Bitcoin’s price has been range-bound, frustrating many investors who expected a continued bull run following the January 2024 launch of spot Bitcoin ETFs. According to Charles Edwards, founder of Capriole Investments, the culprit behind this stagnation isn’t weak demand, but strategic sell-offs by long-term Bitcoin holders.

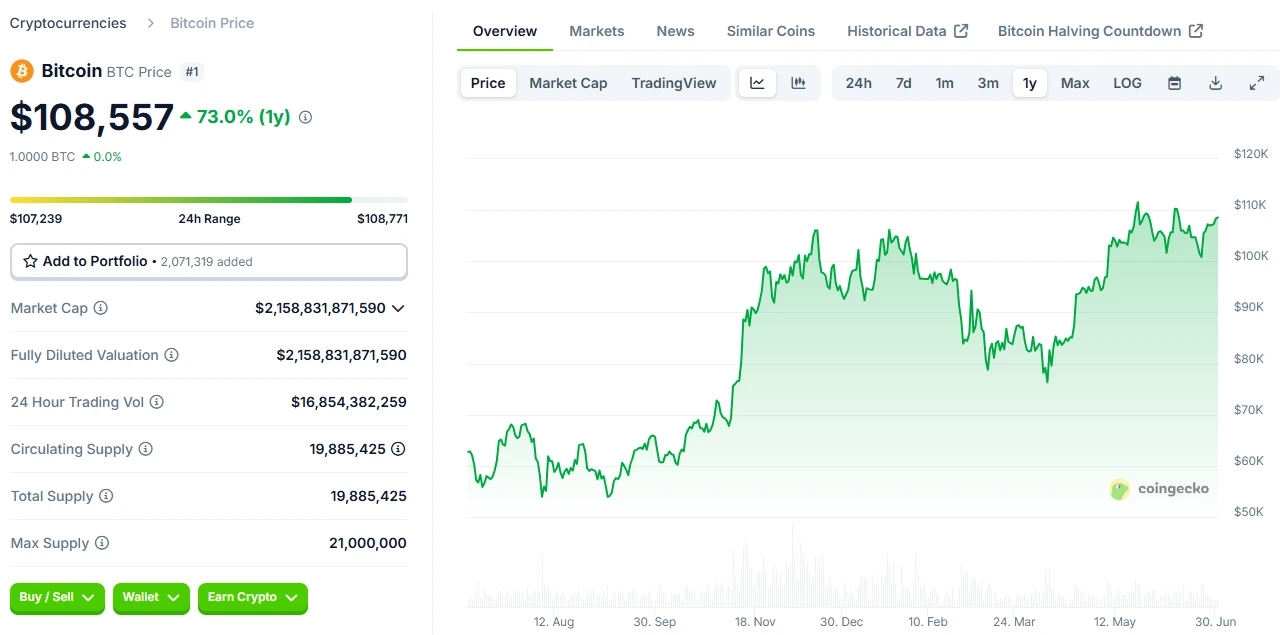

Bitcoin Price Analysis

Source: CoinGecko

These seasoned Bitcoin investors, often referred to as “OGs”, have been offloading their assets gradually, creating consistent resistance that counterbalances fresh institutional demand.

Edwards shared data showing a sharp increase in the number of six-month Bitcoin holders, a group that primarily includes newly onboarded institutional players and treasury companies.

This new wave of treasury investors has absorbed much of the Bitcoin sold by LTHs over the past 18 months. According to Edwards, this marks a pivotal moment in Bitcoin’s adoption curve:

This trend sets the stage for a potential new phase in Bitcoin’s price action, one that could be driven more by treasury inflows than speculative retail trading.

Edwards forecasts a “flywheel buying frenzy” as more corporations follow suit and add Bitcoin to their balance sheets. While ETFs have taken the spotlight, treasury adoption may soon become the primary narrative.

Several new entrants joined the list of Bitcoin treasury companies just last week, including:

This growing list points to a broader acceptance of Bitcoin as a strategic corporate asset, which could have long-term implications for Bitcoin price prediction.

While corporate adoption continues, short-term traders are hedging against potential downside.

Jeff Mei, COO of the BTSE crypto exchange, said many traders are taking profits ahead of the July 9 tariff deadline due to unresolved global trade issues.

BTC/USD

Source: TradingView

Han Xu of HashKey Capital also highlighted uncertainty in U.S. fiscal policy and macroeconomic data as potential risks. Updates on trade negotiations and Trump’s budget bill could dramatically impact short-term price trends.

Any surprises could trigger a sell-off, Xu warned, noting that clarity is needed for bullish momentum to resume.

Since breaking above six figures in May, Bitcoin has remained range-bound between $102,000 and $110,000. Despite occasional spikes, no major breakout has occurred.

At the time of writing, BTC is trading at $108,507, just under resistance at $108,750, a level it has failed to breach in two weeks.

Despite the sideways action, spot Bitcoin ETFs in the U.S. have seen over $3.2 billion in inflows in the past two weeks. Notably, there have been no outflow days, signaling strong investor conviction.

Long-term holders are selling into the market, creating resistance that offsets institutional buying.

They’re early adopters or large holders who have held Bitcoin for over a year. Many began selling after the ETF launch in January 2024.

They are corporations adding Bitcoin to their balance sheets. Their accumulation could fuel long-term price growth and stabilize volatility.

Macroeconomic events like trade tensions, fiscal policy shifts, or unexpected inflation data could trigger sell-offs.

If selling pressure from long-term holders subsides and corporate buying continues, a breakout above $110K is possible in the coming months.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.38%

Figure Heloc(FIGR_HELOC)$1.031.38% USDS(USDS)$1.000.06%

USDS(USDS)$1.000.06% Hyperliquid(HYPE)$29.64-1.43%

Hyperliquid(HYPE)$29.64-1.43% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Canton(CC)$0.1656002.05%

Canton(CC)$0.1656002.05% USD1(USD1)$1.000.08%

USD1(USD1)$1.000.08% Rain(RAIN)$0.009556-0.53%

Rain(RAIN)$0.009556-0.53% World Liberty Financial(WLFI)$0.11540014.84%

World Liberty Financial(WLFI)$0.11540014.84% MemeCore(M)$1.545.58%

MemeCore(M)$1.545.58% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$195.020.73%

Bittensor(TAO)$195.020.73% Aster(ASTER)$0.72-0.49%

Aster(ASTER)$0.72-0.49% Falcon USD(USDF)$1.000.02%

Falcon USD(USDF)$1.000.02% Pi Network(PI)$0.1890905.96%

Pi Network(PI)$0.1890905.96% Global Dollar(USDG)$1.000.02%

Global Dollar(USDG)$1.000.02%