Bitcoin price prediction models indicate potential for BTC to reach $150,000 by the end of 2025.

The NVT golden cross remains in neutral territory, showing room for further growth.

Other bullish signals include MACD buy indicators and positive on-chain data.

Historical patterns suggest BTC could break its all-time high within weeks, possibly by October.

BTC remains in a healthy uptrend, with analysts seeing no signs of a bubble yet.

Other indicators also support a bullish Bitcoin price prediction. The MACD (Moving Average Convergence Divergence) flashed a buy signal in July, another sign that BTC may not yet have reached its peak.

CryptoQuant contributor Axel Adler Jr. recently shared on X:

“BTC is just above the Short-Term Holder (STH) Realized Price, setting the stage for 1–2 weeks of consolidation with a potential push to ATH (All-Time High).”

Source: X (@AxelAdlerJr)

This aligns with forecasts of a breakout to $120,000–$150,000 in Q4 2025.

The latest data from CryptoQuant points to a strong foundation for continued Bitcoin growth. BTC recently rebounded above $115,800, with room for further “price expansion,” according to researcher Pelin Ay, who said:

“Bitcoin is not yet in bubble territory,” Ay noted. “There is still room for price expansion.”

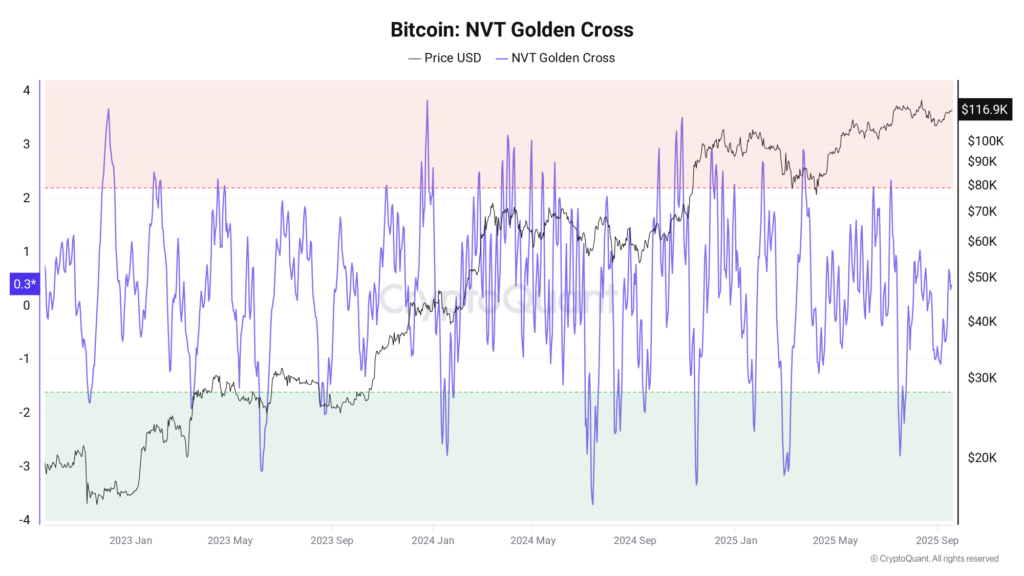

The NVT golden cross (NVT-GC), a leading indicator based on the ratio of Bitcoin’s network value to on-chain transaction volume, currently shows neutral values. Historically, dips into negative territory, especially below -1.6, have signaled bullish momentum ahead.

Bitcoin NVT-GC

Source: CryptoQuant

In July 2025, NVT-GC hit -2.8, triggering a “long” signal. Since then, it has risen to 0.3, indicating Bitcoin is neither overvalued nor overheated.

The Network Value to Transactions (NVT) Golden Cross compares Bitcoin’s market capitalization with its on-chain transaction volume over a specified period.

Simply put, it helps determine whether BTC is overvalued or undervalued.

NVT-GC < -1.6: Strong bullish signal

NVT-GC > 2.2: Potential bearish reversal

0 to 1 range: Neutral trend, possible price growth

Over the past year, the NVT-GC’s four previous dips into bullish territory all preceded significant price increases, including a rally in August 2024.

If historical patterns repeat, Bitcoin may be on the cusp of a new price discovery phase.

While no timeline is guaranteed, analysts suggest BTC could revisit price discovery as early as October 2025, with strong fundamentals supporting long-term growth.

