TeraWulf, a Bitcoin miner, signed a $3.7B AI hosting deal with Fluidstack, backed by Google.

The agreement spans 10 years and could double in value with two five-year extensions.

Google receives 41 million WULF shares as part of its financing support.

TeraWulf’s Q2 financials show recovery, with increased revenue and a return to profitability.

WULF shares surged 48% intraday following the announcement.

Google’s role in the agreement is substantial. Through a support structure for Fluidstack’s $1.8 billion lease obligations and the provision of debt financing, Google is deepening its footprint in AI infrastructure.

Source: X (@mikealfred)

In exchange, Google has secured warrants for around 41 million shares of TeraWulf (WULF), equating to an 8% ownership stake.

“Given the expected improvement in our credit profile, we’ve refined our financing strategy,” said Patrick Fleury, Chief Financial Officer of TeraWulf. “The Google-backed support and lease agreements give us a solid foundation for future capital initiatives.”

This partnership is poised to enhance TeraWulf’s financial position and reshape its long-term growth prospects.

Founded in 2021, TeraWulf began as a Bitcoin miner with a strong commitment to environmentally sustainable practices. It gained attention in the crypto space for its zero-carbon mining operations and ambitions to scale clean energy-powered data centers.

However, the company, like many others in the industry, has faced increasing challenges, particularly after the most recent Bitcoin halving, which cut mining rewards in half and amplified the effects of market volatility and rising infrastructure costs.

Despite reporting a $61.4 million net loss in Q1 2025, TeraWulf returned to profitability in Q2, thanks in part to its diversified strategy. Revenue rose compared to the first quarter, and the new partnership with Fluidstack is expected to strengthen its cash flow considerably.

As of the end of Q2, TeraWulf held $90 million in cash, cash equivalents, and Bitcoin. The company also self-mined 485 BTC during the quarter, a decline from 699 BTC mined in the same period last year, a sign of its evolving operational focus.

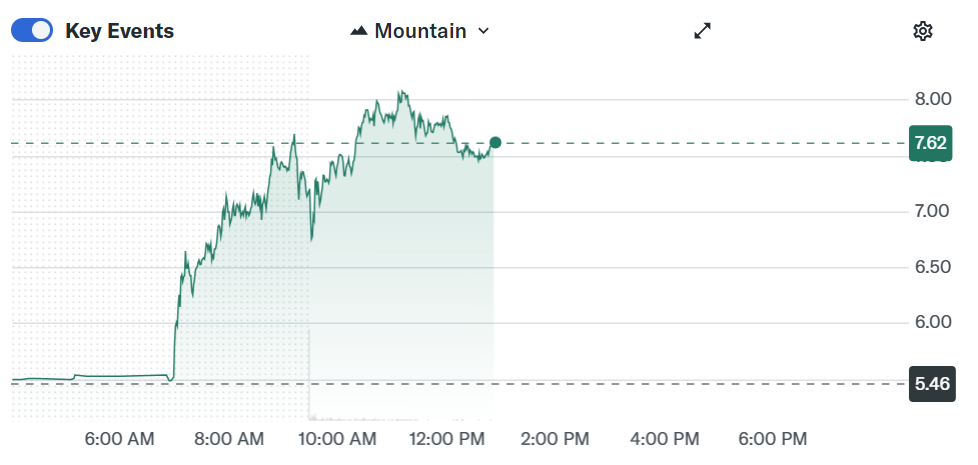

Following the AI deal announcement, WULF shares soared as much as 48% intraday to a high of $8.11.

The trading volume also spiked to more than four times the daily average, according to Yahoo Finance. By the end of the day, shares settled at around $7.50, up 37%, giving TeraWulf a market capitalization close to $3 billion.

WULF’s Price Analysis

Source: Yahoo Finance

This rally not only erased year-to-date losses but also reinforced investor confidence in TeraWulf’s strategic transition.

The 2025 Bitcoin halving event has driven miners to explore alternative revenue streams.

As block rewards decrease and operational costs rise, many Bitcoin miners are leveraging their existing infrastructure to support high-performance computing and AI workloads.

This pivot allows companies like TeraWulf to maintain financial stability while participating in one of the fastest-growing sectors in tech: artificial intelligence.

Yes, while TeraWulf is expanding into AI infrastructure hosting, it continues to mine Bitcoin. In Q2, it self-mined 485 BTC.

Google is supporting TeraWulf’s deal through debt financing and backing Fluidstack’s lease obligations, indicating its confidence in AI infrastructure’s future, and TeraWulf’s role in it.

The 10-year, $3.7 billion agreement is expected to significantly increase the company’s revenue run rate and improve financial stability.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.04-0.40%

Figure Heloc(FIGR_HELOC)$1.04-0.40% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Hyperliquid(HYPE)$31.020.91%

Hyperliquid(HYPE)$31.020.91% Ethena USDe(USDE)$1.00-0.01%

Ethena USDe(USDE)$1.00-0.01% Canton(CC)$0.162403-2.10%

Canton(CC)$0.162403-2.10% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% Rain(RAIN)$0.0098100.51%

Rain(RAIN)$0.0098100.51% World Liberty Financial(WLFI)$0.103663-0.12%

World Liberty Financial(WLFI)$0.103663-0.12% MemeCore(M)$1.452.61%

MemeCore(M)$1.452.61% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.00-0.01%

Falcon USD(USDF)$1.00-0.01% Aster(ASTER)$0.711.71%

Aster(ASTER)$0.711.71% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.02%

Global Dollar(USDG)$1.00-0.02% HTX DAO(HTX)$0.0000021.66%

HTX DAO(HTX)$0.0000021.66%