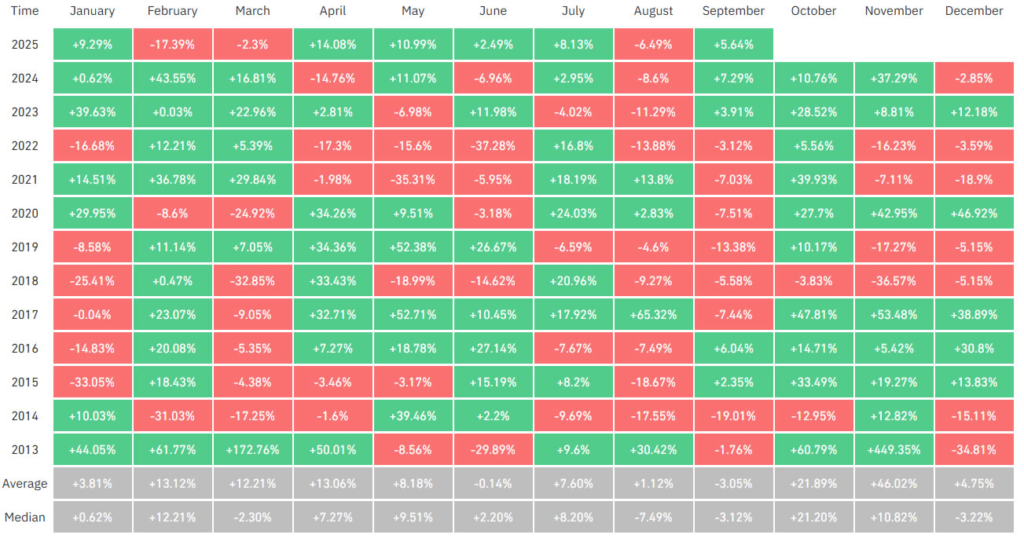

Bitcoin has a strong October track record, with 10 out of 12 years closing green.

Despite the history, Bitcoin recently dropped to 12-day lows, raising concerns about the strength of any “Uptober” rally.

Analysts are split: Some predict a muted bounce; others foresee a surge toward $165K if liquidity improves.

Federal Reserve actions, particularly potential rate cuts, could play a pivotal role in Bitcoin’s October performance.

Caution is advised, as profit-taking, low volatility, and macroeconomic pressures continue to weigh on the crypto markets.

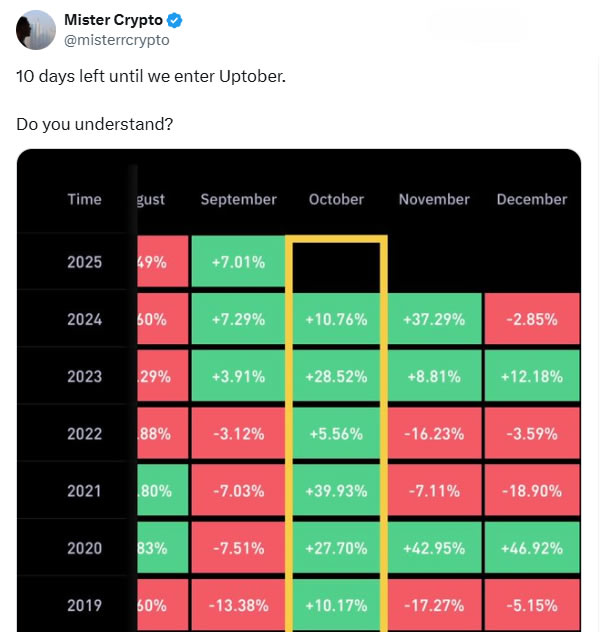

October has earned the nickname “Uptober” in crypto circles due to its bullish historical record. According to CoinGlass, Bitcoin has closed October in the green 10 out of the last 12 years, making it a month to watch for investors and traders alike.

10/12 Previous Octobers Have Been Bullish

Source: CoinGlass

In 2017 and 2021, both bull market years, Bitcoin surged 48% and 40% respectively in October. If similar momentum were to occur this year, Bitcoin could potentially reach $165,000, up from its current trading level of around $114,000.