Pelin Ay remains optimistic but measured:

“Bitcoin is not in a high-risk zone. Historical patterns suggest the price could climb toward the $120,000–$150,000 range in the coming months.”

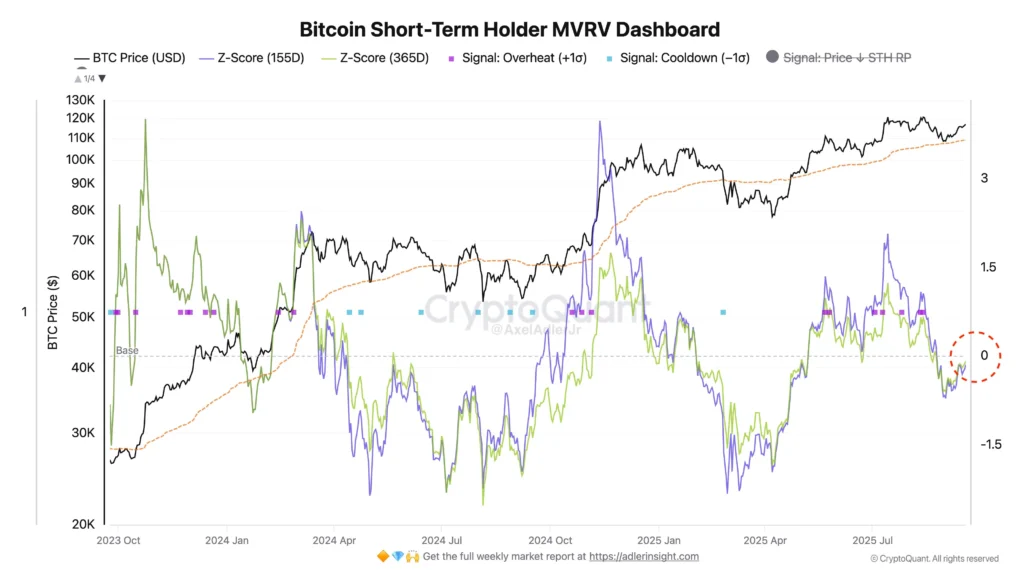

Indicates the average cost basis of wallets that purchased BTC within the last six months.

BTC staying above this metric suggests bullish sentiment among recent investors.

BTC’s Short Term Holder MVRV

Source: CryptoQuant

Occurred in July 2025.

Indicates strengthening upward momentum.

Previous golden crosses in 2023 and 2024 led to major rallies.

Market structure shows no signs of a blow-off top.

While no forecast is certain, on-chain indicators such as the NVT-GC and MACD suggest strong bullish momentum. Analysts predict a potential push toward $120K–$150K by Q4 2025.

According to the NVT golden cross, Bitcoin is currently in neutral territory, meaning it’s not considered overvalued or in a bubble.

Key drivers include:

Institutional adoption

Bullish on-chain metrics (like NVT-GC and MACD)

Continued inflows into Bitcoin ETFs

Supply squeeze due to halving effects

Although indicators show bullish potential, market conditions can change quickly. Always conduct personal research and consider risk tolerance before investing.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.38%

Figure Heloc(FIGR_HELOC)$1.031.38% USDS(USDS)$1.00-0.10%

USDS(USDS)$1.00-0.10% Hyperliquid(HYPE)$29.36-3.27%

Hyperliquid(HYPE)$29.36-3.27% Ethena USDe(USDE)$1.000.06%

Ethena USDe(USDE)$1.000.06% Canton(CC)$0.1665153.07%

Canton(CC)$0.1665153.07% USD1(USD1)$1.000.07%

USD1(USD1)$1.000.07% Rain(RAIN)$0.0097751.97%

Rain(RAIN)$0.0097751.97% World Liberty Financial(WLFI)$0.11350213.85%

World Liberty Financial(WLFI)$0.11350213.85% MemeCore(M)$1.575.35%

MemeCore(M)$1.575.35% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$191.89-1.72%

Bittensor(TAO)$191.89-1.72% Aster(ASTER)$0.71-1.06%

Aster(ASTER)$0.71-1.06% Falcon USD(USDF)$1.00-0.02%

Falcon USD(USDF)$1.00-0.02% Pi Network(PI)$0.1902476.89%

Pi Network(PI)$0.1902476.89% Global Dollar(USDG)$1.000.00%

Global Dollar(USDG)$1.000.00%