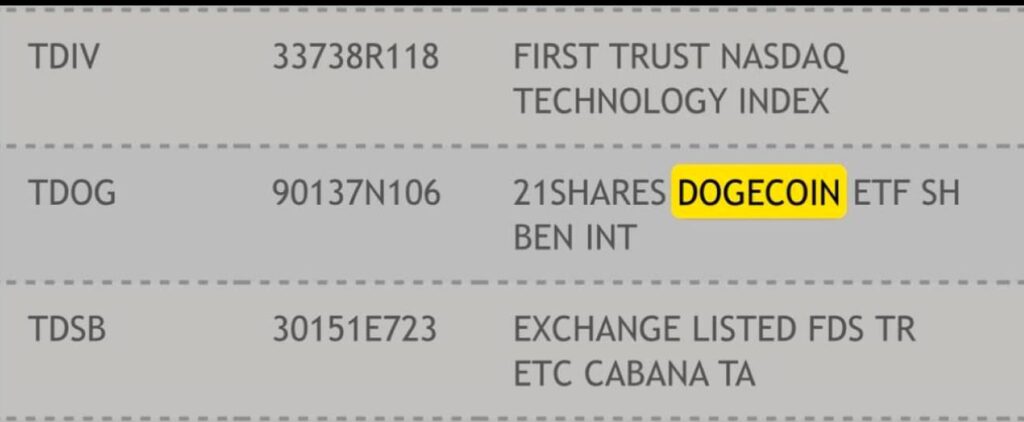

TDOG is a proposed Dogecoin ETF from 21Shares that would offer DOGE exposure without direct ownership.

It is not yet approved by the SEC and cannot trade until both the S-1 and 19b-4 filings are cleared.

TDOG would be a physically backed trust, holding real Dogecoin with transparent valuation and cold custody.

Investors should understand fees (paid in DOGE), intraday pricing variations, and the lack of on-chain utility.

DOJE is currently the only listed Dogecoin ETF on Cboe, with a different structure and exposure strategy.

TDOG is a proposed physically backed Dogecoin ETF from 21Shares, designed to let investors gain exposure to DOGE without needing to manage wallets or hold the memecoin directly. If approved, it would trade under the ticker TDOG on Nasdaq.

Source: 21Shares

Unlike synthetic products, this fund would hold actual Dogecoin, stored in cold custody via Coinbase Custody Trust Company. Shares would be issued and redeemed in cash, and priced based on a reputable Dogecoin benchmark.

Backing: Each share is backed by actual Dogecoin held in custody.

Pricing: The fund uses CF Benchmarks’ Dogecoin-Dollar US Settlement Price, updated daily.

Intraday Value: An intraday indicative value (IIV) updates every 15 seconds during trading hours.

Creation/Redemption: Performed in cash via authorized participants, who exchange cash for DOGE through a prime broker.

One unique aspect of TDOG is that fees are paid in-kind, meaning DOGE is deducted from the fund to cover expenses. Over time, the amount of Dogecoin backing each share slowly declines.

TDOG appearing on the DTCC list signals operational readiness, not regulatory approval.

S-1 Registration Statement: Must be declared effective.

19b-4 Filing with Nasdaq: Needs approval to list as a Commodity-Based Trust Share.

Until both filings are greenlit, TDOG won’t trade. Typically, DTCC listings are common for crypto funds prepping for launch, but they don’t imply SEC approval or market readiness.

TDOG offers a familiar, regulated format for investors who prefer the simplicity of brokerage accounts.

Source: X (@21Shares)

No need to manage wallets, keys, or crypto exchanges

Cold storage custody by Coinbase Custody

Institutional-grade pricing and valuation

Transparent fee structure

DOGE per share declines over time due to in-kind fees

Intraday price deviations from NAV may occur

No on-chain utility (you can’t tip or spend DOGE from the ETF)

Once TDOG secures SEC approval, it will become tradable on Nasdaq. Here’s how to prepare:

Check Broker Availability: Ensure your brokerage supports Nasdaq-listed ETFs.

Use Eligible Accounts: Standard taxable accounts usually qualify, but check any restrictions.

Place Orders Wisely: Use limit orders, especially in early trading sessions when liquidity may be thin.

Track Fees & NAV: Sponsor fees are deducted from the fund, and NAV is updated daily. Compare market price vs. NAV.

Until then, DOJE remains the only ETF offering DOGE exposure today.

No. TDOG is listed on DTCC’s pre-launch list but still needs SEC approval to begin trading.

Yes. It’s a physically backed trust, meaning it will hold actual DOGE in cold storage.

Fees are deducted in-kind—in Dogecoin—reducing the DOGE per share over time.

TDOG is a grantor trust that holds DOGE directly, while DOJE is a 1940-act ETF that may use a combination of instruments, including ETPs and a Cayman portfolio.

TDOG’s prospectus states it disclaims forks and airdrops unless explicitly supported.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.12%

Figure Heloc(FIGR_HELOC)$1.030.12% Wrapped stETH(WSTETH)$3,699.313.15%

Wrapped stETH(WSTETH)$3,699.313.15% Wrapped eETH(WEETH)$3,281.173.18%

Wrapped eETH(WEETH)$3,281.173.18% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03% Hyperliquid(HYPE)$30.6121.92%

Hyperliquid(HYPE)$30.6121.92% Coinbase Wrapped BTC(CBBTC)$89,261.001.30%

Coinbase Wrapped BTC(CBBTC)$89,261.001.30% WETH(WETH)$3,018.073.12%

WETH(WETH)$3,018.073.12% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.154787-0.55%

Canton(CC)$0.154787-0.55% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% World Liberty Financial(WLFI)$0.1650063.48%

World Liberty Financial(WLFI)$0.1650063.48% USDT0(USDT0)$1.00-0.06%

USDT0(USDT0)$1.00-0.06% sUSDS(SUSDS)$1.08-0.23%

sUSDS(SUSDS)$1.08-0.23% Ethena Staked USDe(SUSDE)$1.22-0.03%

Ethena Staked USDe(SUSDE)$1.22-0.03% Rain(RAIN)$0.010068-0.49%

Rain(RAIN)$0.010068-0.49% MemeCore(M)$1.55-3.91%

MemeCore(M)$1.55-3.91%