Binance airdrop worth $45 million in BNB will help over 160,000 traders recover from the October 2025 market crash.

The event follows a historic sell-off triggered by geopolitical fears and thin liquidity across exchanges.

Binance faced criticism for system glitches and oracle data issues but responded with a comprehensive user compensation package.

$283 million in additional reimbursements were made for liquidated positions due to asset depegs.

Despite controversy, BNB reached an all-time high, and Binance reaffirmed its commitment to user trust.

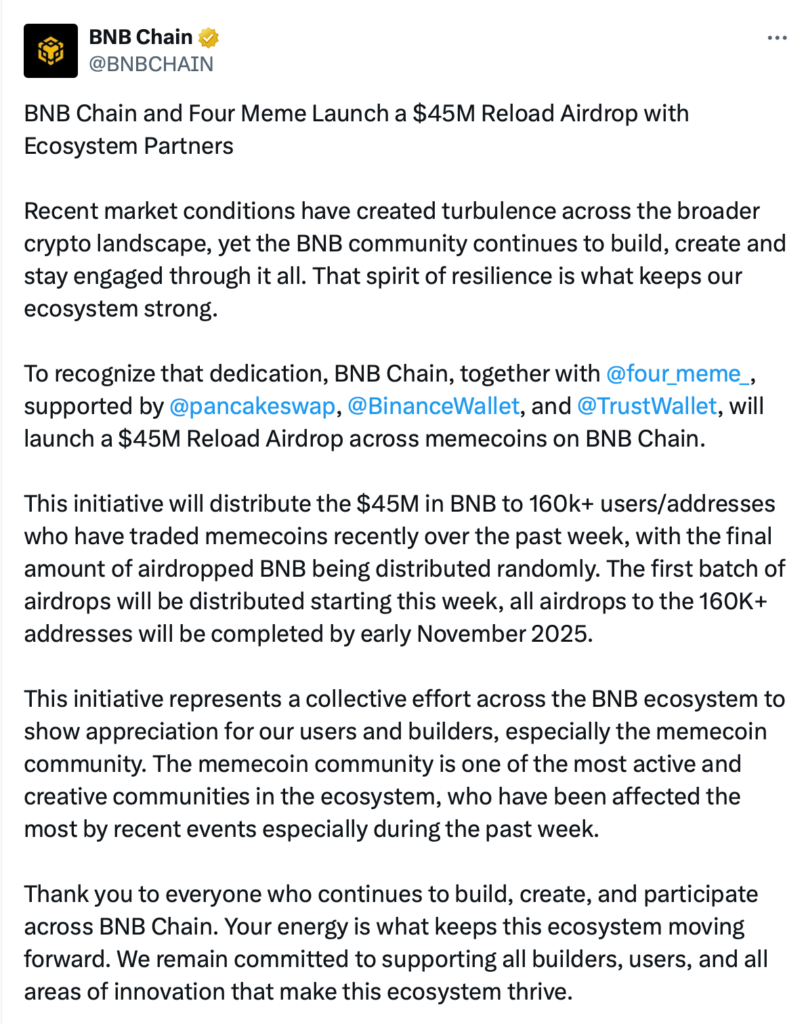

The Binance airdrop will distribute BNB tokens to more than 160,000 wallet addresses that suffered losses during a sharp market downturn that wiped out over $20 billion in crypto assets.

BNB Chain, originally developed by Binance and now managed by a decentralized community, powers the BNB token, which serves as the backbone of DeFi, NFT, and blockchain gaming applications within the ecosystem.

The program kicked off this week and will run through early November 2025.

Source: X (@BNBChain)

The airdrop targets retail traders who were active in memecoin markets during the crash. Binance ecosystem partners including:

Four Meme

PancakeSwap

Trust Wallet

Binance Wallet

…will assist in the token distribution process to ensure fair and random allocations.

At the time of the announcement, BNB had surged to an all-time high of $1,370, helping to boost the total value of the compensation package.

The airdrop is seen as a way to both cushion users and restore confidence following Binance’s controversial role during the sell-off.

The crash began last Friday after a Truth Social post by U.S. President Donald Trump, threatening 100% tariffs on Chinese imports.

This triggered a domino effect across global crypto markets, causing mass liquidations, system overloads, and technical glitches on various exchanges, including Binance.

During the chaos, Binance users reported several issues:

System Glitches: Users were unable to close futures positions.

Depegging of USDe: Ethena’s synthetic dollar dropped to $0.65 on Binance while remaining stable on other platforms.

