The $2,000 tariff dividend is a proposed stimulus payout from US tariff revenue.

Supreme Court approval is uncertain, with odds currently below 25%.

Markets, especially cryptocurrency, may see a short-term boost as stimulus money flows into assets.

Long-term risks include inflation, increased national debt, and reduced purchasing power.

Strategic investment of the dividend may mitigate losses from fiat currency devaluation.

On his social media platform Truth Social, Trump stated:

“A dividend of at least $2,000 a person, not including high-income people, will be paid to everyone.”

Source: X (@realDonaldTrump)

This tariff dividend is intended as a direct payout to American citizens funded by revenues collected from tariffs imposed on foreign goods.

Trump also criticized opponents of his broad tariff policies, arguing that tariffs are essential for national security and economic protection.

Currently, the US Supreme Court is reviewing the legality of these tariffs. Predictions suggest low odds of approval:

Kalshi traders place the odds at 23%.

Polymarket traders estimate 21%.

Trump questioned the restrictions on tariffs, asking whether the President can restrict trade or license foreign countries but cannot impose tariffs for national security purposes.

The ruling is expected to have major implications not only for trade policy but also for economic stimulus efforts like the tariff dividend.

Investors and analysts reacted to Trump’s announcement as a short-term positive for markets, particularly cryptocurrencies.

The rationale is that direct stimulus payments will increase liquidity, some of which could flow into asset markets.

The announcement sparked optimism in cryptocurrency markets, with analysts suggesting that portions of the tariff dividend could be invested in Bitcoin, Ethereum, and other digital assets.

Simon Dixon, Bitcoin analyst and author, warned that without asset allocation, stimulus funds risk being eroded by inflation or used to service government debt.

Anthony Pompliano, investor and market analyst, noted:

“Stocks and Bitcoin only know to go higher in response to stimulus.”

While the short-term effects are expected to be bullish, long-term consequences may include inflationary pressures and reduced purchasing power.

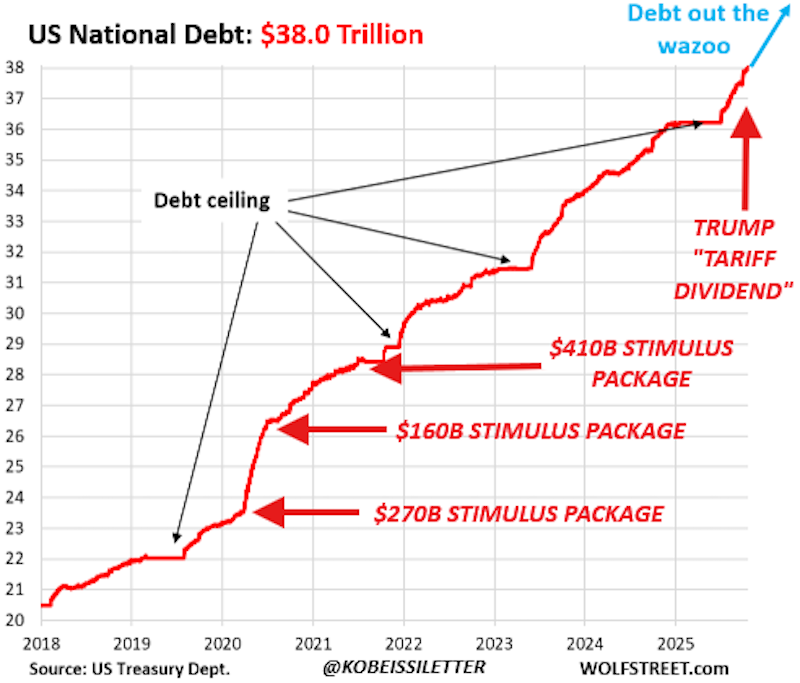

Investment analysts at The Kobeissi Letter forecast that roughly 85% of US adults could receive the $2,000 stimulus, based on historical distribution patterns from COVID-era economic relief checks.

The Proposed Economic Stimulus Checks Could Add To The National Debt

Source: The Kobeissi Letter

Increased consumer spending: Direct payouts will likely increase retail and digital asset purchases.

Boost to markets: Portions of the tariff dividend may flow into stocks and cryptocurrencies.

Fiat currency inflation: Injecting large sums into the economy may devalue the US dollar.

Rising national debt: Additional payouts will increase fiscal pressure over time.

Asset bubbles: Short-term gains may not translate into sustainable economic growth.

Analysts caution that while the tariff dividend is appealing, the long-term economic impact may be negative unless paired with careful monetary and fiscal policies.

Most Americans are expected to qualify, except for high-income earners, based on historical stimulus distribution trends.

Distribution depends on the Supreme Court ruling regarding the legality of the tariffs. No official timeline has been set.

Stimulus funds may increase liquidity in crypto markets, potentially driving prices up in the short term.

Risks include inflation, national debt growth, and erosion of the dividend’s value if not invested.

No. The plan is contingent on the Supreme Court’s approval of the underlying tariffs.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.10%

Figure Heloc(FIGR_HELOC)$1.031.10% Wrapped stETH(WSTETH)$3,572.910.60%

Wrapped stETH(WSTETH)$3,572.910.60% Wrapped eETH(WEETH)$3,166.910.55%

Wrapped eETH(WEETH)$3,166.910.55% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03% Coinbase Wrapped BTC(CBBTC)$87,851.000.14%

Coinbase Wrapped BTC(CBBTC)$87,851.000.14% WETH(WETH)$2,915.630.60%

WETH(WETH)$2,915.630.60% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Hyperliquid(HYPE)$27.5724.04%

Hyperliquid(HYPE)$27.5724.04% Canton(CC)$0.1503971.39%

Canton(CC)$0.1503971.39% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% USDT0(USDT0)$1.00-0.03%

USDT0(USDT0)$1.00-0.03% World Liberty Financial(WLFI)$0.158202-1.73%

World Liberty Financial(WLFI)$0.158202-1.73% sUSDS(SUSDS)$1.08-0.03%

sUSDS(SUSDS)$1.08-0.03% Ethena Staked USDe(SUSDE)$1.22-0.02%

Ethena Staked USDe(SUSDE)$1.22-0.02% Rain(RAIN)$0.0100615.00%

Rain(RAIN)$0.0100615.00% MemeCore(M)$1.55-3.22%

MemeCore(M)$1.55-3.22%