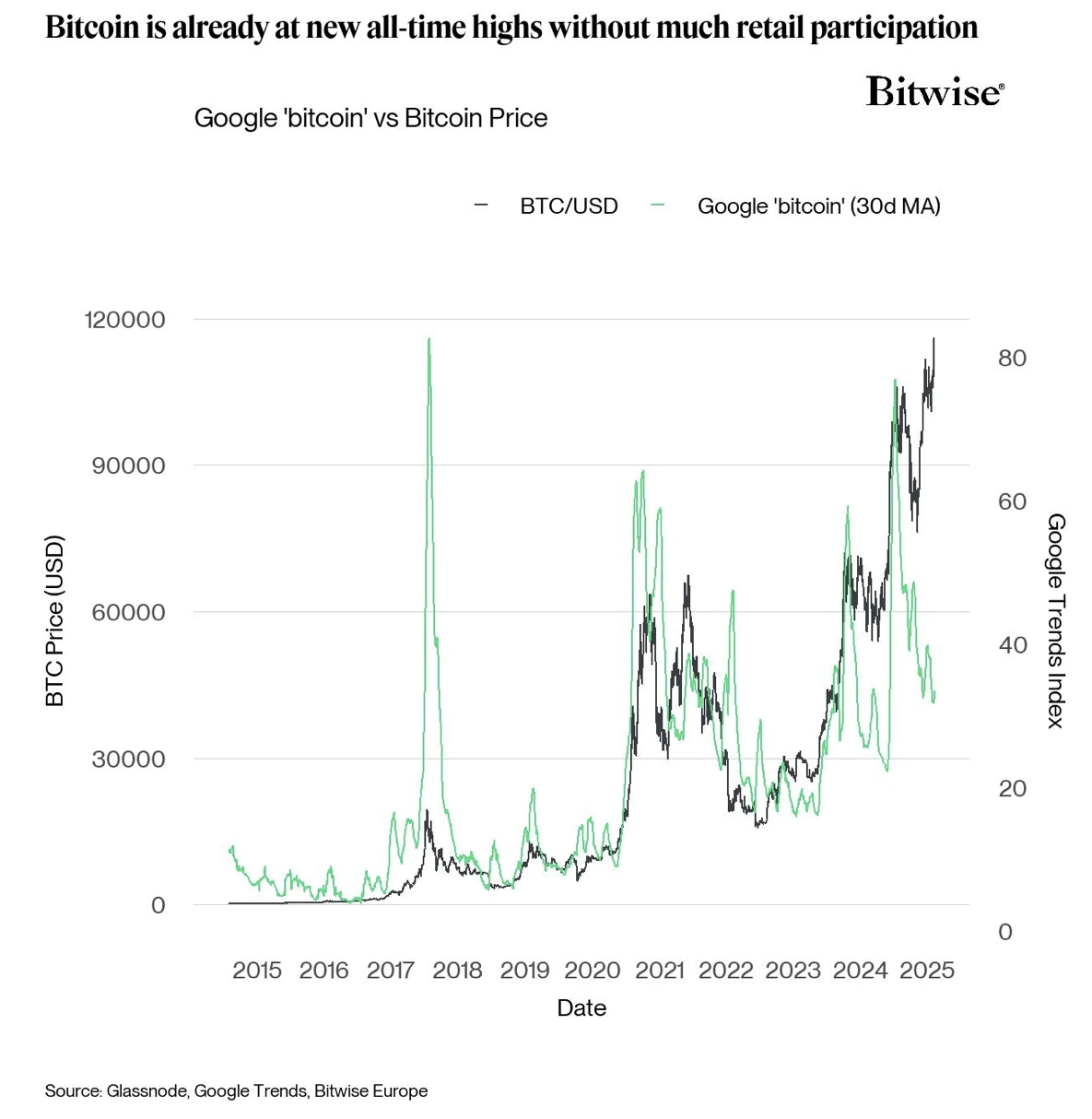

Despite Bitcoin’s price pushing past previous all-time highs, search data and market behavior indicate that average investors are showing surprisingly little interest.

