ETH futures premium is at its highest level in five months, reflecting bullish trader sentiment.

Options market skew remains neutral, showing no signs of increased bearish positioning.

$4.23 billion in ETH ETF inflows over just two weeks indicates growing institutional interest.

Over 40 companies now hold 1,000+ ETH, signaling broader corporate adoption.

A breakout past $4,000 could pave the way for a swift move to $5,000 if trends persist.

On Monday, Ether briefly surged to $3,940 before dropping by 4% to around $3,766, echoing a broader downturn across the crypto market. However, this correction didn’t appear to be caused by any ETH-specific developments.

S&P 500 Futures (Left) Vs. ETH/USD (Right)

Source: TradingView

Despite the pullback, ETH futures remained solid. Traders avoided taking defensive positions, signaling that bullish momentum could still drive ETH toward the $5K milestone.

Current global macroeconomic concerns, particularly U.S. import tariff negotiations, are causing some investors to lean towards cash and short-term bonds.

While a new agreement with Europe was recently reached, traders remain cautious as a looming deadline with China approaches on August 12th. This backdrop creates a risk-averse climate, yet Ether’s derivatives markets are showing a different picture.

The ETH three-month futures premium has climbed to 8% annualized, its highest level in nearly five months. This is a strong signal, especially considering ETH’s 55% price increase over the past three weeks.

A premium between 5% to 10% is considered healthy in neutral markets. A level above that, like the current 8%, often indicates confidence from futures traders, suggesting they are still willing to take on additional risk in anticipation of higher prices.

The 30-day delta skew, a measure of whether traders are leaning bullish or bearish, currently sits near the neutral 6% line.

Last week, the skew reflected an 8% bullish bias, but the recent neutral stance suggests traders are not rushing for downside protection despite the price dip.

This kind of positioning implies that institutional investors and market makers still have confidence in Ether’s near-term potential.

One of the clearest drivers behind ETH’s resilience is the growing demand from institutional investors. The launch and success of ETH exchange-traded funds (ETFs) have been a major catalyst.

From July 11th to July 26th, Ether ETFs experienced $4.23 billion in net inflows, boosting total U.S.-listed ETH ETF assets to over $17.24 billion.

This kind of institutional commitment reinforces the long-term investment thesis for ETH.

