Bitcoin hit a new all-time high of $126,200, supported by $5.67 billion in weekly ETP inflows.

The “debasement trade” is driving investor interest amid growing fiscal and geopolitical risks.

Institutional investors are leading the charge, with spot Bitcoin ETFs attracting most of the inflows.

Retail participation is declining, suggesting a maturing, less speculative market.

Macroeconomic instability and fiscal fragility point to a bullish long-term Bitcoin price prediction.

Bitcoin has stormed past its previous highs, hitting $126,200, marking one of its strongest performances ever.

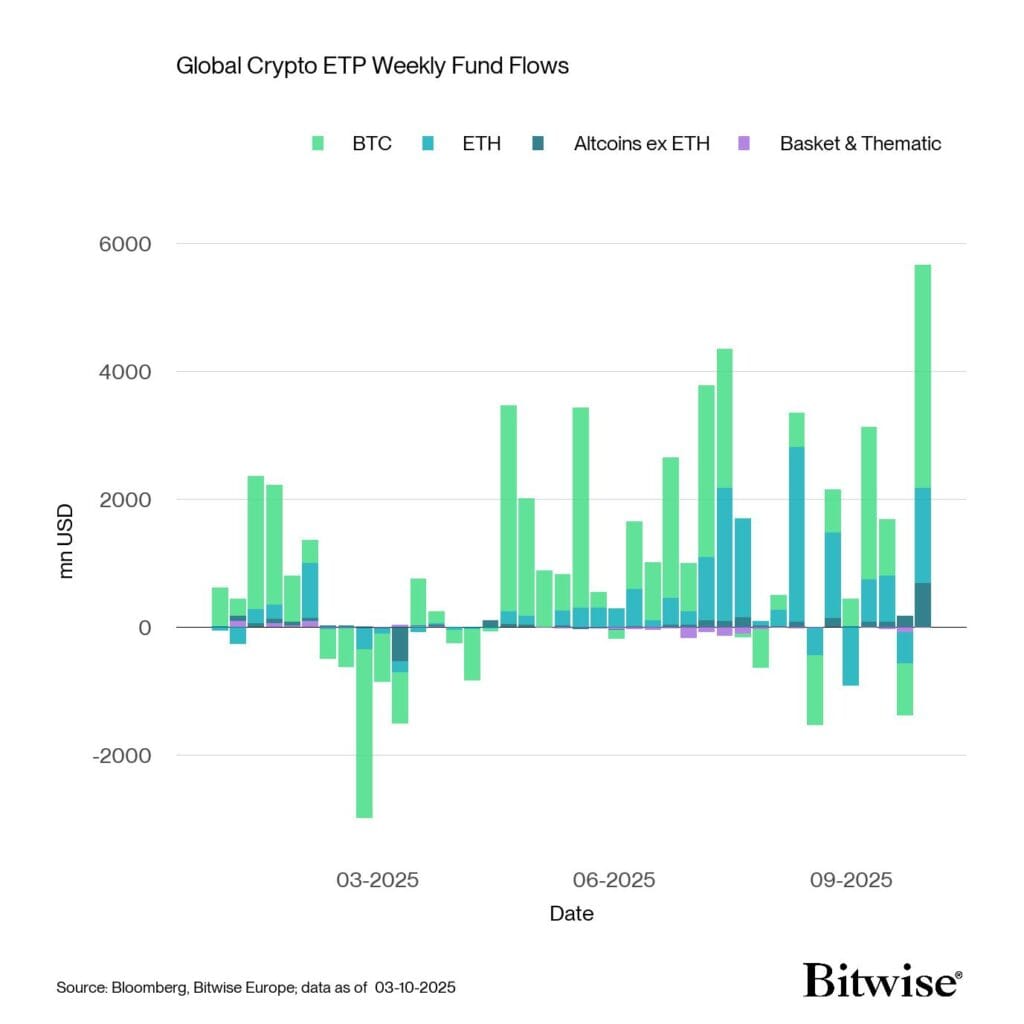

According to market data, this surge was driven largely by record inflows into crypto ETPs, pointing to growing investor confidence in BTC as a hedge against inflation and fiat currency devaluation.

Rising geopolitical uncertainty and weakening global fiat currencies have revived interest in what investors call the “debasement trade”, the strategy of rotating capital into hard assets like Bitcoin and gold to protect against monetary dilution.

According to Bitwise’s latest market report, macro conditions are now “structurally bullish” for Bitcoin. As fiat currencies struggle and central banks lean dovish, store-of-value assets are becoming increasingly attractive.