Bitcoin’s recent rally has been largely fueled by institutional players. Spot Bitcoin exchange-traded funds (ETFs) have recorded unprecedented activity. On both Thursday and Friday of last week, daily inflows surpassed $1 billion, a first for back-to-back days.

Source: X (@WClementeIII)

A recurring theory among Bitcoin analysts and influencers is that retail investors feel like they’ve “missed the boat.” With Bitcoin priced over $117,000, the psychological barrier for newcomers may be higher than ever.

Bitcoin commentator Lindsay Stamp explained it plainly:

“I think a lot of retail folks find out the price of one Bitcoin is 117k and think, nahhh I missed the boat and don’t even give it a second thought.”

Cedric Youngelman, host of the Bitcoin Matrix podcast, echoed this view on social media:

“At what Bitcoin price do you think retail wakes up? I’ll go first. I don’t think they’re coming for a long time.”

Willy Woo, a well-known onchain analyst, remains optimistic about the longevity of Bitcoin’s current run, stating:

“This run has plenty of legs left in it. However, recent conversations have raised a crucial question: does onchain data accurately represent Bitcoin retail interest, or is it now more reflective of ETF activity?”

This shift in investor behavior is making it harder to interpret the real level of grassroots interest in Bitcoin.

According to data from Farside, spot Bitcoin ETFs saw $2.72 billion in inflows over a five-day trading period. These numbers confirm that institutions, not retail investors, are behind the current market movement.

The growing popularity of ETFs among wealth managers and institutional buyers marks a new chapter in Bitcoin’s evolution.

Even more telling, Google search interest for “Bitcoin” is still down 60% compared to the week of November 10th to 16th, 2024, the period following Donald Trump’s U.S. presidential election win.

Source: Glassnode

That same period saw a surge in retail enthusiasm, leading to Bitcoin’s first-ever milestone of $100K on December 5th.

Many retail investors believe it’s “too late” to invest in Bitcoin due to its high price. Others may not be aware that they can buy fractional shares of BTC. This psychological barrier keeps them from entering the market.

Institutional inflows, particularly through spot Bitcoin ETFs, are the primary drivers behind Bitcoin’s current surge. Retail participation remains minimal based on search trends and trading behavior.

Retail interest is typically tracked through metrics like Google search trends, onchain activity from smaller wallets, and trading volume on retail exchanges. Currently, these indicators show a lack of retail participation.

Not necessarily. Low retail interest can sometimes be bullish, as it indicates that the market isn’t overheated. Many analysts believe the current rally still has room to grow, especially if retail investors eventually re-enter.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.040.26%

Figure Heloc(FIGR_HELOC)$1.040.26% Wrapped stETH(WSTETH)$2,770.32-3.49%

Wrapped stETH(WSTETH)$2,770.32-3.49% USDS(USDS)$1.000.03%

USDS(USDS)$1.000.03% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.05% Hyperliquid(HYPE)$33.01-6.70%

Hyperliquid(HYPE)$33.01-6.70% Wrapped eETH(WEETH)$2,460.55-3.61%

Wrapped eETH(WEETH)$2,460.55-3.61% Canton(CC)$0.178671-5.15%

Canton(CC)$0.178671-5.15% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Coinbase Wrapped BTC(CBBTC)$76,426.00-3.09%

Coinbase Wrapped BTC(CBBTC)$76,426.00-3.09% USD1(USD1)$1.00-0.03%

USD1(USD1)$1.00-0.03% WETH(WETH)$2,260.37-3.73%

WETH(WETH)$2,260.37-3.73% USDT0(USDT0)$1.00-0.12%

USDT0(USDT0)$1.00-0.12% sUSDS(SUSDS)$1.090.05%

sUSDS(SUSDS)$1.090.05% Ethena Staked USDe(SUSDE)$1.220.03%

Ethena Staked USDe(SUSDE)$1.220.03% World Liberty Financial(WLFI)$0.1345114.62%

World Liberty Financial(WLFI)$0.1345114.62% Rain(RAIN)$0.009110-3.48%

Rain(RAIN)$0.009110-3.48% MemeCore(M)$1.490.74%

MemeCore(M)$1.490.74%