Bitcoin’s first red Uptober in seven years saw prices fall over 10%.

BNB Chain transactions surged 135%, driven by memecoin trading mania.

BNB price briefly crossed $1,300, closing October up 6.6%.

Stablecoin market cap exceeded $300 billion, marking a new milestone for crypto adoption.

Analysts remain divided on Bitcoin price predictions, with November shaping up to be another volatile month.

For six straight years, October was a month Bitcoin traders eagerly anticipated. The “Uptober” trend had built a reputation for steady green candles, symbolizing bullish sentiment and renewed investor optimism.

But this time, Bitcoin bucked the trend, finishing the month over 10% down, making 2025 the first “red Uptober” since 2018.

Bitcoin’s October Price Chart

Source: TradingView

Multiple macroeconomic and market factors contributed to the dip. A near-$20 billion liquidation event, triggered by escalating trade tensions between the United States and China, rattled investor confidence.

Additionally, U.S. Federal Reserve rate cuts created uncertainty around liquidity and capital flows in the crypto market.

The combination of risk aversion and leveraged positions led to aggressive sell-offs across exchanges. Traders who had bet on another bullish Uptober were forced to unwind positions, pushing prices even lower.

Historically, when Bitcoin closes October in the red, volatility tends to follow. Analyst Crypto Rover noted:

“Last time October closed red for Bitcoin, November saw a 36.57% drop.”

Still, others believe a rebound could be imminent. Historically, Bitcoin has often bounced back after deep pullbacks, as investors seek to “buy the dip.”

Based on technical indicators and current on-chain metrics, short-term resistance is seen near $112,000, with potential support around $104,000.

While no one can predict market movements with certainty, this pullback may present an opportunity for long-term investors, especially if historical cyclical trends repeat.

While Bitcoin’s performance disappointed, BNB Chain became a hotbed of activity in October.

According to analytics firm Nansen, transactions on BNB Chain surged by 135%, driven primarily by a massive wave of memecoin launches.