Token Price Collapses: Coins like IoTeX, Enjin, and Cosmos briefly appeared to drop to $0.

Many of these issues were isolated to Binance, raising concerns about its infrastructure and data feeds.

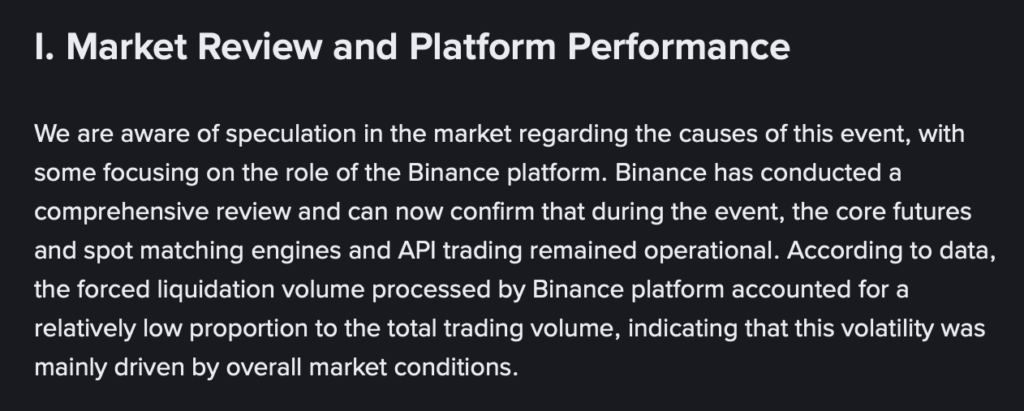

Binance issued a formal statement outlining its findings after conducting a comprehensive internal review.

Source: Binance

Key points included:

Futures Platform Stability: Core futures systems remained operational.

Zero Price Glitch: Caused by a change in decimal display settings, not actual token value drops.

Thin Liquidity Triggering Limit Orders: Many old orders were executed due to unusual market conditions.

Binance acknowledged that it used its own internal order book data as a price oracle, rather than external feeds, contributing to the USDe depeg.

This had several long-reaching ripple effects, especially for users using USDe, BNSOL, or WBETH as collateral.

Binance confirmed it had reimbursed affected users, covering a total of $283 million in losses.

This effort, combined with the $45 million Binance airdrop, marks one of the most significant user recovery initiatives in crypto history.

The Binance airdrop is a $45 million compensation program distributing BNB tokens to users affected by the recent crypto market crash, particularly those trading memecoins.

Eligibility is based on activity during the crash, with more than 160,000 addresses selected. Binance ecosystem partners are involved in the distribution process.

Distribution began in mid-October 2025 and will be completed by early November 2025.

The depeg occurred because Binance used internal order book data as its pricing oracle, while other platforms used external sources.

Binance acknowledged technical issues but stated that its core systems remained functional. It compensated users for losses related to the volatility and price depegging.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.21%

Figure Heloc(FIGR_HELOC)$1.031.21% Wrapped stETH(WSTETH)$3,450.85-0.07%

Wrapped stETH(WSTETH)$3,450.85-0.07% USDS(USDS)$1.000.02%

USDS(USDS)$1.000.02% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.12%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.000.12% Hyperliquid(HYPE)$31.875.03%

Hyperliquid(HYPE)$31.875.03% WETH(WETH)$2,827.890.12%

WETH(WETH)$2,827.890.12% Wrapped eETH(WEETH)$3,059.880.07%

Wrapped eETH(WEETH)$3,059.880.07% Ethena USDe(USDE)$1.000.05%

Ethena USDe(USDE)$1.000.05% Coinbase Wrapped BTC(CBBTC)$87,184.001.40%

Coinbase Wrapped BTC(CBBTC)$87,184.001.40% World Liberty Financial(WLFI)$0.1574847.37%

World Liberty Financial(WLFI)$0.1574847.37% sUSDS(SUSDS)$1.08-0.04%

sUSDS(SUSDS)$1.08-0.04% Ethena Staked USDe(SUSDE)$1.210.06%

Ethena Staked USDe(SUSDE)$1.210.06% USDT0(USDT0)$1.000.03%

USDT0(USDT0)$1.000.03% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% Canton(CC)$0.074605-9.84%

Canton(CC)$0.074605-9.84% Bittensor(TAO)$262.85-0.96%

Bittensor(TAO)$262.85-0.96%