At the Wall Street open on Friday, Bitcoin attempted to reclaim bullish momentum, rallying toward the $116K mark.

However, it was promptly rejected, slipping back to $112,240. This rejection came despite seemingly favorable tailwinds from U.S. labor data and mounting speculation around interest rate cuts.

Bitcoin price prediction remains uncertain, as macro catalysts battle with technical resistance and exchange dynamics.

Concerns over a new wave of U.S. trade tariffs pressured Bitcoin earlier in the week, driving it as low as $114,116. Traders remained cautious as they navigated a confluence of bearish news and potential bullish setups.

BTC/USD 1-Hour Chart

Source: TradingView

Meanwhile, July’s nonfarm payrolls came in at just 73,000, well below the anticipated 100,000, signaling potential weakness in the U.S. labor market.

The weaker-than-expected jobs data dramatically shifted expectations for U.S. monetary policy. According to the CME Group’s FedWatch Tool, the probability of a rate cut at the Fed’s September meeting has surpassed 75%.

Commenting on the data, The Kobeissi Letter raised concerns over major revisions in previous employment figures. Downward adjustments to May and June totals have erased 258,000 jobs from earlier reports.

Source: X (@realDonaldTrump)

Adding fuel to the fire, President Donald Trump also weighed in, ramping up public pressure on Fed Chair Jerome Powell to reverse course and begin cutting rates.

