Bitcoin dropped to $102,000 on Binance following Trump’s announcement of 100% tariffs on China.

The price crash led to $9.4 billion in total crypto liquidations, most of them from long positions.

Rare earth export controls from China could affect crypto mining and tech sectors.

The broader crypto market, including Ethereum and Solana, saw double-digit percentage losses.

Bitcoin price prediction for the short term suggests high volatility amid geopolitical uncertainty.

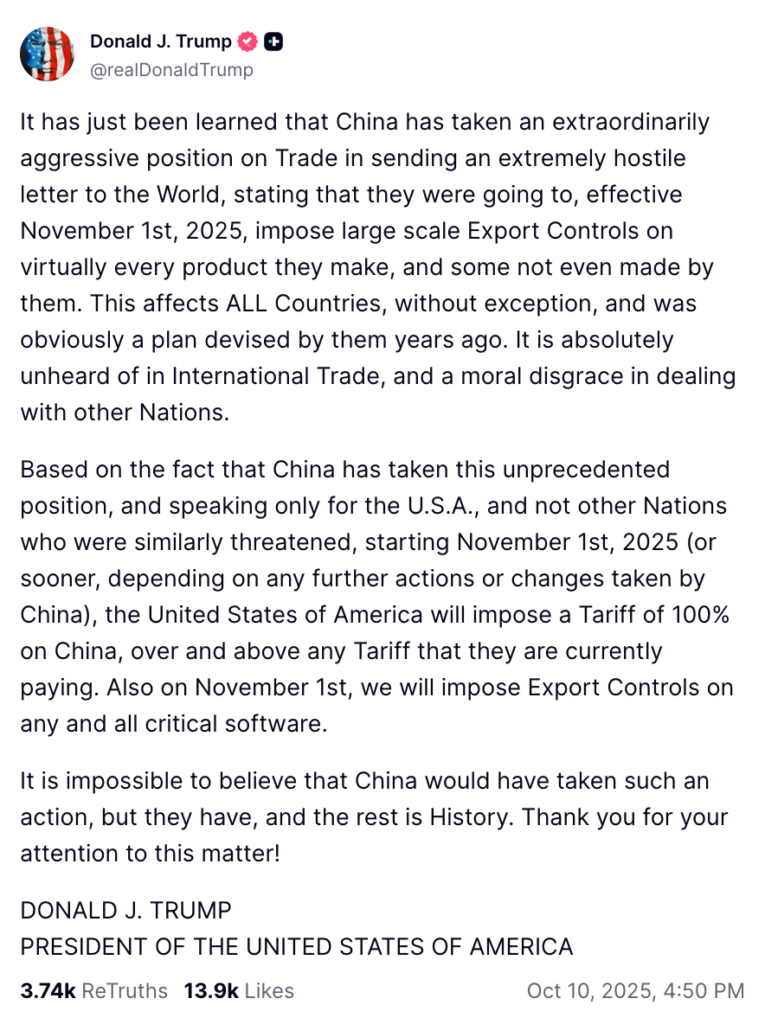

Posting on Truth Social, Donald Trump stated that China would begin restricting exports of rare earth elements, a critical component for technologies such as semiconductors, AI systems, and crypto mining rigs, starting November 1st, 2025.

Source: X (@realDonaldTrump)

The U.S. President wrote:

“It has just been learned that China has taken an extraordinarily aggressive position on Trade… They were going to… impose large-scale Export Controls on virtually every product they make.”

The announcement comes on the heels of earlier trade tensions in April, which already had put crypto markets on edge.

Rare earth elements like neodymium, lanthanum, and terbium are essential for the production of high-performance computing equipment, including crypto mining infrastructure.

Limiting access to these materials could severely impact both traditional and decentralized financial sectors.

Shortly after Trump’s statement, BTC/USDT futures on Binance fell to $102,000, the lowest price since late June. On Coinbase, Bitcoin spot prices dipped to $107,000, marking a significant downturn from recent highs near $120K.