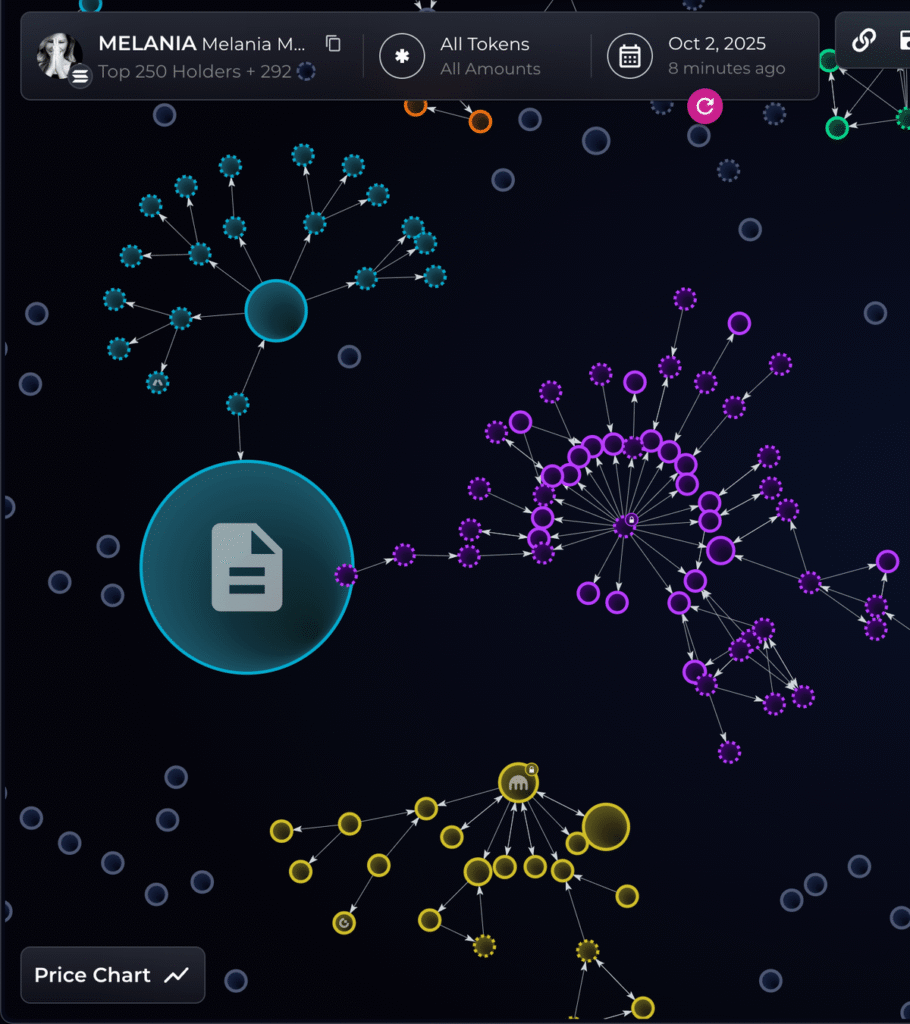

Bubblemaps declared that “memecoin szn is real” on BNB Chain. On October 7th, over 100,000 new traders entered the memecoin market, with nearly 70% recording profits during the early phase of the frenzy.

Source: Bubblemaps

Astonishingly, 40 traders made over $1 million, while another 6,000 earned at least $10,000.

However, the boom was short-lived. Pseudonymous trader Star Platinum observed that most memecoins crashed within days, leaving latecomers holding significant losses.

A notable shift also occurred in how memecoins were launched. On October 1st, Pump.fun accounted for over 90% of all new token issuances.

But by October 8th, Four.meme had flipped that dominance, hosting over 80% of all new token launches on BNB Chain.

The surge in network activity helped push BNB’s token price past $1,300 on October 13th, before cooling off later in the month. Despite the correction, BNB still closed October up 6.6%, outperforming most major cryptocurrencies.

Beyond Bitcoin and BNB, the global crypto landscape saw key regulatory and adoption milestones:

Stablecoin Market Cap Hits $300 Billion: October marked the first time the total stablecoin market capitalization surpassed this milestone, signaling growing demand for digital dollar alternatives.

European Union Delays “Chat Control” Decision: Lawmakers postponed a controversial vote on digital surveillance until December after nine countries voiced opposition.

Crypto Regulation Advances in the U.S.: Despite a government slowdown, several states pushed forward with new crypto legislation during October.

Analysts expect high volatility following October’s red close. Short-term projections suggest Bitcoin could test $104,000 support before a possible rebound toward $115,000 if buying pressure returns.

Bitcoin’s decline was mainly due to macroeconomic tensions, large-scale liquidations, and uncertainty over Federal Reserve policy shifts.

BNB remains one of the strongest-performing altcoins, but memecoin-driven spikes are often short-lived. Long-term growth depends on sustained network utility and ecosystem development.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.12%

Figure Heloc(FIGR_HELOC)$1.030.12% Wrapped stETH(WSTETH)$3,680.732.88%

Wrapped stETH(WSTETH)$3,680.732.88% Wrapped eETH(WEETH)$3,265.212.93%

Wrapped eETH(WEETH)$3,265.212.93% USDS(USDS)$1.000.02%

USDS(USDS)$1.000.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.01% Hyperliquid(HYPE)$29.8120.39%

Hyperliquid(HYPE)$29.8120.39% Coinbase Wrapped BTC(CBBTC)$89,042.001.06%

Coinbase Wrapped BTC(CBBTC)$89,042.001.06% WETH(WETH)$3,004.022.87%

WETH(WETH)$3,004.022.87% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% Canton(CC)$0.1547881.32%

Canton(CC)$0.1547881.32% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% World Liberty Financial(WLFI)$0.1634512.33%

World Liberty Financial(WLFI)$0.1634512.33% USDT0(USDT0)$1.00-0.06%

USDT0(USDT0)$1.00-0.06% sUSDS(SUSDS)$1.08-0.08%

sUSDS(SUSDS)$1.08-0.08% Ethena Staked USDe(SUSDE)$1.22-0.07%

Ethena Staked USDe(SUSDE)$1.22-0.07% Rain(RAIN)$0.010094-3.40%

Rain(RAIN)$0.010094-3.40% MemeCore(M)$1.56-3.43%

MemeCore(M)$1.56-3.43%