The company announced its intention to gradually exit Bitcoin mining operations and either sell or wind down its infrastructure. In a statement, Bit Digital described its new direction as a “pure play Ethereum staking and treasury company.”

This strategic overhaul is not sudden; it follows moves the company began as early as 2022, including building Ethereum staking infrastructure and accumulating ETH.

As of March 31, 2025, Bit Digital reported holdings of:

If all BTC were to be sold and converted at current exchange rates, the company’s Ethereum treasury would surpass 42,000 ETH, making it a heavyweight in the ETH-staking world.

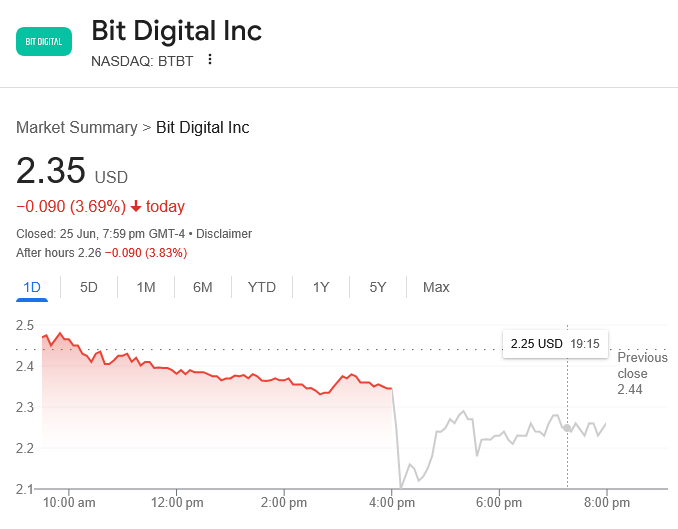

Following the announcement, Bit Digital’s stock fell:

Bit Digital Fell Further During After Hours Trading

Source: Google Finance

This drop reflects investor concerns over the firm leaving the Bitcoin miner space, a historically lucrative market. Year-to-date, BTBT is down nearly 25%, and it has fallen 39% from its January high of $3.88.

In its most recent earnings report, Bit Digital showed:

Despite the earnings slump, Bit Digital is investing in diversification, including the $53 million acquisition of a high-performance computing facility in North Carolina, likely intended to support both AI workloads and Ethereum staking operations.

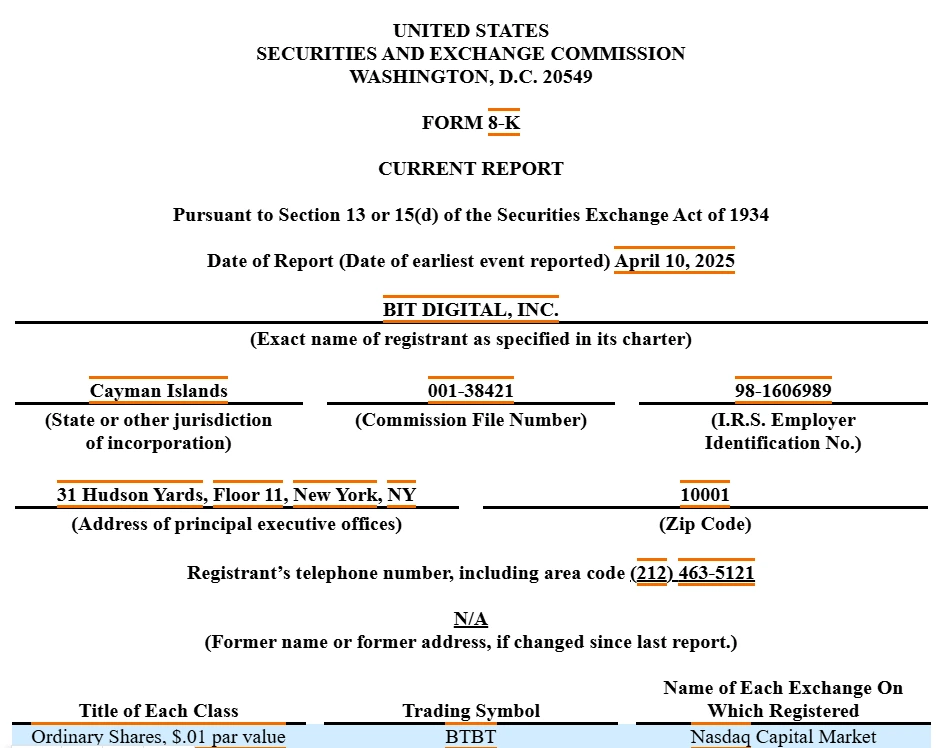

Bit Digital Announced The Acquisition Via A Form 8-K Filed With The SEC

Source: U.S. SEC

Bit Digital isn’t alone in the shift toward Ethereum. Several publicly traded companies are increasing their ETH exposure:

According to Strategic ETH Reserve, a tracker for institutional ETH holdings:

The shift away from being a traditional Bitcoin miner to a staking-focused model aligns with Ethereum’s transformation to a proof-of-stake (PoS) protocol. This newer consensus mechanism is viewed as:

While Bit Digital’s departure from Bitcoin mining is significant, it doesn’t necessarily signal the end of the Bitcoin miner era. Many companies still find value in BTC mining, especially those with access to cheap electricity or vertically integrated operations.

However, Ethereum’s staking appeal continues to rise, especially for companies that prioritize treasury growth, ESG goals, and reduced operational risk.

Bit Digital is transitioning to focus on Ethereum staking, which offers more predictable returns and aligns with current crypto infrastructure trends.

As of Q1 2025, the company holds 24,434.2 ETH. If all BTC reserves were converted, that figure could rise to over 42,000 ETH.

They plan to reinvest the proceeds, along with new funds from stock sales, into Ethereum purchases for staking purposes.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.020.00%

Figure Heloc(FIGR_HELOC)$1.020.00% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Hyperliquid(HYPE)$30.69-3.74%

Hyperliquid(HYPE)$30.69-3.74% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% Canton(CC)$0.161797-2.40%

Canton(CC)$0.161797-2.40% USD1(USD1)$1.000.05%

USD1(USD1)$1.000.05% Rain(RAIN)$0.0098790.70%

Rain(RAIN)$0.0098790.70% World Liberty Financial(WLFI)$0.101028-5.87%

World Liberty Financial(WLFI)$0.101028-5.87% MemeCore(M)$1.30-2.91%

MemeCore(M)$1.30-2.91% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.73-0.77%

Aster(ASTER)$0.73-0.77% Bittensor(TAO)$184.44-3.44%

Bittensor(TAO)$184.44-3.44% Falcon USD(USDF)$1.000.03%

Falcon USD(USDF)$1.000.03% Pi Network(PI)$0.1765581.63%

Pi Network(PI)$0.1765581.63% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00%