Riot and CleanSpark significantly increased BTC output in August 2025, despite tougher mining conditions.

Riot mined 477 BTC, while CleanSpark mined 657 BTC, reflecting strong year-over-year growth.

Both companies more than doubled their hash rates, reaching 31.4 EH/s and 43.3 EH/s respectively.

Bitcoin mining difficulty rose 44.9% in the past year, pushing miners to optimize operations.

Diversification into AI and high-performance computing is becoming a key strategy for future-focused Bitcoin miners.

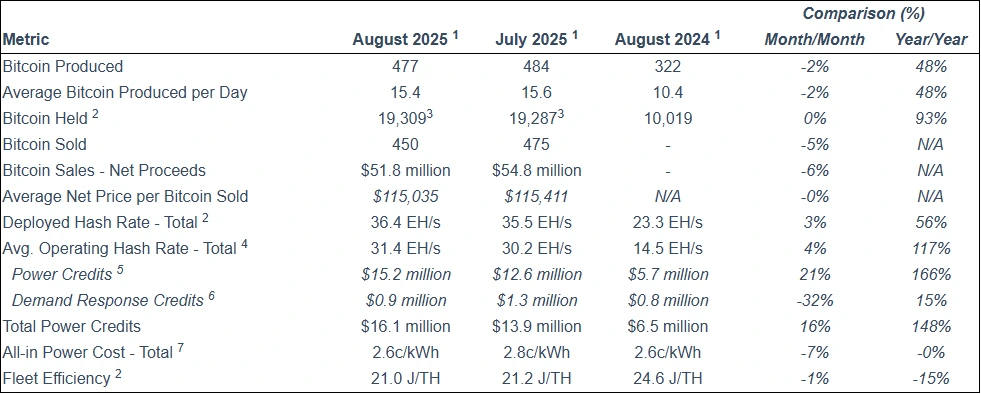

Riot Platforms produced 477 BTC in August 2025, up from 322 BTC the same month last year, marking a 48% year-over-year increase in output.

Riot Platforms’ Bitcoin Mining Yield

Source: Riot Platforms

This output boost reflects Riot’s continued investment in mining capacity and data center expansion, allowing it to scale despite tougher market conditions.

Riot’s average operational hash rate jumped to 31.4 EH/s in August, up from 14.5 EH/s in August 2024

This 116.6% increase indicates substantial hardware and infrastructure upgrades over the past year.

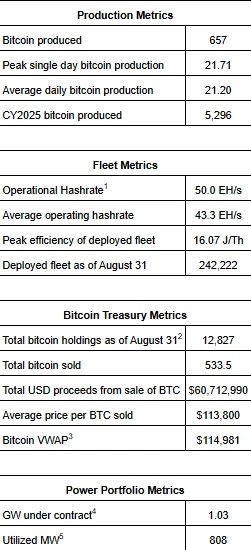

CleanSpark mined 657 BTC in August, a 37.5% increase from the 478 BTC mined in August 2024.

Riot Platforms’ Bitcoin Mining Yield

Source: CleanSpark

CleanSpark continues to follow through on its April 2025 strategy of selling BTC to fund operations, aiming to become financially self-sufficient.

CleanSpark’s operational hash rate rose to 43.3 EH/s, compared to 21.3 EH/s a year prior. That’s a 103.3% increase, making it one of the fastest-growing miners in terms of hash power.

