Ethena Labs will launch two new product lines within the next three months.

The company is expanding its engineering and product teams, hiring 10+ new roles.

Founder Guy Young suggests the new products could rival USDe in scale and impact.

This is the first major diversification by Ethena Labs since its inception.

The move reflects a larger DeFi trend toward ecosystem expansion beyond core products.

Since launching USDe, Ethena Labs has maintained a laser focus on stability and adoption in the DeFi sector. Now, the company aims to leverage that success by launching two new verticals that could open up significant market opportunities.

Although the details remain under wraps, Guy Young hinted that both upcoming products are designed to have as much, if not more, impact than USDe.

Source: X (@gdog97_)

These projects will likely focus on unlocking new financial primitives or decentralized applications (dApps) built on top of Ethena’s protocol infrastructure.

The planned expansion reflects a broader trend within DeFi: successful protocol teams are evolving beyond a single-use case to build ecosystem-level platforms.

Ethena’s upcoming product lines are expected to integrate seamlessly with its existing suite, reinforcing its position as a key innovator in the space.

To support these initiatives, Ethena Labs is hiring 10 new engineers and product developers, growing its team from around two dozen to more than 30.

This marks a significant ramp-up in operational capacity for a team known for staying lean and focused.

Smart contract engineers

DeFi product strategists

UI/UX and front-end developers

This talent expansion suggests that the forthcoming products will be technically complex and designed to scale, much like USDe itself.

USDe has already positioned itself as a top-tier algorithmic stablecoin, gaining rapid traction since its launch.

Its innovative approach to price stability via smart contracts has distinguished it from earlier failed models like TerraUSD (UST), which famously collapsed in 2022.

Unlike UST, Ethena’s stablecoin architecture is designed with risk mitigation at its core, contributing to the growing trust and adoption by DeFi users and liquidity providers.

By hinting at the release of two new scalable products, Ethena Labs is clearly signaling that it intends to be more than just a stablecoin issuer.

