The April 2024 Bitcoin halving cut block rewards to 3.125 BTC, pressuring miners to diversify income sources and reevaluate their business models.

Many mining firms pivoted toward AI and high-performance computing (HPC) to utilize existing infrastructure and counteract reduced crypto earnings.

Core Scientific transitioned into AI colocation services, boosting stock value despite lower mining revenue.

Hut 8 Launched Highrise AI with over 1,000 Nvidia H100 GPUs.

Some mining firms dipped their toes into AI, while others committed billions. For a few, the pivot has revitalized operations; for others, it’s a strategic hedge against further halving shocks.

Once on the brink of collapse, Core Scientific stands out as a rare Bitcoin miner that rebounded strongly after embracing AI.

Despite a Q1 2025 revenue drop to $79.5 million (from $179.3 million year-over-year), surging Bitcoin prices and AI leasing deals helped offset some losses.

In June 2025, acquisition talks with CoreWeave resumed, driving a spike in Core Scientific’s stock.

Core Scientific Was Among The Few Miners To Make A Profit Following The BTC Halving

Source: Nasdaq

Australian-based Iren started purchasing Nvidia GPUs in early 2024 and has since made meaningful progress.

Iren is developing AI data centers in Texas and British Columbia, though it faces legal scrutiny over alleged investor misrepresentation.

Hive pivoted to AI in 2023 and has steadily built out its infrastructure:

Hive’s AI expansion now contributes around 9% of total revenue, positioning it as a serious player in both mining and AI.

Riot began evaluating AI conversion for its massive Corsicana, Texas facility in 2025.

Riot also holds 19,225 BTC, the fourth-largest public treasury.

While some companies have gone all-in on AI, others view it as a supplementary revenue stream.

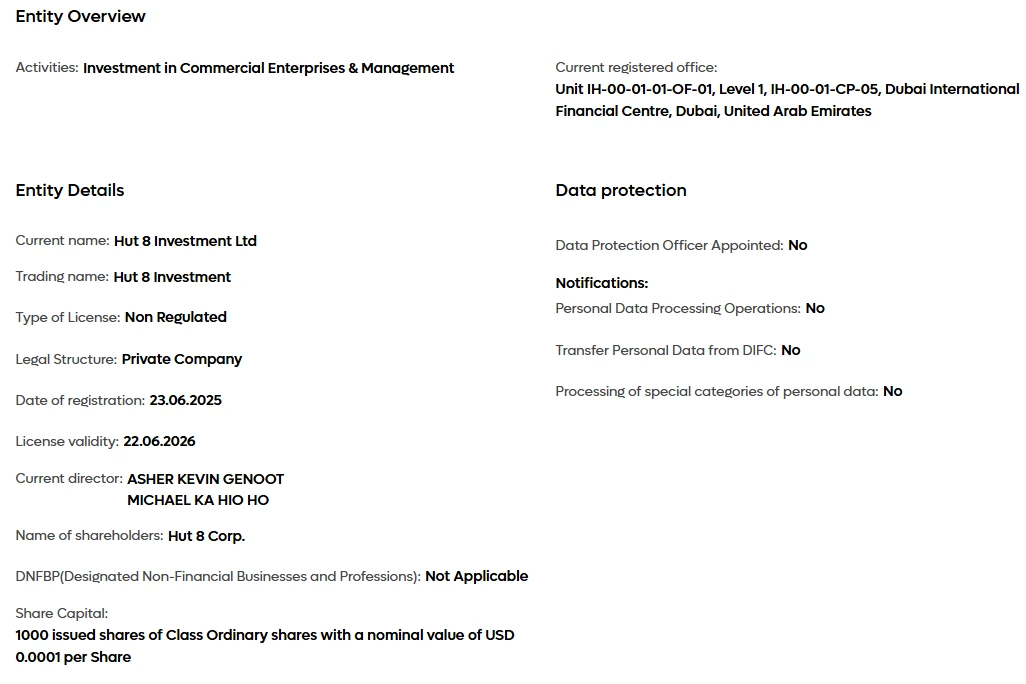

Hut 8 launched Highrise AI, its GPU-as-a-Service division, in September 2024.

Hut 8’s Filing

Source: difc.com

Though Q1 2025 saw a net loss of $134.3 million and mining output drop to 167 BTC (from 716 BTC the previous year), the company emphasized strategic investments and holds a significant Bitcoin treasury of 10,273 BTC.

Notably, its subsidiary, American Bitcoin, raised $220 million to expand mining infrastructure, reinforcing the firm’s commitment to Bitcoin despite AI exploration.

In contrast to the AI wave, Canaan, an ASIC hardware manufacturer, chose to shut down its AI chip division in July 2025.

After the 2024 halving, many Bitcoin miners faced reduced revenues. AI and HPC offer new revenue streams using similar infrastructure (e.g., data centers, GPUs).

Core Scientific has made the most significant turnaround, leveraging a $3.5 billion AI hosting deal to emerge from bankruptcy and regain market strength.

No. Most firms like Hut 8 and Hive are expanding into AI while continuing to mine Bitcoin and hold substantial BTC reserves.

Capital-intensive infrastructure, regulatory hurdles, and competition from hyperscalers make the transition complex. Some companies, like Iren, have faced legal issues tied to AI rollout claims.

Unlikely in the near term. AI is becoming a complementary business model rather than a replacement. For now, mining remains the primary revenue source for most.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.39%

Figure Heloc(FIGR_HELOC)$1.031.39% USDS(USDS)$1.000.02%

USDS(USDS)$1.000.02% Hyperliquid(HYPE)$29.58-4.22%

Hyperliquid(HYPE)$29.58-4.22% Ethena USDe(USDE)$1.000.02%

Ethena USDe(USDE)$1.000.02% Canton(CC)$0.1657113.56%

Canton(CC)$0.1657113.56% USD1(USD1)$1.000.07%

USD1(USD1)$1.000.07% Rain(RAIN)$0.0099392.61%

Rain(RAIN)$0.0099392.61% World Liberty Financial(WLFI)$0.1079827.22%

World Liberty Financial(WLFI)$0.1079827.22% MemeCore(M)$1.527.26%

MemeCore(M)$1.527.26% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$191.67-3.38%

Bittensor(TAO)$191.67-3.38% Falcon USD(USDF)$0.99-0.32%

Falcon USD(USDF)$0.99-0.32% Aster(ASTER)$0.71-3.18%

Aster(ASTER)$0.71-3.18% Pi Network(PI)$0.1841217.29%

Pi Network(PI)$0.1841217.29% Global Dollar(USDG)$1.00-0.02%

Global Dollar(USDG)$1.00-0.02%