Aster token surged over 30% after CZ revealed a $2.5 million personal investment.

Trading volume skyrocketed from $224M to $2B within 24 hours.

Some whales are shorting Aster, anticipating a correction.

CZ’s connection to the project dates back to investments via YZi Labs in 2024.

Aster’s future performance will depend on market sentiment and broader crypto trends.

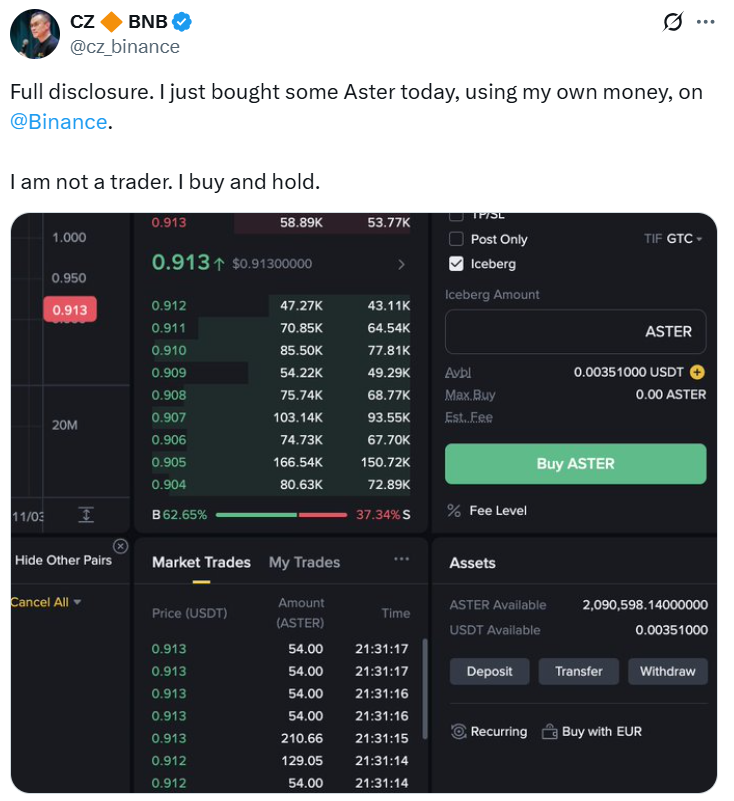

CZ revealed a screenshot of his wallet, showing that he had purchased over 2 million Aster tokens using his own funds on Binance.

Source: X (@cz_binance)

Following his announcement, Aster surged from $0.91 to $1.26. At the time of writing, the token had stabilized around $1.22, maintaining most of its impressive daily gains.

The move mirrors a similar trend seen last week when Zcash (ZEC) spiked 30% after crypto entrepreneur Arthur Hayes predicted it could reach $10,000.

Despite the excitement, not everyone in the market believes the rally will last. Data from Lookonchain revealed that at least two major whales opened short positions against Aster, betting on a future price decline.

One trader built a short position of 42.97 million Aster tokens, valued at $52.8 million, with a liquidation price of $2.00. Another whale increased their short to 15.3 million tokens, worth $19.1 million, with a liquidation price near $2.11.

These bearish moves indicate that while retail traders are optimistic, some large players are hedging against a potential pullback after the rapid surge.

CZ’s relationship with Aster is not entirely new. Back in September, he congratulated the project’s team on X, encouraging developers to “keep building.” However, questions have circulated about how directly CZ is tied to the project.

What’s known is that CZ’s family office, YZi Labs (formerly Binance Labs), invested in Aster’s predecessor, Astherus, in 2024. Aster itself emerged later that year following a merger between Astherus and APX Finance, a decentralized perpetuals protocol.

A BNB Chain representative confirmed that Aster had received support from both BNB Chain and YZi Labs, though CZ’s direct involvement wasn’t specified.

CZ’s endorsement triggered an immediate wave of trading activity. According to DefiLlama, Aster’s 24-hour trading volume soared from $224 million to over $2 billion, while its market capitalization climbed from $1.8 billion to $2.5 billion.

Many traders rushed to follow the Binance founder’s lead. One prominent trader, known by the handle “Gold,” shared on X that they opened a position in Aster immediately after CZ’s post.

Source: X (@Gold_Cryptoz)

CZ later joked about the rally, saying he had hoped to “buy more at lower prices” and clarified that he rarely purchases tokens — apart from BNB eight years ago and Aster now.

With trading activity surging and investor sentiment at an all-time high, Aster’s short-term outlook remains volatile. The token’s sharp rally could attract profit-taking, especially as whales begin to short the market.

Still, CZ’s public endorsement has put Aster firmly in the spotlight, and many in the crypto community see his involvement as a sign of confidence in the project’s long-term potential.

Aster is the native token of a decentralized exchange protocol designed to provide efficient and transparent trading on blockchain networks. It was formed in 2024 following the merger of Astherus and APX Finance.

Aster spiked after Binance co-founder CZ revealed he purchased over $2.5 million worth of Aster tokens with his own funds, signaling strong personal confidence in the project.

While CZ’s family office, YZi Labs, invested in Aster’s predecessor, Aster is not officially part of Binance. It has, however, received support from BNB Chain and YZi Labs.

Yes, some large traders have opened short positions worth tens of millions of dollars, expecting Aster’s price to correct after its rapid surge.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.12%

Figure Heloc(FIGR_HELOC)$1.030.12% Wrapped stETH(WSTETH)$3,699.313.15%

Wrapped stETH(WSTETH)$3,699.313.15% Wrapped eETH(WEETH)$3,281.173.18%

Wrapped eETH(WEETH)$3,281.173.18% USDS(USDS)$1.000.01%

USDS(USDS)$1.000.01% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03% Hyperliquid(HYPE)$30.6121.92%

Hyperliquid(HYPE)$30.6121.92% Coinbase Wrapped BTC(CBBTC)$89,261.001.30%

Coinbase Wrapped BTC(CBBTC)$89,261.001.30% WETH(WETH)$3,018.073.12%

WETH(WETH)$3,018.073.12% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.154787-0.55%

Canton(CC)$0.154787-0.55% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% World Liberty Financial(WLFI)$0.1650063.48%

World Liberty Financial(WLFI)$0.1650063.48% USDT0(USDT0)$1.00-0.06%

USDT0(USDT0)$1.00-0.06% sUSDS(SUSDS)$1.08-0.23%

sUSDS(SUSDS)$1.08-0.23% Ethena Staked USDe(SUSDE)$1.22-0.03%

Ethena Staked USDe(SUSDE)$1.22-0.03% Rain(RAIN)$0.010068-0.49%

Rain(RAIN)$0.010068-0.49% MemeCore(M)$1.55-3.91%

MemeCore(M)$1.55-3.91%