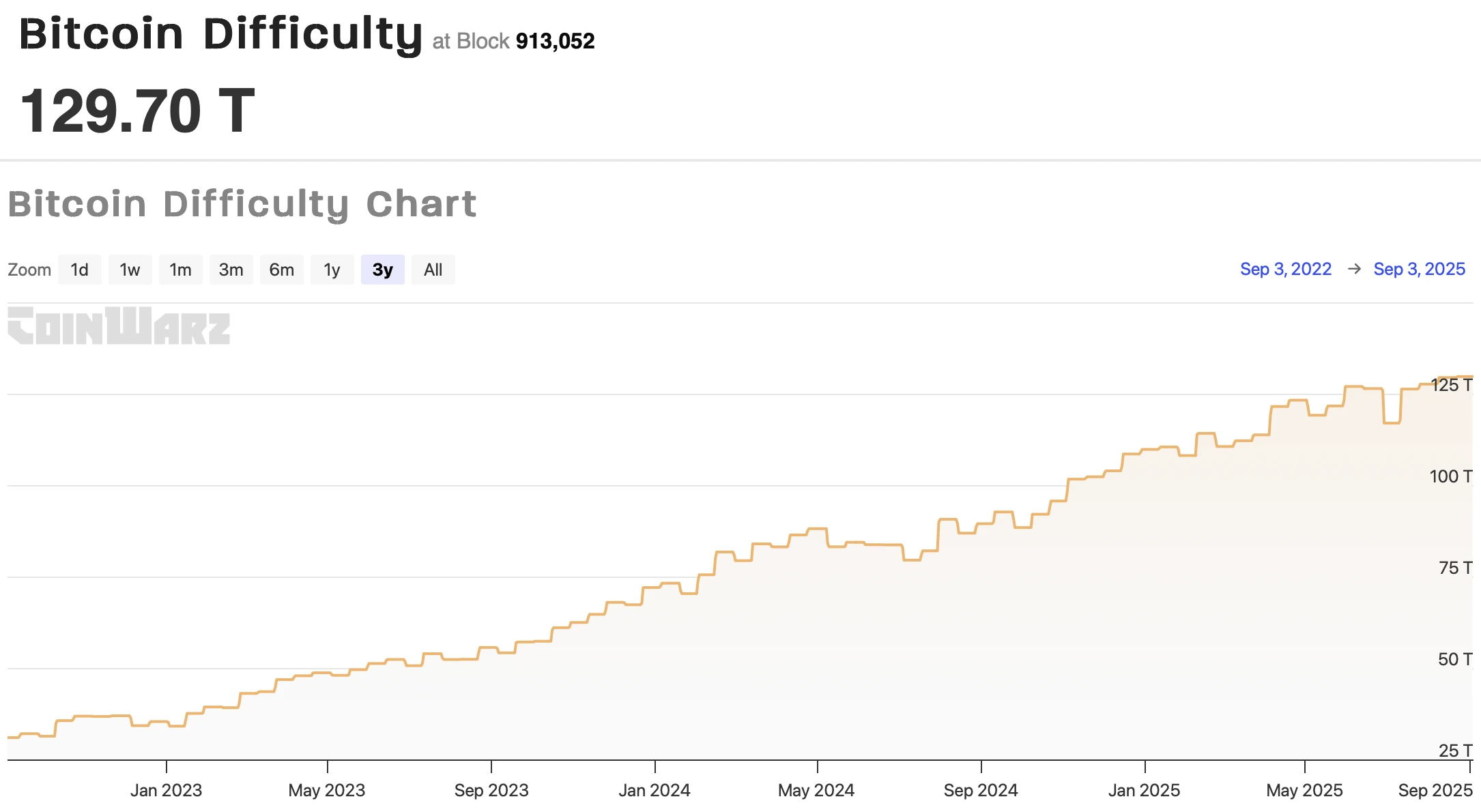

Despite this output growth, Bitcoin mining has become considerably more difficult in 2025.

According to CoinWarz:

Mining difficulty as of August 2025: 129.7 trillion

August 2024 difficulty: 89.5 trillion

YoY increase: 44.9%

3-year Bitcoin Mining Difficulty Chart

Source: CoinWarz

Bitcoin mining difficulty refers to how challenging it is for a Bitcoin miner to solve cryptographic puzzles to validate transactions and add blocks to the blockchain.

The higher the difficulty, the more computational power is required, often pushing miners to:

Upgrade mining rigs

Expand or modernize data centers

Reassess operational strategies

With rising costs and difficulty, some mining companies are diversifying beyond BTC production:

Hut 8 is developing four data centers in the U.S. for AI and high-performance computing workloads.

Hive Digital Technologies and Iren (Australia) are investing in similar non-mining initiatives.

In February 2025, Riot appointed an adviser to help pivot mining assets toward AI applications, a strategic hedge against Bitcoin market volatility.

A hash rate measures the computational power a Bitcoin miner uses to solve blockchain puzzles. A higher hash rate generally means a better chance of earning BTC.

Mining difficulty adjusts based on the number of active miners and available hash power. As more miners join the network or upgrade hardware, the protocol increases the difficulty to maintain consistent block times.

Yes—leading miners like Riot and CleanSpark continue to generate significant revenue. However, profitability depends heavily on electricity costs, mining difficulty, and BTC market prices.

With volatility in BTC prices and rising difficulty, miners are exploring alternative revenue streams, including AI computing, to diversify and stabilize their businesses.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.020.00%

Figure Heloc(FIGR_HELOC)$1.020.00% USDS(USDS)$1.000.00%

USDS(USDS)$1.000.00% Hyperliquid(HYPE)$30.63-3.96%

Hyperliquid(HYPE)$30.63-3.96% Ethena USDe(USDE)$1.000.03%

Ethena USDe(USDE)$1.000.03% Canton(CC)$0.161957-2.90%

Canton(CC)$0.161957-2.90% USD1(USD1)$1.000.03%

USD1(USD1)$1.000.03% Rain(RAIN)$0.0098750.64%

Rain(RAIN)$0.0098750.64% World Liberty Financial(WLFI)$0.101049-5.66%

World Liberty Financial(WLFI)$0.101049-5.66% MemeCore(M)$1.30-3.02%

MemeCore(M)$1.30-3.02% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Aster(ASTER)$0.73-1.08%

Aster(ASTER)$0.73-1.08% Bittensor(TAO)$184.34-3.40%

Bittensor(TAO)$184.34-3.40% Falcon USD(USDF)$1.00-0.01%

Falcon USD(USDF)$1.00-0.01% Pi Network(PI)$0.1778581.18%

Pi Network(PI)$0.1778581.18% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00%