According to Nansen, BNB reached a new all-time high of $850.70 on Monday.

With the token’s price rising by over 12% in just seven days, analysts attribute this bullish momentum to several key factors, including:

A June 2024 Forbes report revealed that Changpeng Zhao holds approximately 64% of BNB’s circulating supply, which currently stands at 139.3 million tokens. Binance reportedly controls another 7%, meaning that CZ himself owns an estimated 89.1 million BNB tokens.

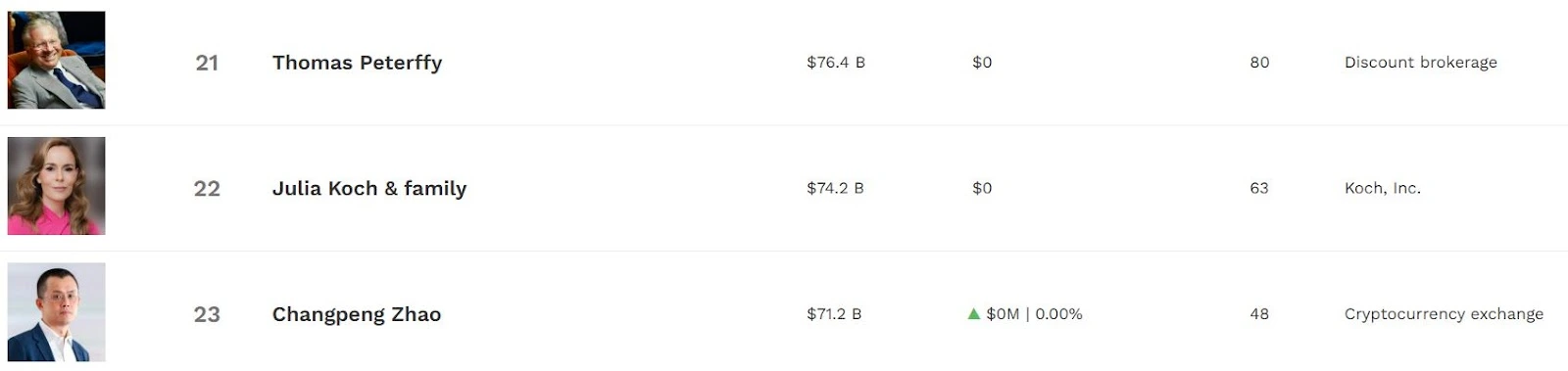

Changpeng Zhao Is Currently Listed As The 23rd Richest Man Worldwide

Source: Forbes

In his own words from a February post on Binance Square, CZ disclosed that 98% of his portfolio is held in BNB, with just 1.32% allocated to Bitcoin.

As of July 2025, CZ ranks 23rd on Forbes’ list of the world’s richest individuals, with a reported net worth of $71 billion, based primarily on his 90% stake in Binance and his massive BNB holdings. If valued solely by his BNB assets, he would surpass American billionaire Julia Koch and her family.

Crypto analyst Dominick John from Kronos Research suggests that the rise in BNB’s price is closely tied to on-chain activity. Key metrics such as:

John noted:

“Treasury demand must remain high, TVL and PancakeSwap volume must keep increasing, and the quarterly token burns should continue reducing supply.”

