BONK price prediction favors short-term bullish continuation above $0.00001380.

Trading volume jumped 67%, reflecting renewed market participation.

Next resistance sits at $0.00001410–$0.00001450 with upside targets toward $0.00001500.

Memecoin sentiment on Solana is improving, hinting at broader sector momentum.

Risk remains elevated, traders should monitor key support levels closely.

In the latest price movement, BONK gained 4.6%, climbing to $0.00001394 and marking a decisive move above the critical $0.00001380 resistance zone.

This breakout pushed the token to a new local high of $0.000013968, signaling strengthening buyer confidence and a potential shift in short-term trend direction.

BONK’s 24-hour range tightened between $0.00001281 and $0.00001410, showing more controlled volatility even as market participation grew.

Source: X (@LSTraderCrypto)

The token’s consistent pattern of higher lows continues to reinforce its bullish technical structure, a promising sign for those anticipating further gains.

One of the most telling indicators of BONK’s momentum is the 67% increase in trading volume, totaling around 1.15 trillion tokens over 24 hours.

This sharp uptick confirms renewed interest from both retail traders and speculative investors eager to capitalize on early November price action.

The positive movement in BONK also reflects a wider improvement in sentiment across Solana-based memecoins. After a period of consolidation and fading hype, cautious optimism has returned to the market.

Traders are now watching the $0.00001400–$0.00001410 range as the next major resistance zone that BONK must overcome to confirm its breakout.

Immediate Support: $0.00001380

Primary Resistance: $0.00001410

Extended Target: $0.00001450+

If BONK manages to sustain above $0.00001380, the next logical price target lies around $0.00001450 and possibly higher, depending on continued buying pressure.

However, failure to hold that breakout level could trigger renewed consolidation, potentially dragging the token back toward its previous range near $0.0000130.

From a technical perspective, BONK’s ascending pattern and growing liquidity favor a short-term bullish scenario.

Increasing speculative activity coupled with expanding volatility suggests that traders may be positioning for another leg higher, especially if broader crypto sentiment remains steady.

Based on recent technical trends and volume dynamics, short-term BONK price predictions suggest potential movement toward the $0.00001450–$0.00001500 range if bullish momentum continues. Sustained closes above $0.00001410 would strengthen this outlook.

However, if BONK loses its foothold below $0.00001380, a correction toward $0.0000130 or lower could unfold before any new upward move resumes.

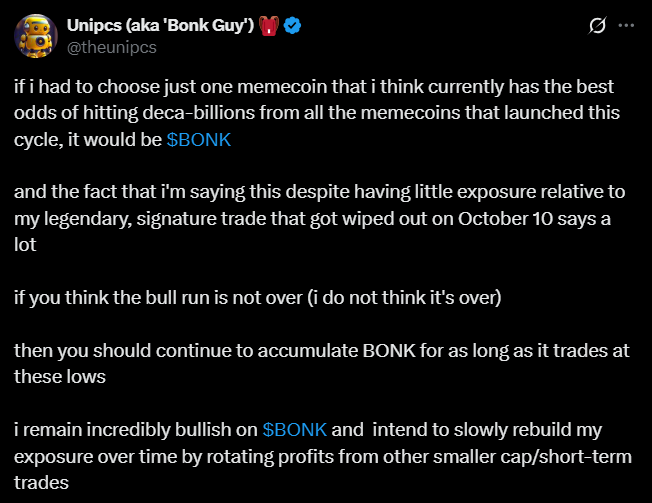

Source: X (@theunipcs)

Overall, the near-term bias remains positive, with BONK positioned as one of the few memecoins showing active breakout potential in an otherwise cautious market.

The memecoin market is showing early signs of revival as we move into November.

BONK’s price action appears to be part of a broader sector rotation into high-volume speculative tokens, as traders seek new momentum plays following slower performance in major cryptocurrencies.

While enthusiasm is returning, investors should remain aware that memecoin volatility cuts both ways. BONK’s current setup offers attractive upside potential but also carries typical risks associated with sudden reversals.

As always, disciplined position sizing and awareness of market sentiment remain essential.

BONK is in a short-term bullish phase after breaking above key resistance at $0.00001380, supported by strong trading volume and positive market sentiment.

If momentum continues, BONK could aim for the $0.00001450–$0.00001500 range. Failure to hold above $0.00001380 could send it back into consolidation.

Rising speculative interest in memecoins, particularly those on Solana, has driven BONK’s resurgence as traders look for early momentum plays.

While short-term technicals look bullish, BONK remains a high-risk, high-reward asset. Investors should consider volatility and manage positions accordingly.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.03-0.27%

Figure Heloc(FIGR_HELOC)$1.03-0.27% USDS(USDS)$1.00-0.01%

USDS(USDS)$1.00-0.01% Hyperliquid(HYPE)$29.423.19%

Hyperliquid(HYPE)$29.423.19% Ethena USDe(USDE)$1.00-0.04%

Ethena USDe(USDE)$1.00-0.04% Canton(CC)$0.158407-2.44%

Canton(CC)$0.158407-2.44% USD1(USD1)$1.00-0.06%

USD1(USD1)$1.00-0.06% Rain(RAIN)$0.009447-1.58%

Rain(RAIN)$0.009447-1.58% World Liberty Financial(WLFI)$0.116058-2.87%

World Liberty Financial(WLFI)$0.116058-2.87% MemeCore(M)$1.32-6.83%

MemeCore(M)$1.32-6.83% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.00-0.01%

Falcon USD(USDF)$1.00-0.01% Aster(ASTER)$0.710.43%

Aster(ASTER)$0.710.43% Bittensor(TAO)$177.00-5.38%

Bittensor(TAO)$177.00-5.38% Global Dollar(USDG)$1.000.00%

Global Dollar(USDG)$1.000.00% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00%