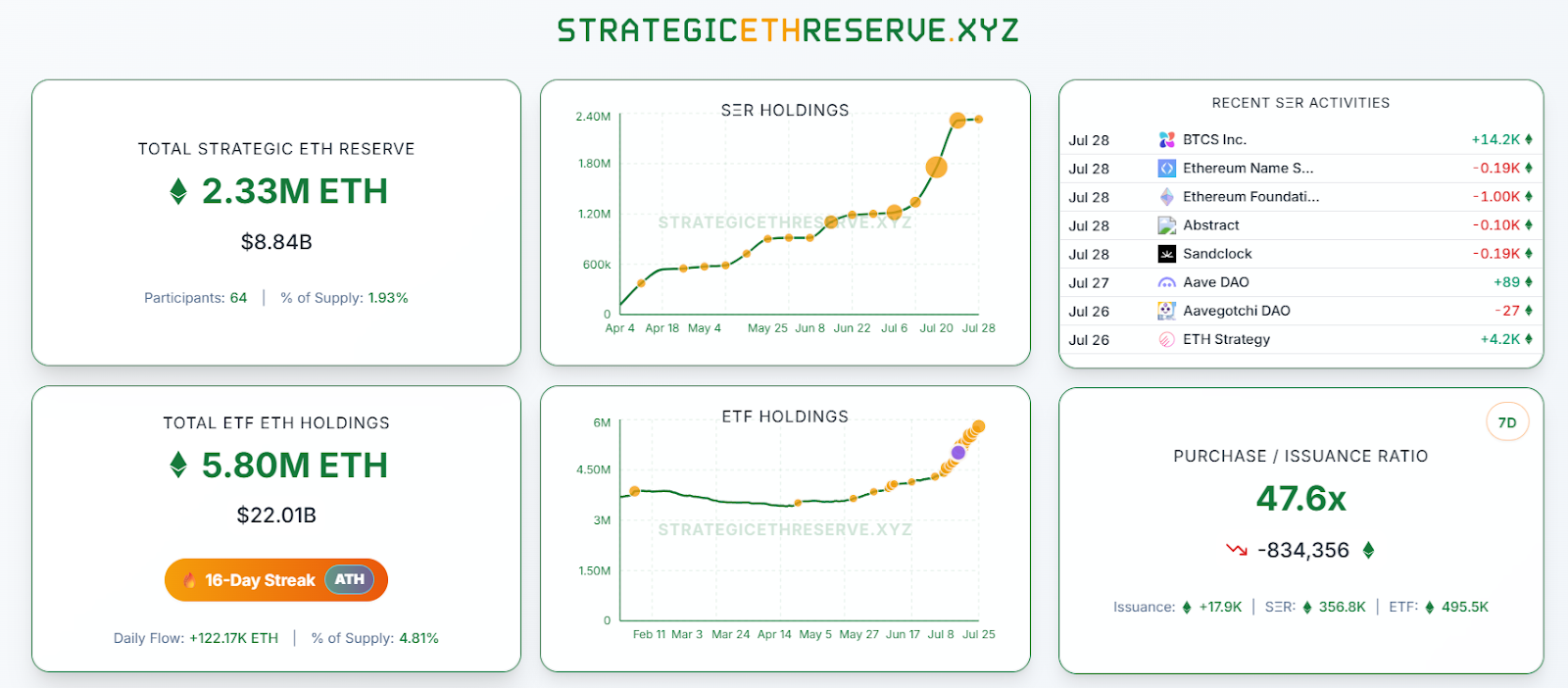

According to data from StrategicEthReserve, more than 40 companies now hold at least 1,000 ETH, worth about $3.8 million per firm at current prices.

Source: strategicethreserve.xyz

Some of the notable names include:

Bitmine Immersion Tech

SharpLink Gaming

The Ether Machine

Together, these companies hold $8.84 billion worth of ETH, highlighting how corporate adoption is accelerating. In comparison, only eight U.S. companies hold more than $1 billion in BTC, excluding Bitcoin-focused firms like MicroStrategy and mining giants.

Looking at the derivatives market, the cautious optimism is unmistakable. The steady ETH futures premium, combined with the balanced options skew and inflows into ETH ETFs, creates a strong foundation for a breakout.

If ETH surpasses the $4,000 resistance with momentum, a path toward $5,000 could quickly materialize, especially if institutional inflows and corporate holdings continue to grow.

ETH futures are derivative contracts that allow traders to speculate on the future price of Ether (ETH) without owning the underlying asset. They are widely used by institutional and retail traders for hedging or leverage.

The futures premium shows how much traders are willing to pay for ETH contracts set to settle in the future. A high premium often indicates strong bullish sentiment.

Current data from both futures and options markets suggests that traders remain optimistic. With institutional inflows rising and no defensive positioning evident, a rally to $5,000 is a realistic near-term scenario.

ETH ETFs are attracting billions in institutional capital. This sustained demand increases market stability and creates a positive feedback loop for ETH’s price performance.

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Content Strategist

Subscribe to stay informed and receive latest updates on the latest happenings in the crypto world!

Figure Heloc(FIGR_HELOC)$1.02-1.05%

Figure Heloc(FIGR_HELOC)$1.02-1.05% USDS(USDS)$1.000.03%

USDS(USDS)$1.000.03% Hyperliquid(HYPE)$30.920.99%

Hyperliquid(HYPE)$30.920.99% Ethena USDe(USDE)$1.000.00%

Ethena USDe(USDE)$1.000.00% Canton(CC)$0.153069-1.79%

Canton(CC)$0.153069-1.79% USD1(USD1)$1.000.04%

USD1(USD1)$1.000.04% Rain(RAIN)$0.009101-3.00%

Rain(RAIN)$0.009101-3.00% World Liberty Financial(WLFI)$0.099297-3.46%

World Liberty Financial(WLFI)$0.099297-3.46% MemeCore(M)$1.502.60%

MemeCore(M)$1.502.60% Pi Network(PI)$0.22687312.21%

Pi Network(PI)$0.22687312.21% Circle USYC(USYC)$1.120.00%

Circle USYC(USYC)$1.120.00% BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00%

BlackRock USD Institutional Digital Liquidity Fund(BUIDL)$1.000.00% Falcon USD(USDF)$1.00-0.02%

Falcon USD(USDF)$1.00-0.02% Aster(ASTER)$0.700.09%

Aster(ASTER)$0.700.09% Global Dollar(USDG)$1.000.01%

Global Dollar(USDG)$1.000.01% Bittensor(TAO)$176.60-6.44%

Bittensor(TAO)$176.60-6.44% Sky(SKY)$0.070702-7.91%

Sky(SKY)$0.070702-7.91%