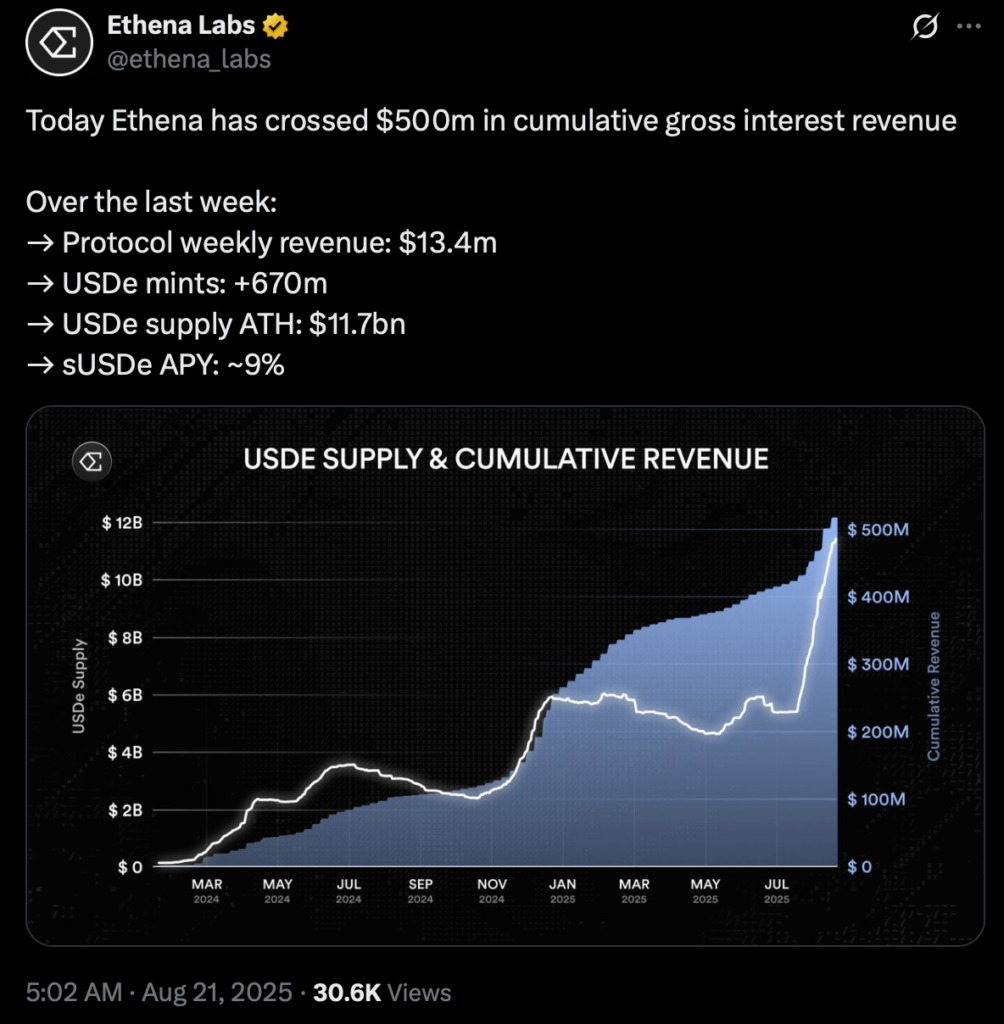

In August, the Ethena protocol generated $13.4 million in revenue, while the circulating supply of Ethena USDe hit a record high of $11.7 billion.

Source: X (@ethena_labs)

The upcoming expansion could position it as one of the most ambitious and forward-thinking players in DeFi for 2025 and beyond.

With a proven team, successful products, and now, a strategic expansion plan, all eyes are on what comes next.

Ethena Labs is best known for its algorithmic stablecoin USDe and the ENA token, both of which play key roles in decentralized finance ecosystems.

Guy Young, founder of Ethena Labs, announced that the company will launch two new products and is hiring engineers and developers to support the expansion.

The new product lines are expected to roll out within the next three months, likely by early 2026.

While both are algorithmic stablecoins, USDe is built with a more risk-managed and transparent architecture, aiming to avoid the failures of UST.

Ethena Labs plans to increase its workforce by approximately 40%, focusing on product development and engineering roles to support its new initiatives.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.041.33%

Figure Heloc(FIGR_HELOC)$1.041.33% Wrapped stETH(WSTETH)$3,357.77-5.83%

Wrapped stETH(WSTETH)$3,357.77-5.83% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Wrapped eETH(WEETH)$2,977.70-5.82%

Wrapped eETH(WEETH)$2,977.70-5.82% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.07%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.07% Hyperliquid(HYPE)$29.44-12.61%

Hyperliquid(HYPE)$29.44-12.61% Coinbase Wrapped BTC(CBBTC)$82,996.00-5.26%

Coinbase Wrapped BTC(CBBTC)$82,996.00-5.26% Ethena USDe(USDE)$1.000.24%

Ethena USDe(USDE)$1.000.24% Canton(CC)$0.1713670.11%

Canton(CC)$0.1713670.11% WETH(WETH)$2,741.00-5.83%

WETH(WETH)$2,741.00-5.83% USD1(USD1)$1.00-0.04%

USD1(USD1)$1.00-0.04% USDT0(USDT0)$1.000.13%

USDT0(USDT0)$1.000.13% sUSDS(SUSDS)$1.090.14%

sUSDS(SUSDS)$1.090.14% World Liberty Financial(WLFI)$0.148797-6.39%

World Liberty Financial(WLFI)$0.148797-6.39% Ethena Staked USDe(SUSDE)$1.220.16%

Ethena Staked USDe(SUSDE)$1.220.16% Rain(RAIN)$0.009538-0.49%

Rain(RAIN)$0.009538-0.49% MemeCore(M)$1.44-6.36%

MemeCore(M)$1.44-6.36%