Bitcoin price prediction remains bullish as BTC approaches $118,000 for the first time since August.

Weak U.S. labor data increases likelihood of Fed rate cuts, providing tailwinds for crypto markets.

Analysts label dips as buying opportunities, with key short-term support at $112K.

The U.S. government shutdown is being treated as a non-event by traders.

A confirmed breakout could trigger a sharp move to new multi-month highs.

Bitcoin (BTC) surged to $117,713 following weaker-than-expected U.S. private-sector employment figures. This brings Bitcoin within striking distance, just $150, of surpassing its September highs.

BTC/USD 4 Hour Chart

Source: TradingView

Well-known trader Rekt Capital noted that Bitcoin is attempting to break out of its monthly range on the very first day of October, signaling a bullish tone for Q4.

The strength in Bitcoin’s movement follows labor data showing a surprise decline in private-sector job growth, a figure that was expected to rise by 45,000.

This underperformance hints at a cooling labor market, which in turn raises hopes for a Federal Reserve rate cut, a scenario typically favorable for Bitcoin and other high-risk assets.

While political gridlock in Washington has led to another government shutdown, crypto markets seem unconcerned. Analysts argue that shutdowns historically have minimal lasting impact on risk assets.

Trading firm QCP Capital described the situation as fiscal theatre, asserting that “essential services continue, back-pay limits income effects, and past episodes have not derailed risk assets.”

During the 2018 shutdown, the S&P 500 actually ended 10% higher, a trend that could bode well for Bitcoin considering its high beta correlation to equities.

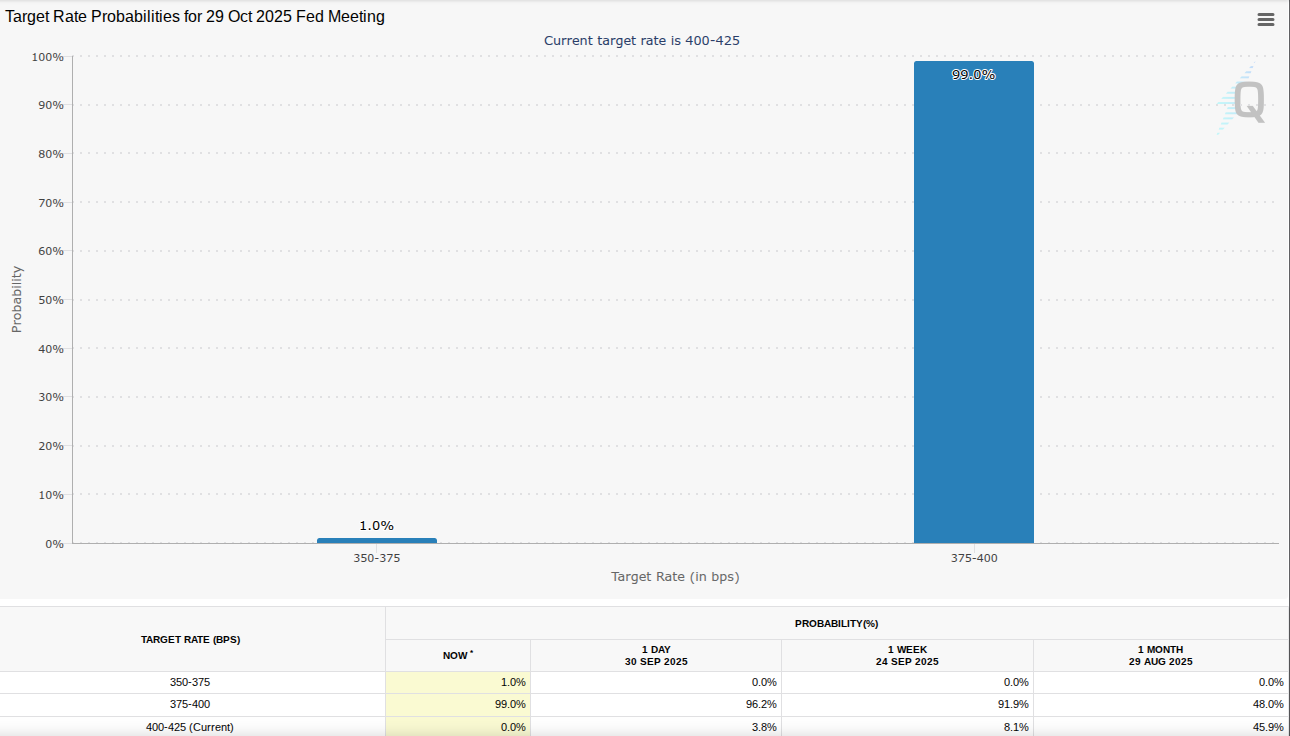

According to CME Group’s FedWatch Tool, the market is now pricing in a 0.25% rate cut at the Federal Reserve’s October meeting.

Fed Target Rate Probabilities For The October FOMC Meeting

Source: CME Group

This potential easing of monetary policy is acting as a catalyst for both crypto and traditional equity markets. Trader Jelle said:

“Bitcoin is pushing through the resistance like it isn’t even there.”

Resistance: $118,000+ (psychological and technical resistance)

Short-term Support: $112,000 (key level highlighted by Daan Crypto Trades)

Trader Jelle suggests that a clear break above September highs will leave bears with “very little leg to stand on,” opening the door for further upside.

A confirmed breakout above $118K could lead to a rally toward $125K–$130K in the coming weeks, especially if macroeconomic conditions favor rate cuts.

A failure to break resistance could send BTC back to test the $112K support zone. However, analysts maintain that any such dip is likely to be bought quickly.

Bitcoin could also consolidate between $112K–$118K while awaiting further economic signals.

Analysts are targeting a breakout above $118,000. If successful, BTC could move toward $125K–$130K in the near term.

Weaker job data increases the chances of interest rate cuts, which can drive capital into Bitcoin and other risk assets.

So far, no. Historical trends suggest shutdowns have minimal impact on market performance, and current sentiment remains bullish.

Many traders view current price dips as buying opportunities, especially with macroeconomic conditions leaning favorable.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.02-1.33%

Figure Heloc(FIGR_HELOC)$1.02-1.33% USDS(USDS)$1.000.02%

USDS(USDS)$1.000.02% Hyperliquid(HYPE)$30.80-1.11%

Hyperliquid(HYPE)$30.80-1.11% Ethena USDe(USDE)$1.000.05%

Ethena USDe(USDE)$1.000.05% Canton(CC)$0.160834-3.55%

Canton(CC)$0.160834-3.55% USD1(USD1)$1.00-0.05%

USD1(USD1)$1.00-0.05% Rain(RAIN)$0.0101510.28%

Rain(RAIN)$0.0101510.28% World Liberty Financial(WLFI)$0.102318-3.11%

World Liberty Financial(WLFI)$0.102318-3.11% MemeCore(M)$1.32-3.97%

MemeCore(M)$1.32-3.97% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Bittensor(TAO)$185.42-2.96%

Bittensor(TAO)$185.42-2.96% Aster(ASTER)$0.71-1.28%

Aster(ASTER)$0.71-1.28% Falcon USD(USDF)$1.000.04%

Falcon USD(USDF)$1.000.04% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% Global Dollar(USDG)$1.00-0.02%

Global Dollar(USDG)$1.00-0.02%