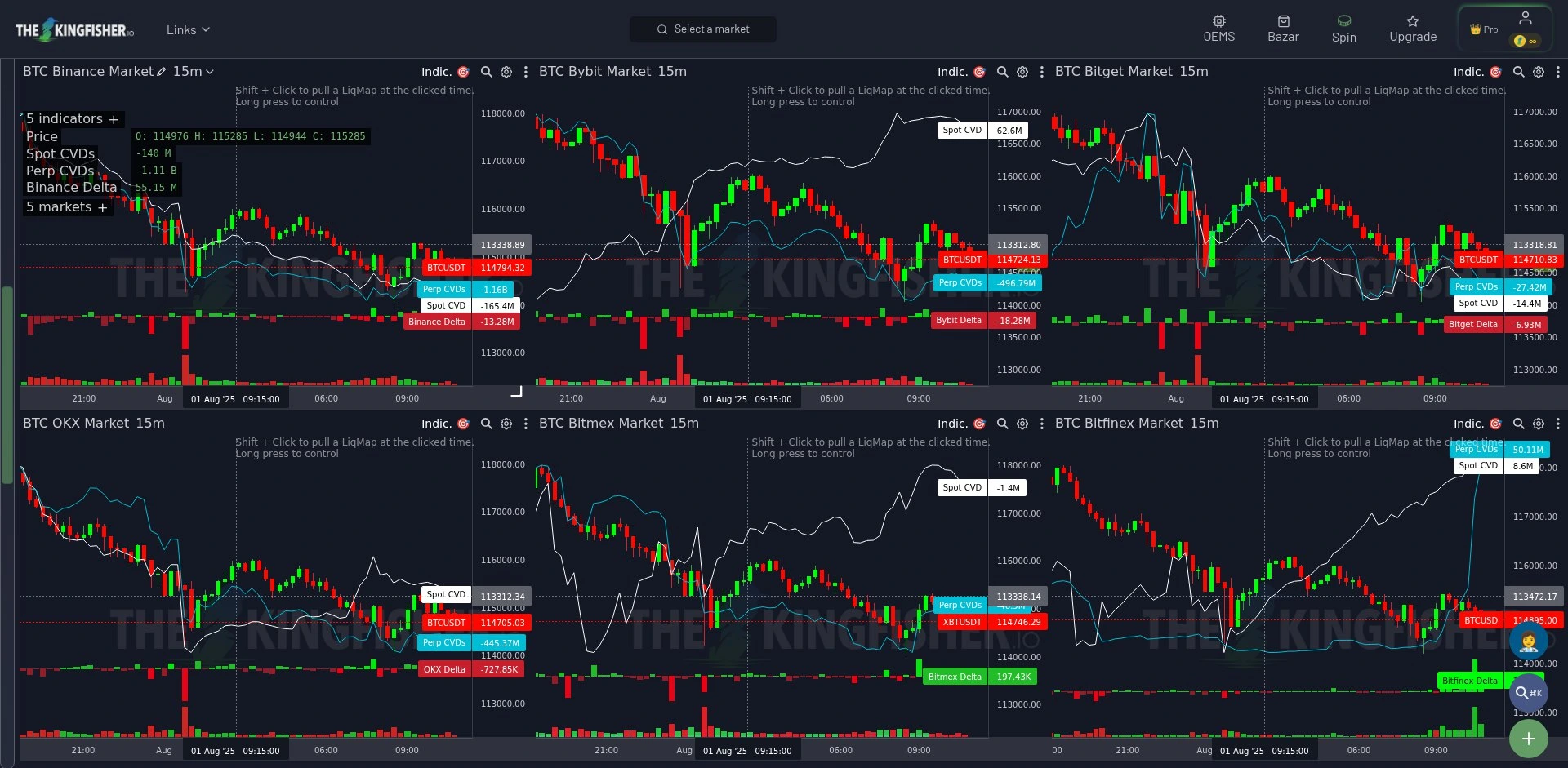

Despite the rejection at $116K, multiple indicators suggest a potential upside move. Exchange order-book data reveals clusters of short positions around the $120K level. A breakout could trigger a liquidity-driven short squeeze, rapidly sending BTC higher.

Fresh exchange data from Bitfinex highlights significant buying activity below the $115K mark.

Bitfinex Traders Keep Buying Below $115K

Source: Bitfinex

These trades suggest that institutional or high-volume players may be accumulating in anticipation of a price rebound.

Popular trader CrypNuevo noted that the current BTC/USDT chart structure bears similarities to earlier phases this year, hinting at potential bullish continuation.

Meanwhile, Ted Pillows posted a heatmap from CoinGlass showing large pools of liquidity waiting just above current price levels.

Ted stated:

“It’s just a matter of time before Bitcoin grabs it. I am referring to the clustered short liquidations above $118K–$120K.”

The recent drop was influenced by macroeconomic concerns, including U.S. trade tariff fears and broader market uncertainty. Despite favorable jobs data that increases the likelihood of a rate cut, technical resistance and profit-taking pressured prices lower.

Lower interest rates generally weaken the U.S. dollar and boost risk-on assets like Bitcoin. If the Fed cuts rates in September, it could drive more capital into crypto markets, supporting higher BTC prices.

There is a growing chance of a short squeeze, particularly if BTC manages to break above the $118K–$120K range, where large short positions are currently concentrated.

Yes, activity on exchanges like Bitfinex suggests that high-volume traders are accumulating BTC below $115K, likely anticipating a rebound.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.031.39%

Figure Heloc(FIGR_HELOC)$1.031.39% USDS(USDS)$1.00-0.10%

USDS(USDS)$1.00-0.10% Hyperliquid(HYPE)$29.58-4.41%

Hyperliquid(HYPE)$29.58-4.41% Ethena USDe(USDE)$1.000.01%

Ethena USDe(USDE)$1.000.01% Canton(CC)$0.1648193.01%

Canton(CC)$0.1648193.01% USD1(USD1)$1.000.05%

USD1(USD1)$1.000.05% Rain(RAIN)$0.0099412.65%

Rain(RAIN)$0.0099412.65% World Liberty Financial(WLFI)$0.1078347.20%

World Liberty Financial(WLFI)$0.1078347.20% MemeCore(M)$1.527.64%

MemeCore(M)$1.527.64% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$191.53-3.63%

Bittensor(TAO)$191.53-3.63% Falcon USD(USDF)$1.00-0.12%

Falcon USD(USDF)$1.00-0.12% Aster(ASTER)$0.71-2.94%

Aster(ASTER)$0.71-2.94% Pi Network(PI)$0.1849247.35%

Pi Network(PI)$0.1849247.35% Global Dollar(USDG)$1.00-0.03%

Global Dollar(USDG)$1.00-0.03%