This week, the Bitcoin mining difficulty soared to a record 127.6 trillion, marking the highest point ever recorded.

Bitcoin Mining Difficulty Reached A New ATH & Has Been Gradually Rising Over Time

Source: CryptoQuant

However, according to projections, the difficulty is expected to drop by approximately 3% to 123.7 trillion during the next difficulty adjustment scheduled for August 9th.

The current average block time stands at roughly 10 minutes and 20 seconds, slightly above the Bitcoin protocol’s target of 10 minutes, as reported by CoinWarz.

Data from CryptoQuant shows that Bitcoin mining difficulty experienced a decline in June, with a steep drop toward the end of the month and during the first two weeks of July.

During this period, difficulty levels bottomed out around 116.9 trillion. However, since mid-July, the difficulty trend reversed and began climbing again, resuming its long-term upward trajectory.

The stock-to-flow (S2F) ratio compares the total existing supply of an asset (stock) to the amount of new supply produced over a period (flow). It’s a key indicator of scarcity.

Historically, this model explains why gold has maintained higher value compared to silver. Silver’s lower stock-to-flow ratio makes it more susceptible to price drops when production increases.

Bitcoin currently boasts a stock-to-flow ratio much higher than gold, with about 94% of the total 21 million BTC supply already mined and circulating. Gold, on the other hand, lacks a fixed supply cap and inflates roughly 2% annually.

PlanB, the creator of the Bitcoin stock-to-flow price model, has highlighted Bitcoin’s scarcity as roughly twice that of gold. He states:

“Gold scarcity, the stock-to-flow ratio, is about 60. Bitcoin’s scarcity is about 120. So, Bitcoin is 2x scarcer than gold.”

This extraordinary scarcity helps shield Bitcoin’s price from the destabilizing effects of new supply flooding the market.

The Bitcoin protocol adjusts mining difficulty to keep production steady and prevent price collapse due to oversupply. When more Bitcoin miners contribute computing power, difficulty rises to maintain the 10-minute block time and avoid sudden surges in new BTC entering the market.

If difficulty didn’t adjust, miners could produce blocks too quickly, leading to rapid BTC inflation and price drops as new coins flood the market.

Conversely, if the total hashrate decreases, perhaps due to miners shutting down unprofitable rigs, the difficulty drops, ensuring blocks are still mined close to the target time. This adaptability maintains balance between supply, network security, and miner incentives.