Bitcoin price prediction models suggest that a breakout in October could align with historical trends, but analysts are split on the likelihood this year.

Despite optimism, Bitcoin fell to a 12-day low on Monday, triggering doubts across the market. The broader crypto market also shed $80 billion, with Ethereum (ETH) dropping over 4% to dip below $4,300.

Analysts point to multiple reasons behind the drop:

Weakening momentum from large buyers

Profit-taking behavior from early investors

Persistent macroeconomic uncertainty

Jeff Mei, COO of BTSE exchange, commented:

“We think that the Uptober trend is less likely to occur this year given macro uncertainty and the fact that September hasn’t seen markets fall.”

Not everyone is bearish. Several analysts still believe the fundamentals for a rally are intact, particularly if monetary policy becomes more accommodative.

Source: X (@misterrcrypto)

Kyle Chassé pointed to increasing odds of a Federal Reserve rate cut in October, currently priced in at 92% according to CME futures. He noted that:

“The easing cycle is basically priced in. Liquidity is coming — and that’s the fuel Bitcoin and crypto thrive on.”

Arthur Hayes, co-founder of BitMEX, echoed the sentiment, suggesting Bitcoin will resume its “up only” mode once the U.S. Treasury General Account (TGA) finishes filling its reserves.

While some analysts forecast an explosive move, others expect a more tempered recovery.

Sykodelic, a pseudonymous market commentator, said:

“$112,500 is the number. Once we hit that, we’ll likely see new highs and a euphoric final leg.”

In contrast, Augustine Fan from SignalPlus warned:

“Rallies could be muted due to low implied volatility, upside skews, and lingering profit-takers.”

For a significant Bitcoin price surge in October, these factors could act as catalysts:

A confirmed rate cut by the Fed

Signs of rising liquidity in the market

Strong institutional inflows

Positive ETF-related news or approvals

Historically, Bitcoin has shown strong performance in October, rising in 10 of the past 12 years — thus earning the name “Uptober.”

If historical patterns repeat and market conditions improve, analysts speculate Bitcoin could surge toward $165,000 in October 2025. However, this depends heavily on macroeconomic factors.

While some analysts see the current dip as a buying opportunity, others urge caution due to macro uncertainty. Always consider your risk tolerance and investment goals.

Yes. Rate cuts usually boost liquidity, which can lead to increased investment in risk-on assets like Bitcoin.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.032.66%

Figure Heloc(FIGR_HELOC)$1.032.66% Wrapped stETH(WSTETH)$3,667.18-6.85%

Wrapped stETH(WSTETH)$3,667.18-6.85% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Wrapped eETH(WEETH)$3,251.54-6.90%

Wrapped eETH(WEETH)$3,251.54-6.90% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03% WETH(WETH)$2,993.36-6.88%

WETH(WETH)$2,993.36-6.88% Coinbase Wrapped BTC(CBBTC)$89,442.00-3.86%

Coinbase Wrapped BTC(CBBTC)$89,442.00-3.86% Ethena USDe(USDE)$1.00-0.15%

Ethena USDe(USDE)$1.00-0.15% Hyperliquid(HYPE)$21.45-10.58%

Hyperliquid(HYPE)$21.45-10.58% USDT0(USDT0)$1.00-0.07%

USDT0(USDT0)$1.00-0.07% Canton(CC)$0.12491615.82%

Canton(CC)$0.12491615.82% sUSDS(SUSDS)$1.09-0.23%

sUSDS(SUSDS)$1.09-0.23% World Liberty Financial(WLFI)$0.162136-2.52%

World Liberty Financial(WLFI)$0.162136-2.52% Ethena Staked USDe(SUSDE)$1.220.00%

Ethena Staked USDe(SUSDE)$1.220.00% USD1(USD1)$1.00-0.05%

USD1(USD1)$1.00-0.05% Rain(RAIN)$0.008620-5.28%

Rain(RAIN)$0.008620-5.28% MemeCore(M)$1.644.64%

MemeCore(M)$1.644.64%