Zcash (ZEC) rebounded from a 45% crash to reclaim its pre-meltdown high of $291.

The crypto market meltdown was triggered by President Trump’s social media announcement of a 100% tariff on Chinese goods.

Zcash is currently trading at around $273, down only 5.5% from its recent high.

The broader crypto market saw $20 billion in liquidations following the news.

Zcash had previously surged nearly 4x in two weeks leading up to the crash.

Zcash, a privacy-focused, supply-capped layer-1 cryptocurrency, demonstrated remarkable strength during the recent crypto market meltdown.

On Friday, ZEC plummeted by 45%, crashing from approximately $273 to $150 within hours. By Saturday, however, the token had rebounded sharply to hit a new local high of $291, before settling near $273 at the time of writing.

Zcash Had A Massive Rally This Month & Is Trading At Pre-Crash Levels

Source: TradingView

While the broader crypto market remained in distress, ZEC’s swift recovery positioned it as one of the top-performing assets over the weekend.

Currently down just 5.5% from its recent high, Zcash has outpaced most other major tokens.

For comparison:

Ethereum (ETH) is still down over 22% from its all-time high of $4,957.

Many altcoins remain trapped in double-digit losses post-crash.

This resilience has sparked renewed interest in Zcash among investors seeking refuge in more stable digital assets during turbulent times.

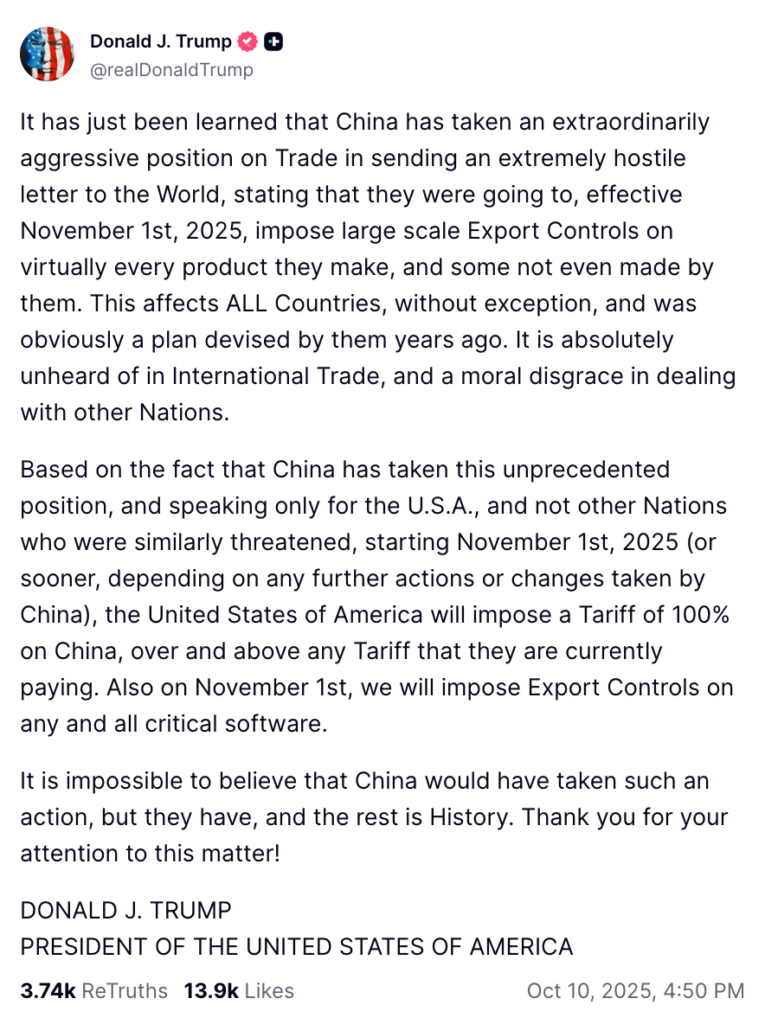

The catalyst for Friday’s crypto market meltdown was a series of posts on social media from U.S. President Donald Trump.

In his initial message, he criticized China’s export controls on rare earth elements, calling them “very hostile” and warning that they could severely disrupt global supply chains.

Trump later announced a 100% tariff on all Chinese goods, effective November 1st, 2025, or possibly earlier.

Source: X (@realDonaldTrump)

These announcements came just weeks ahead of a planned meeting with Chinese President Xi Jinping, which now appears unlikely to proceed.

Within hours of Trump’s tariff announcement, over $20 billion worth of positions were liquidated across major crypto exchanges, marking one of the largest liquidation events in crypto history.

This sudden crash wiped out short-term gains and left many traders reeling.

Before the market turned bearish, Zcash had already been on a tear. From October 1st to the crash, ZEC soared from $74 to $291, nearly quadrupling in value in just under two weeks.

Analysts attribute the rise to increased interest in privacy-focused projects and Zcash’s capped supply, which makes it an attractive hedge during market uncertainty.

Despite the crypto market’s collective downturn, Zcash has managed to retain most of its gains.

The recovery to pre-crash levels signals continued investor confidence, especially amid concerns over economic instability and heightened geopolitical tensions.

The meltdown was primarily triggered by President Trump’s announcement of new tariffs on Chinese goods and warnings about China’s rare earth export policies. These events sparked a massive risk-off movement across both traditional and crypto markets.

Zcash dropped by approximately 45%, falling from about $273 to $150 in a matter of hours during the peak of the meltdown.

Yes, Zcash quickly rebounded and reached $291, slightly above its pre-crash price. It is now trading just below that level at around $273.

Zcash’s limited supply, strong privacy features, and a growing user base likely contributed to its resilience. Its performance may also reflect investor interest in privacy coins during times of market uncertainty.

While Zcash has shown strong performance, it’s important to remember that cryptocurrencies remain highly volatile. Always conduct your own research and consider consulting a financial advisor before investing.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.03%

Figure Heloc(FIGR_HELOC)$1.031.03% Wrapped stETH(WSTETH)$3,594.241.29%

Wrapped stETH(WSTETH)$3,594.241.29% Wrapped eETH(WEETH)$3,188.491.27%

Wrapped eETH(WEETH)$3,188.491.27% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.00%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.00% Coinbase Wrapped BTC(CBBTC)$87,799.000.30%

Coinbase Wrapped BTC(CBBTC)$87,799.000.30% WETH(WETH)$2,933.501.23%

WETH(WETH)$2,933.501.23% Hyperliquid(HYPE)$27.9924.64%

Hyperliquid(HYPE)$27.9924.64% Ethena USDe(USDE)$1.000.07%

Ethena USDe(USDE)$1.000.07% Canton(CC)$0.1526021.43%

Canton(CC)$0.1526021.43% USD1(USD1)$1.000.03%

USD1(USD1)$1.000.03% USDT0(USDT0)$1.000.02%

USDT0(USDT0)$1.000.02% World Liberty Financial(WLFI)$0.1573971.94%

World Liberty Financial(WLFI)$0.1573971.94% sUSDS(SUSDS)$1.080.17%

sUSDS(SUSDS)$1.080.17% Ethena Staked USDe(SUSDE)$1.220.01%

Ethena Staked USDe(SUSDE)$1.220.01% Rain(RAIN)$0.0100345.95%

Rain(RAIN)$0.0100345.95% MemeCore(M)$1.54-5.72%

MemeCore(M)$1.54-5.72%