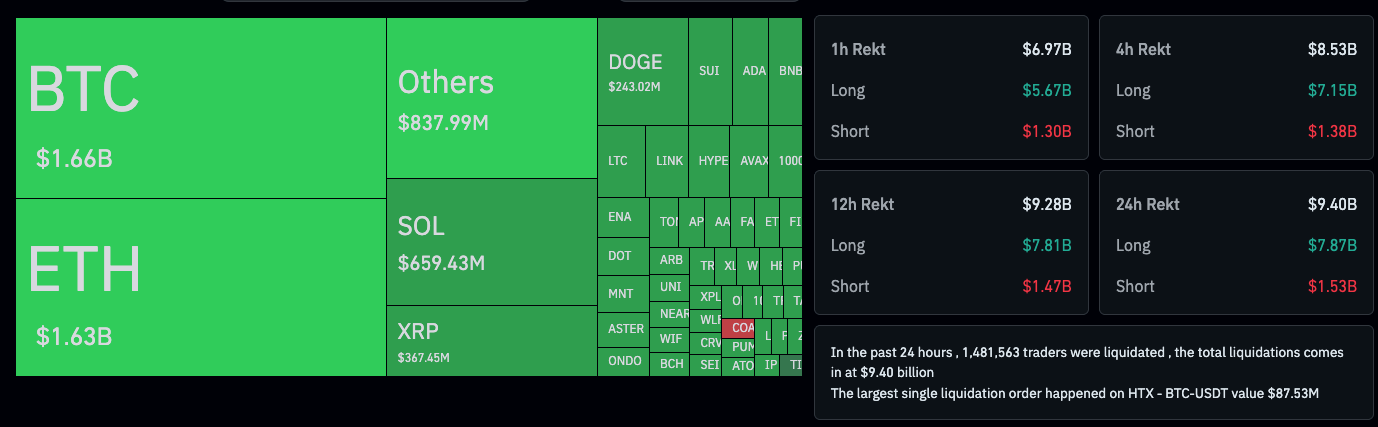

According to CoinGlass, over $9.4 billion in total crypto market positions were liquidated in the past 24 hours. An astonishing $7.15 billion of those were leveraged long positions, revealing just how unprepared traders were for the sudden shift.

Overall Crypto Market Liquidations

Source: CoinGlass

It wasn’t just Bitcoin that suffered:

Ethereum (ETH) fell to $3,500

Solana (SOL) dropped below $140

Altcoin markets experienced significant wipeouts as well, with Hyblock Capital noting:

“Global 2x leverage on most altcoins was totally wiped out.”

The sudden price drop and massive liquidations suggest that Bitcoin’s short-term price prediction points toward continued volatility.

As global markets digest the implications of a potential U.S., China trade standoff, BTC may face resistance levels near $110K, with potential support near the $95K–$100K range.

While some investors see the dip as a panic-driven sell-off, others view it as a potential buying opportunity. Market analysts warn that if geopolitical tensions escalate, Bitcoin could retest June’s lows below $100,000.

Although Bitcoin operates independently of national governments, global macroeconomic conditions, especially supply chain risks and investor sentiment, play a massive role in price action.

Tariffs, inflation fears, and recession indicators often push traders toward or away from risk assets.

Bitcoin’s price fell in response to Donald Trump’s announcement of 100% tariffs on China, sparking fears of a global economic downturn and triggering mass liquidations across the crypto market.

Rare earth elements are vital for tech manufacturing, including crypto mining rigs. Restrictions could raise hardware costs, affect mining efficiency, and strain the supply chain, impacting Bitcoin and altcoins.

Some analysts see this as a potential buy-the-dip moment, while others urge caution given ongoing geopolitical uncertainty. Investors should watch support/resistance levels and global news closely.

Volatility is expected. If market fear persists, BTC could fall below $100K again. A strong bounce-back would require positive global developments or stabilization in trade tensions.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

JUSD(JUSD)$1.000.02%

JUSD(JUSD)$1.000.02% Figure Heloc(FIGR_HELOC)$1.051.11%

Figure Heloc(FIGR_HELOC)$1.051.11% Wrapped stETH(WSTETH)$3,600.720.28%

Wrapped stETH(WSTETH)$3,600.720.28% Wrapped eETH(WEETH)$3,192.51-0.05%

Wrapped eETH(WEETH)$3,192.51-0.05% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.07%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.07% Coinbase Wrapped BTC(CBBTC)$89,505.000.72%

Coinbase Wrapped BTC(CBBTC)$89,505.000.72% WETH(WETH)$2,940.020.31%

WETH(WETH)$2,940.020.31% Ethena USDe(USDE)$1.00-0.08%

Ethena USDe(USDE)$1.00-0.08% Canton(CC)$0.143798-4.29%

Canton(CC)$0.143798-4.29% Hyperliquid(HYPE)$22.335.14%

Hyperliquid(HYPE)$22.335.14% World Liberty Financial(WLFI)$0.171620-1.01%

World Liberty Financial(WLFI)$0.171620-1.01% USDT0(USDT0)$1.00-0.04%

USDT0(USDT0)$1.00-0.04% sUSDS(SUSDS)$1.080.01%

sUSDS(SUSDS)$1.080.01% USD1(USD1)$1.000.20%

USD1(USD1)$1.000.20% Ethena Staked USDe(SUSDE)$1.22-0.01%

Ethena Staked USDe(SUSDE)$1.22-0.01% Rain(RAIN)$0.010036-0.39%

Rain(RAIN)$0.010036-0.39% MemeCore(M)$1.61-2.52%

MemeCore(M)$1.61-2.52%