The mass movement of funds has alarmed the crypto community, especially as the PUMP token drops in price, raising concerns about a broader memecoin market correction.

Source: X (@lookonchain)

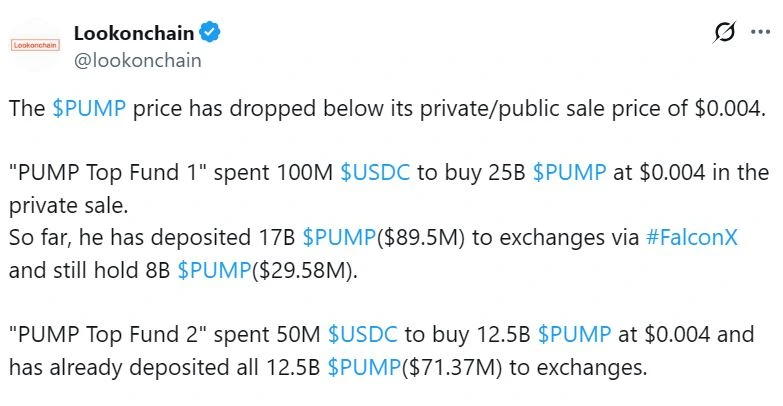

Lookonchain recently reported that two prominent investors, labeled on Solscan as “PUMP Top Fund 1” and “PUMP Top Fund 2,” are at the center of this activity.

These wallets, which participated heavily in the Pump.fun private sale, are now unloading billions of tokens.

These whale-level movements are viewed by analysts as potential indicators of a broader sell-off that could further depress the token’s price.

After a promising debut, the PUMP token has begun showing signs of weakness. A high unlock percentage appears to be one of the key reasons behind the token’s decline.

According to CoinGecko, the PUMP token hit an all-time low of $0.003642 on Friday, marking:

This puts many Pump.fun private sale investors at a loss, particularly those who held onto their tokens hoping for post-launch appreciation.

BitMEX analysts believe the large float and high unlock percentage may have applied downward pressure, particularly in derivatives markets.

High unlocks at launch tend to suppress price movement in the short term, noted BitMEX in their report.

The PUMP price decline isn’t happening in isolation. The entire memecoin sector has shown signs of fatigue following weeks of explosive growth.

Total Memecoin Market Cap

Source: CoinMarketCap

As per CoinMarketCap data:

This suggests that the Pump.fun private sale sell-off might be both a symptom and a contributor to a broader market shift.

Anthony Anzalone, CEO of the layer-1 blockchain Xion, believes the memecoin boom is reflective of idle capital in the crypto space:

“The spike in memecoin market cap shows that capital doesn’t have anywhere better to flow right now.”

The Pump.fun private sale was a fundraising event where early investors purchased PUMP tokens at a fixed price. The event raised $500 million.

Many investors appear to be taking profits, especially after the token’s brief post-launch rally. The high unlock percentage allowed them to quickly access and sell their tokens.

Over $160 million in PUMP tokens have been sent to exchanges by just two early investors.

While it’s too early to call it a crash, the sell-off has certainly contributed to growing volatility in the broader memecoin sector.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.05%

Figure Heloc(FIGR_HELOC)$1.030.05% USDS(USDS)$1.00-0.02%

USDS(USDS)$1.00-0.02% Hyperliquid(HYPE)$28.34-3.88%

Hyperliquid(HYPE)$28.34-3.88% Ethena USDe(USDE)$1.00-0.02%

Ethena USDe(USDE)$1.00-0.02% Canton(CC)$0.159164-4.82%

Canton(CC)$0.159164-4.82% USD1(USD1)$1.00-0.03%

USD1(USD1)$1.00-0.03% Rain(RAIN)$0.009631-3.02%

Rain(RAIN)$0.009631-3.02% World Liberty Financial(WLFI)$0.116383-6.25%

World Liberty Financial(WLFI)$0.116383-6.25% MemeCore(M)$1.37-8.65%

MemeCore(M)$1.37-8.65% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.01%

Falcon USD(USDF)$1.000.01% Aster(ASTER)$0.69-2.80%

Aster(ASTER)$0.69-2.80% Bittensor(TAO)$175.65-7.99%

Bittensor(TAO)$175.65-7.99% Pi Network(PI)$0.182757-3.04%

Pi Network(PI)$0.182757-3.04% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01%