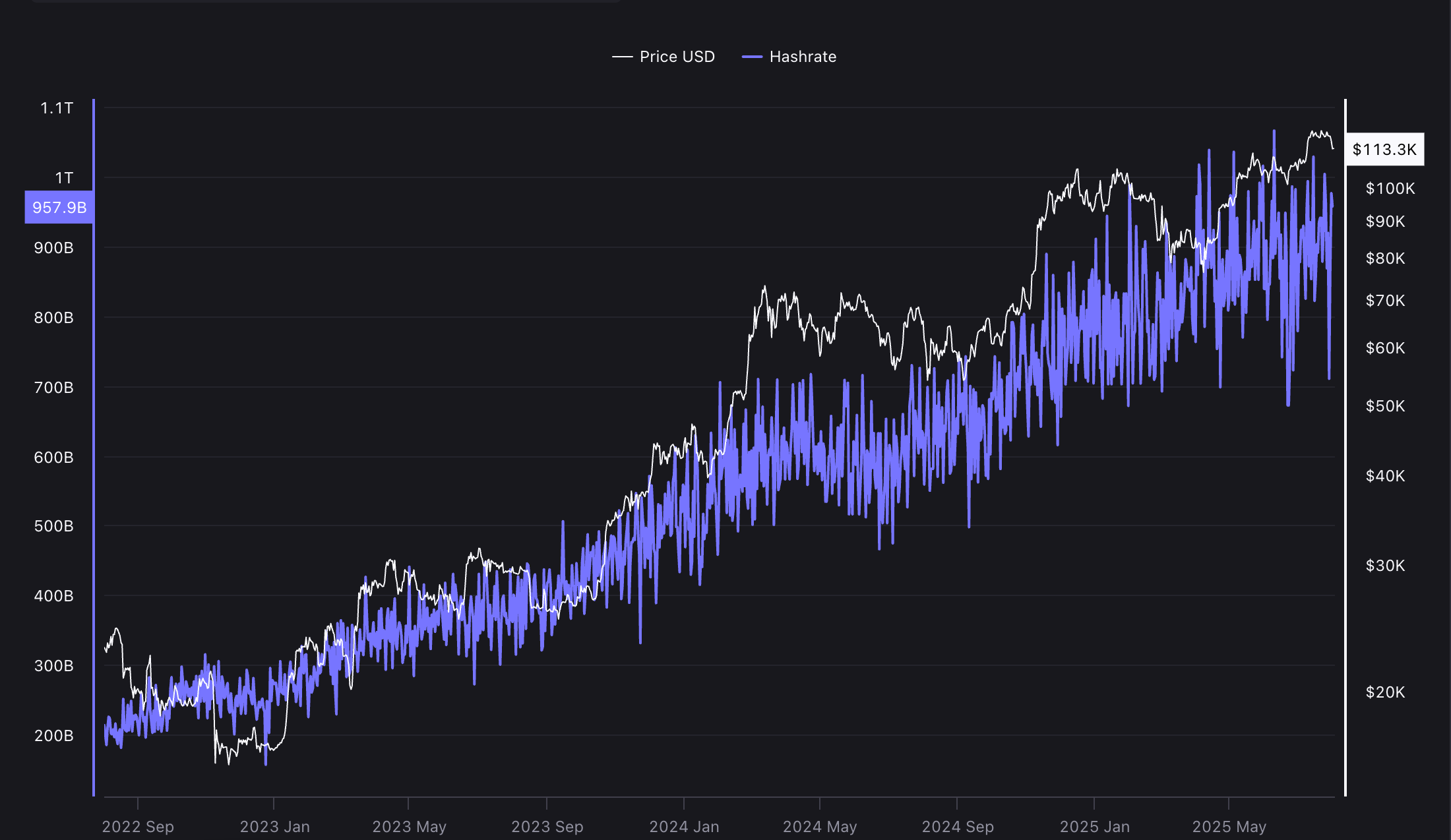

The network’s hashrate represents the total computational power securing Bitcoin.

The Bitcoin network’s Hashrate Represents The Overall Amount Of Computing Power Deployed To Secure The Network

Source: CryptoQuant

When this hashrate grows, more miners are participating or upgrading hardware, indicating a healthy, competitive mining environment.

However, the hashrate and difficulty share a direct relationship:

Both metrics serve as critical barometers of the network’s health, miner profitability, and security resilience.

Bitcoin mining difficulty is a measure of how hard it is for miners to find a valid hash for a new block. It adjusts every two weeks to keep block times close to 10 minutes, regardless of changes in network hashrate.

Difficulty changes based on the total computational power (hashrate) used by Bitcoin miners. When more miners join or existing miners upgrade equipment, difficulty increases. When miners leave, difficulty decreases.

Higher difficulty means miners must use more computational power to solve blocks, potentially lowering profitability unless Bitcoin’s price rises or mining technology improves.

The next difficulty adjustment is projected for August 9, when difficulty is expected to drop by around 3%.

Difficulty helps regulate Bitcoin’s supply by maintaining steady block times and preventing rapid overproduction, which could negatively impact price stability.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.041.54%

Figure Heloc(FIGR_HELOC)$1.041.54% USDS(USDS)$1.000.10%

USDS(USDS)$1.000.10% Hyperliquid(HYPE)$29.830.76%

Hyperliquid(HYPE)$29.830.76% Ethena USDe(USDE)$1.00-0.02%

Ethena USDe(USDE)$1.00-0.02% Canton(CC)$0.163046-2.23%

Canton(CC)$0.163046-2.23% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.009825-3.43%

Rain(RAIN)$0.009825-3.43% World Liberty Financial(WLFI)$0.1062494.07%

World Liberty Financial(WLFI)$0.1062494.07% MemeCore(M)$1.43-2.48%

MemeCore(M)$1.43-2.48% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.03%

Falcon USD(USDF)$1.000.03% Aster(ASTER)$0.710.51%

Aster(ASTER)$0.710.51% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.01%

Global Dollar(USDG)$1.00-0.01% HTX DAO(HTX)$0.0000020.98%

HTX DAO(HTX)$0.0000020.98%