Source: Bitwise

While Bitcoin has gained 27% year-to-date, gold is up 50%, outpacing BTC during the same period.

However, many investors now view Bitcoin as offering greater asymmetric upside over the long term, especially as currency debasement concerns rise.

In the past week alone:

Spot Bitcoin ETFs saw $3.49 billion in inflows

Ethereum products brought in $1.49 billion

Altcoins excluding Ethereum saw $685 million

This suggests that institutional interest is driving the rally, with firms like BlackRock’s iShares Bitcoin Trust (IBIT) and Bitwise’s BITB capturing a large share of these flows.

On-chain analysis revealed that over 49,000 BTC were withdrawn from exchanges, primarily by whale entities.

This withdrawal typically reflects a long-term bullish outlook, as investors move assets to cold storage rather than preparing for quick sell-offs.

Leverage across the market remains moderate, suggesting that the current rally is sustainable rather than speculative.

Famed investor Paul Tudor Jones recently emphasized that fiscal instability is now the dominant macro factor influencing risk assets.

With U.S. interest costs projected to surpass $1 trillion annually, the likelihood of sustained monetary easing grows, a historically strong driver for BTC performance.

As foreign holders reduce exposure to U.S. Treasurys and the dollar weakens, capital is flowing into “hard assets” such as Bitcoin.

According to Tudor, this pattern mirrors the late 1990s bull cycle, but without the signs of retail-driven mania.

Interestingly, while Bitcoin’s price is soaring, retail activity has declined. Data from on-chain analyst Axel Adler Jr. shows a drop in small transaction volume, typically driven by individual investors.

Bitcoin Retail Volume Tracker

Source: X (@AxelAdlerJr)

This divergence suggests the current rally is institutionally dominated, with retail fatigue evident beneath the surface of bullish price action.

With Q4 historically being a strong quarter for crypto, and with liquidity conditions likely to remain supportive, analysts believe Bitcoin could push even higher. The combination of:

Institutional inflows

Weakening fiat currencies

Fiscal mismanagement

Moderate leverage

…makes a compelling case for continued upward momentum in Bitcoin’s price.

While short-term corrections are always possible, the long-term outlook remains bullish, especially if macroeconomic instability persists.

Analysts suggest that Bitcoin could continue to rise throughout Q4, potentially reaching $130,000–$140,000, assuming current macro trends continue.

Bitcoin is rising due to record institutional inflows, fears of currency debasement, and weakening confidence in fiat currencies amid geopolitical and fiscal instability.

No. On-chain data shows that retail activity is declining, indicating the current rally is being driven by institutions, not individual traders.

While gold has outperformed Bitcoin YTD in raw percentage gains, many view Bitcoin as a better long-term asymmetric bet, particularly in digital-native portfolios.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.77%

Figure Heloc(FIGR_HELOC)$1.03-0.77% Wrapped stETH(WSTETH)$3,624.78-1.70%

Wrapped stETH(WSTETH)$3,624.78-1.70% Wrapped eETH(WEETH)$3,214.28-1.54%

Wrapped eETH(WEETH)$3,214.28-1.54% USDS(USDS)$1.000.03%

USDS(USDS)$1.000.03% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.03% Hyperliquid(HYPE)$32.45-2.95%

Hyperliquid(HYPE)$32.45-2.95% Coinbase Wrapped BTC(CBBTC)$88,237.00-0.90%

Coinbase Wrapped BTC(CBBTC)$88,237.00-0.90% WETH(WETH)$2,957.55-1.67%

WETH(WETH)$2,957.55-1.67% Ethena USDe(USDE)$1.00-0.05%

Ethena USDe(USDE)$1.00-0.05% Canton(CC)$0.162015-0.65%

Canton(CC)$0.162015-0.65% USD1(USD1)$1.000.01%

USD1(USD1)$1.000.01% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% World Liberty Financial(WLFI)$0.160882-1.28%

World Liberty Financial(WLFI)$0.160882-1.28% sUSDS(SUSDS)$1.08-0.58%

sUSDS(SUSDS)$1.08-0.58% Ethena Staked USDe(SUSDE)$1.220.01%

Ethena Staked USDe(SUSDE)$1.220.01% Rain(RAIN)$0.0097660.20%

Rain(RAIN)$0.0097660.20% MemeCore(M)$1.53-1.61%

MemeCore(M)$1.53-1.61%