affected everyday users and highlighted the fragility of centralized banking.

Bitcoiners in the region used the incident to advocate for decentralized alternatives. “This is why we need Bitcoin,” posted one user from the Bitcoin Learning Center in Thailand.

Pakistan made headlines by inviting major crypto firms to help build its digital asset framework. With the country ranked third in global crypto adoption (according to Chainalysis), the move is seen as a green light for Bitcoin growth in emerging markets.

Source: Cointelegraph

While optimism is growing, traders should be cautious. The current rally may face short-term pullbacks, especially if macro data surprises to the downside or if investors take profits.

That said, the fundamental drivers for Bitcoin remain intact: limited supply, increasing institutional interest, and global demand for financial alternatives.

The rate cut increased market liquidity, which generally boosts risk assets like Bitcoin. Historically, looser monetary policy has preceded major Bitcoin bull runs.

While short-term corrections are possible, many analysts are optimistic. Key models forecast Bitcoin reaching new all-time highs in 2026, with some calling for $150K+ if macro conditions remain favorable.

Banking instability (like in Thailand), crypto adoption in emerging markets (e.g. Pakistan), and inflationary pressure on fiat currencies are all boosting Bitcoin’s appeal as a store of value.

That depends on your financial goals and risk tolerance. While long-term prospects look strong, Bitcoin remains volatile. Dollar-cost averaging is a popular strategy to manage entry points.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.032.72%

Figure Heloc(FIGR_HELOC)$1.032.72% Wrapped stETH(WSTETH)$3,671.67-6.72%

Wrapped stETH(WSTETH)$3,671.67-6.72% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Wrapped eETH(WEETH)$3,257.54-6.69%

Wrapped eETH(WEETH)$3,257.54-6.69% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05% WETH(WETH)$2,998.21-6.70%

WETH(WETH)$2,998.21-6.70% Coinbase Wrapped BTC(CBBTC)$89,687.00-3.67%

Coinbase Wrapped BTC(CBBTC)$89,687.00-3.67% Ethena USDe(USDE)$1.00-0.17%

Ethena USDe(USDE)$1.00-0.17% Hyperliquid(HYPE)$21.39-10.48%

Hyperliquid(HYPE)$21.39-10.48% Canton(CC)$0.12568014.32%

Canton(CC)$0.12568014.32% USDT0(USDT0)$1.00-0.04%

USDT0(USDT0)$1.00-0.04% sUSDS(SUSDS)$1.09-0.10%

sUSDS(SUSDS)$1.09-0.10% World Liberty Financial(WLFI)$0.164371-0.79%

World Liberty Financial(WLFI)$0.164371-0.79% Ethena Staked USDe(SUSDE)$1.220.05%

Ethena Staked USDe(SUSDE)$1.220.05% USD1(USD1)$1.00-0.05%

USD1(USD1)$1.00-0.05% Rain(RAIN)$0.008637-5.04%

Rain(RAIN)$0.008637-5.04% MemeCore(M)$1.655.25%

MemeCore(M)$1.655.25%