TeraWulf’s Q3 revenue jumped 87% year-over-year, driven by higher Bitcoin prices and expanded operations.

The Bitcoin miner is pivoting toward AI and HPC services to build sustainable long-term income.

Deals with Google and Fluidstack highlight TeraWulf’s move into next-generation computing.

With a mix of blockchain and AI infrastructure, the company is well-positioned for future industry shifts.

During the third quarter of 2025, TeraWulf generated $50.6 million in total revenue, marking an impressive increase compared to the same period last year. Of this total, $43.4 million came from digital asset operations, primarily Bitcoin mining.

The company credited the revenue jump to a combination of higher Bitcoin prices and the ramp-up of its data centers. Although the total number of Bitcoin mined declined from 555 to 377 year-over-year, the average market price of Bitcoin nearly doubled, rising from $61,023 in Q3 2024 to $114,390 in Q3 2025.

Earlier in the year, TeraWulf reported a net loss in Q1. However, Q2 results showed momentum, with a 34% year-over-year revenue increase to $47.6 million.

The third-quarter surge further reinforces the company’s turnaround, as the Bitcoin miner benefited from both favorable market conditions and an expanded business model.

As the crypto industry adapts to the April 2024 Bitcoin halving, which reduced mining rewards, many mining firms are diversifying into new revenue streams. TeraWulf is no exception.

TeraWulf’s CEO, Paul Prager, described the third and fourth quarters as “remarkably busy” as the company advances beyond its traditional Bitcoin mining operations.

Source: X (@TeraWulfInc)

He highlighted expanded partnerships with Fluidstack and Google at the company’s Lake Mariner facility, as well as a new Abernathy joint venture in the Southwest Power Pool region.

These collaborations support TeraWulf’s push into high-performance computing (HPC) and AI infrastructure leasing, areas expected to drive strong growth through 2027 and beyond.

To fund these initiatives, TeraWulf announced a $3.2 billion senior secured notes offering in October 2025. The funds will help finance additional data center capacity at its Lake Mariner campus in Barker, New York.

The company also entered into three 10-year lease agreements with Fluidstack, worth a combined $6.7 billion, cementing its position in the AI hosting sector.

Despite the company’s diversification, Bitcoin remains a major driver of TeraWulf’s financial results.

The surge in Bitcoin prices provided a crucial boost, offsetting lower mining output and higher operating costs.

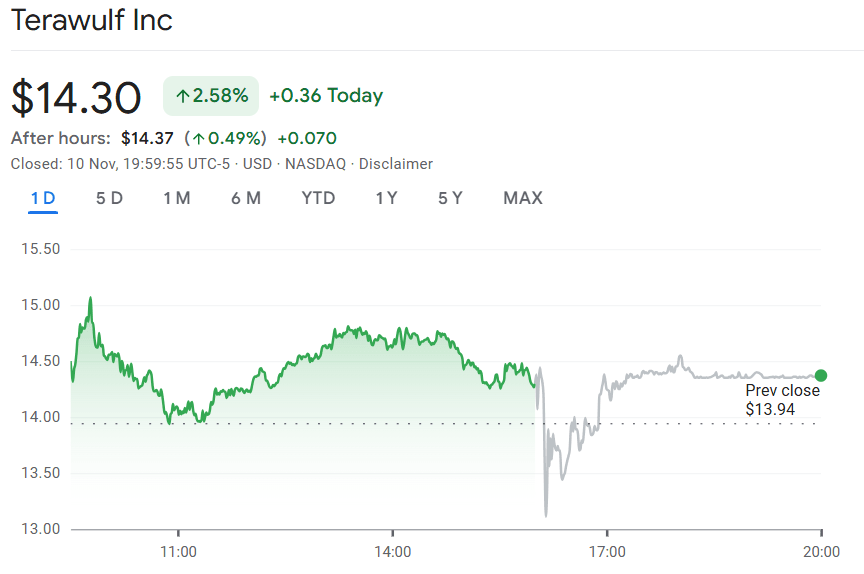

During Monday’s trading session following the earnings release, TeraWulf’s stock (WULF) initially climbed 6% to reach $14.85, up from the previous close of $13.94. By the end of the day, shares settled at $14.30, maintaining a 0.49% gain after hours.

Source: Google Finance

The modest increase reflects growing investor confidence in the company’s hybrid approach, maintaining a Bitcoin miner core business while branching into AI-driven computing solutions.

The shift toward AI infrastructure marks a larger industry trend. Since the halving event, several Bitcoin miners have redirected portions of their computing power toward AI data hosting, HPC services, and cloud infrastructure.

This strategic pivot helps mitigate volatility in Bitcoin prices while leveraging miners’ existing access to cheap, renewable energy sources and high-performance hardware.

TeraWulf’s expansion into this space signals its intent to remain competitive in a rapidly evolving landscape. By pairing blockchain operations with AI hosting, the Bitcoin miner is positioning itself at the intersection of two transformative technologies.

TeraWulf mined fewer Bitcoins in Q3 primarily due to network difficulty adjustments and reduced block rewards following the 2024 halving. However, higher Bitcoin prices offset the decline in production.

The company is expanding into AI and high-performance computing by leasing data center capacity to enterprise clients through partnerships with Google and Fluidstack.

Investor optimism stems from the company’s growing revenue, strong partnerships, and balanced approach between Bitcoin mining and AI infrastructure.

Yes. Despite diversification efforts, Bitcoin mining continues to represent a large share of revenue, though AI hosting is becoming an increasingly important growth engine.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.051.23%

Figure Heloc(FIGR_HELOC)$1.051.23% USDS(USDS)$1.00-0.13%

USDS(USDS)$1.00-0.13% Hyperliquid(HYPE)$31.147.17%

Hyperliquid(HYPE)$31.147.17% Canton(CC)$0.1690542.83%

Canton(CC)$0.1690542.83% Ethena USDe(USDE)$1.00-0.05%

Ethena USDe(USDE)$1.00-0.05% USD1(USD1)$1.00-0.07%

USD1(USD1)$1.00-0.07% Rain(RAIN)$0.010047-1.84%

Rain(RAIN)$0.010047-1.84% World Liberty Financial(WLFI)$0.1081455.60%

World Liberty Financial(WLFI)$0.1081455.60% MemeCore(M)$1.421.36%

MemeCore(M)$1.421.36% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.000.06%

Falcon USD(USDF)$1.000.06% Aster(ASTER)$0.717.83%

Aster(ASTER)$0.717.83% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.03%

Global Dollar(USDG)$1.00-0.03% Sky(SKY)$0.0672801.91%

Sky(SKY)$0.0672801.91%