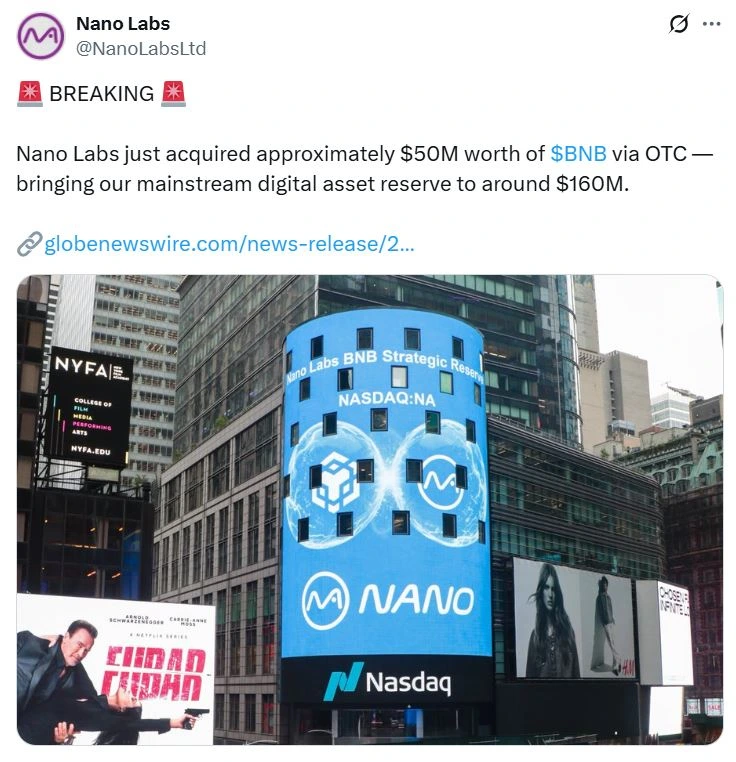

Adding to the bullish outlook is institutional interest, including Nano Labs, a Chinese microchip firm that recently announced plans to acquire up to 10% of BNB’s circulating supply.

Source: X (@NanoLabsLtd)

This move indicates growing treasury demand and long-term confidence in the token.

The initial supply of BNB was capped at 200 million coins, but thanks to Binance’s ongoing token burn program, the supply is consistently shrinking.

These burns are designed to reduce circulating tokens, which can create deflationary pressure and, theoretically, increase the token’s value over time.

Kadan Stadelmann, CTO at Komodo Platform, emphasized that token burns have both psychological and practical impacts on BNB price:

“The token burn program is a deliberate attempt to aid BNB’s price by reducing supply. Historically, each burn has led to bullish expectations and often an actual price bump.”

Stadelmann also pointed out that whale and corporate investor activity can disproportionately affect smaller crypto ecosystems like BNB, which operates on a proof-of-stake model.

The recent Maxwell upgrade to BNB Smart Chain, launched on June 30th, is another possible catalyst behind the price rally. According to the BNB Chain team, this upgrade delivers:

With infrastructure upgrades complementing market activity, many investors are optimistic about the long-term BNB price prediction.

As of the latest data, BNB is trading at $852.64, its highest price to date.

CZ is estimated to hold around 89.1 million BNB tokens, accounting for 64% of the circulating supply.

If positive momentum continues, some bullish analysts predict BNB could surpass $1,000 in the next 6–12 months, especially if adoption grows and market conditions remain favorable.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.030.01%

Figure Heloc(FIGR_HELOC)$1.030.01% Wrapped stETH(WSTETH)$3,682.020.47%

Wrapped stETH(WSTETH)$3,682.020.47% Wrapped eETH(WEETH)$3,264.900.44%

Wrapped eETH(WEETH)$3,264.900.44% USDS(USDS)$1.000.29%

USDS(USDS)$1.000.29% Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01%

Binance Bridged USDT (BNB Smart Chain)(BSC-USD)$1.00-0.01% Hyperliquid(HYPE)$33.0618.47%

Hyperliquid(HYPE)$33.0618.47% Coinbase Wrapped BTC(CBBTC)$89,572.001.15%

Coinbase Wrapped BTC(CBBTC)$89,572.001.15% WETH(WETH)$3,005.000.58%

WETH(WETH)$3,005.000.58% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Canton(CC)$0.1673089.31%

Canton(CC)$0.1673089.31% USD1(USD1)$1.000.00%

USD1(USD1)$1.000.00% World Liberty Financial(WLFI)$0.1652544.32%

World Liberty Financial(WLFI)$0.1652544.32% USDT0(USDT0)$1.00-0.02%

USDT0(USDT0)$1.00-0.02% sUSDS(SUSDS)$1.08-0.23%

sUSDS(SUSDS)$1.08-0.23% Ethena Staked USDe(SUSDE)$1.22-0.04%

Ethena Staked USDe(SUSDE)$1.22-0.04% Rain(RAIN)$0.010020-1.39%

Rain(RAIN)$0.010020-1.39% MemeCore(M)$1.551.11%

MemeCore(M)$1.551.11%