The U.S. government shutdown ended after a 40-day stalemate, restoring market stability.

Major cryptocurrencies, led by Bitcoin and Ethereum, surged in response to renewed investor confidence.

Altcoins including XRP, BNB, and Zcash posted double-digit gains.

Analysts expect further upside if economic data supports a continued risk-on environment.

Temporary funding runs until January 30th, meaning political uncertainty could return early next year.

Following a record 40-day shutdown, the U.S. Senate voted late Sunday to approve a bipartisan funding measure after marathon negotiations between Senate Majority Leader John Thune, the White House, and several moderate Democrats.

The temporary funding bill, which now moves to the House of Representatives, will keep federal agencies operational until January 30th and ensure back pay for approximately 1.4 million federal employees.

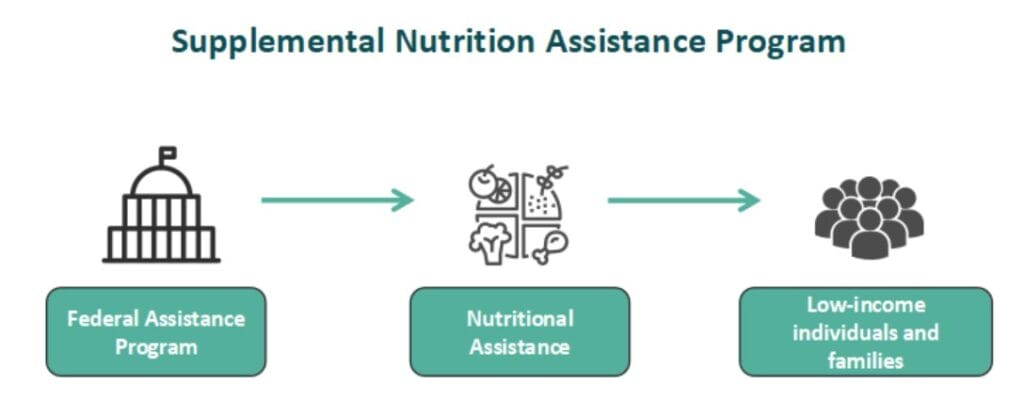

In addition, the bill guarantees funding for critical federal programs such as veterans’ services, agriculture, and Supplemental Nutrition Assistance Program (SNAP) benefits through the next fiscal cycle, a move expected to ease immediate economic pressures on millions of Americans.

Source: WallStreetMojo

In the hours following news of the U.S. government shutdown resolution, major cryptocurrencies surged. Bitcoin (BTC) jumped 4.4% in the past 24 hours, crossing the $106,000 mark after briefly dipping below $104,000 earlier in the week.

Meanwhile, Ethereum (ETH) soared 5.9% to trade above $3,600, demonstrating renewed strength after a volatile start to November. Analysts note that both assets have benefited from improved market sentiment and increased institutional inflows as traders reposition for a more stable macroeconomic outlook.

XRP was among the standout performers, gaining 8.56% to reach $2.47, as traders rotated back into large-cap altcoins. The strong moves in major assets have reignited optimism that crypto’s bull cycle could extend into the year-end period.

Other leading altcoins also joined the rally. Binance Coin (BNB) once again approached the $1,000 resistance level — a price threshold that many traders view as a key psychological milestone.

Solana (SOL) gained 5.6%, trading near $167, while Chainlink (LINK) rose 6.5% to $16.28. Cardano (ADA) followed with a 5.5% increase to $0.587.

The day’s top performer was Zcash (ZEC), which skyrocketed 16.99%, extending its impressive seven-day rally of over 70%. Analysts say growing demand for privacy-focused cryptocurrencies like ZEC reflects renewed investor appetite for niche blockchain projects during market rebounds.

Financial experts attribute the market’s upward movement to a combination of reduced political uncertainty and renewed liquidity confidence following the U.S. government shutdown deal.

Khoo added that if upcoming U.S. inflation data, particularly the Consumer Price Index (CPI) and Producer Price Index (PPI) reports, align with forecasts, the market could see a sustained “risk-on” rally through mid-November.

However, he cautioned that while sentiment is improving, traders should remain alert for policy shifts from the Federal Reserve and ongoing fiscal debates in Washington ahead of the January funding deadline.

With the U.S. government shutdown now temporarily resolved, many traders are eyeing whether this rally marks the start of a broader recovery.

US Senate Majority Leader John Thune Confirming The Government Shutdown

Source: Getty Images

The next few weeks will be crucial, as economic data and potential legislative negotiations could influence both liquidity conditions and market direction.

If inflation pressures continue to ease and the Federal Reserve maintains a neutral tone, analysts expect Bitcoin and Ethereum to maintain upward momentum, with altcoins potentially outperforming in a renewed risk cycle.

The shutdown created uncertainty around economic stability and government spending, prompting many investors to reduce exposure to volatile assets. Once the shutdown deal was announced, markets rebounded on improved confidence.

The agreement reduced short-term political risk and reassured markets that federal operations and spending programs would continue, increasing investor appetite for riskier assets like crypto.

Analysts say yes, if upcoming inflation data and central bank guidance remain favorable, and political tensions stay contained through early 2026.

Zcash (ZEC), XRP, and Chainlink (LINK) were among the top gainers, while Bitcoin (BTC) and Ethereum (ETH) led in total market capitalization growth.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.04%

Figure Heloc(FIGR_HELOC)$1.03-0.04% Wrapped stETH(WSTETH)$3,639.311.48%

Wrapped stETH(WSTETH)$3,639.311.48% Wrapped eETH(WEETH)$3,223.071.31%

Wrapped eETH(WEETH)$3,223.071.31% USDS(USDS)$1.000.03%

USDS(USDS)$1.000.03% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.11%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.11% Coinbase Wrapped BTC(CBBTC)$88,095.00-0.19%

Coinbase Wrapped BTC(CBBTC)$88,095.00-0.19% WETH(WETH)$2,970.491.37%

WETH(WETH)$2,970.491.37% Hyperliquid(HYPE)$28.4617.12%

Hyperliquid(HYPE)$28.4617.12% Ethena USDe(USDE)$1.00-0.02%

Ethena USDe(USDE)$1.00-0.02% Canton(CC)$0.1532391.17%

Canton(CC)$0.1532391.17% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% USDT0(USDT0)$1.000.03%

USDT0(USDT0)$1.000.03% World Liberty Financial(WLFI)$0.157607-0.98%

World Liberty Financial(WLFI)$0.157607-0.98% sUSDS(SUSDS)$1.090.30%

sUSDS(SUSDS)$1.090.30% Ethena Staked USDe(SUSDE)$1.22-0.07%

Ethena Staked USDe(SUSDE)$1.22-0.07% Rain(RAIN)$0.0100856.53%

Rain(RAIN)$0.0100856.53% MemeCore(M)$1.57-2.25%

MemeCore(M)$1.57-2.25%